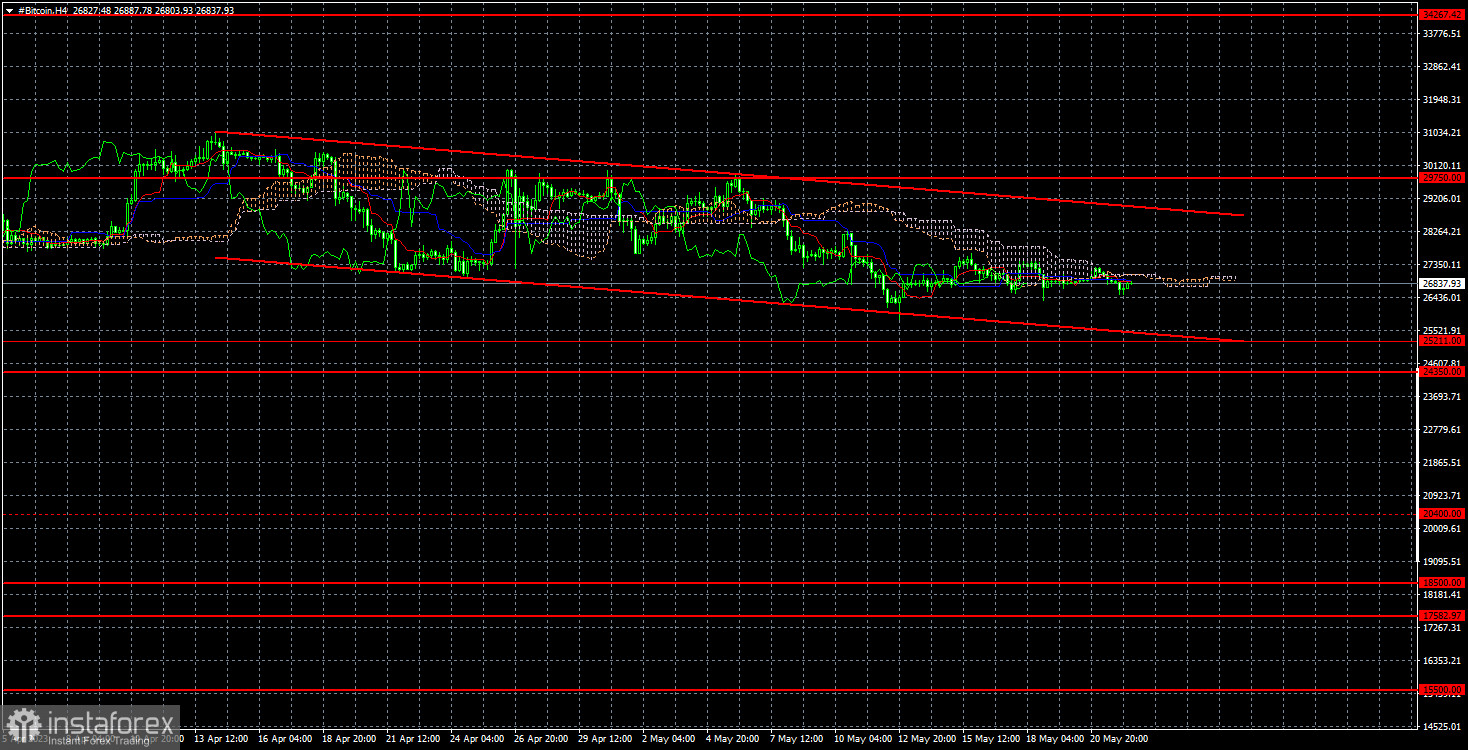

On the 4-hour chart, it is also clear that Bitcoin has extended its downtrend, which is now supported by a descending channel. It has breached the sideways channel, along with the principle according to which Bitcoin has been trading for the past 9-12 months. Not only are we seeing a flat period after another round of growth (or decline), but a full-fledged correction. As I have previously mentioned, the nearest target is $25,211.

Meanwhile, Robert Kiyosaki, who needs no introduction, once again took to social media to advocate for buying gold, silver, and Bitcoin. If he did this every few months (like most cryptocurrency enthusiasts), we wouldn't have any questions. However, Kiyosaki has been urging people to buy gold, silver, and Bitcoin every week. What could this mean? Why is the author of the bestseller "Rich Dad Poor Dad" so actively promoting his opinion?

In my opinion, it is not about altruism here. Firstly, there is nothing new in advocating for buying gold and silver, as the whole world knows that these precious metals will not increase in supply, therefore they will always be valuable. So Kiyosaki is simply using gold and silver as a cover, placing them on the same line as Bitcoin, which recently plummeted from $70,000 to $15,000. There is no connection between cryptocurrencies and precious metals. Secondly, gold does not appreciate in value as quickly. One should not forget about inflation, which erodes the purchasing power of the dollar every year. Thirdly, Bitcoin is an investment tool, not a store of value. As we have seen more than once, it has a big problem with preserving even its own value. So why is Kiyosaki actively advocating for buying Bitcoin?

I believe that Kiyosaki himself is an investor in Bitcoin, which is why he is interested in its growth. It can only grow if there is an increasing demand for it. And in order for it to grow, faith needs to be instilled in "retail investors" regarding the safety of the investment. The idea is that Bitcoin will grow regardless, and if you don't buy now, you will regret it later. Kiyosaki also actively criticizes the US government. This time, he stated that corruption in the US is off the charts, and Bitcoin is the best form of protection against the incompetence of the Federal Reserve and corruption.

On the 4-hour chart, the cryptocurrency is already trading within a descending channel. We previously advised selling Bitcoin on every rebound from the $29,750 level, and now that the price has left the sideways channel, it would be wise to maintain short positions with $25,211 as the target. After that, everything will depend on the price behavior around the Senkou Span B line on the daily chart, near $25,211, and the trendline. I believe that you should only consider long positions once strong buy signals are formed on the 24-hour chart or if the price consolidates above the descending channel on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română