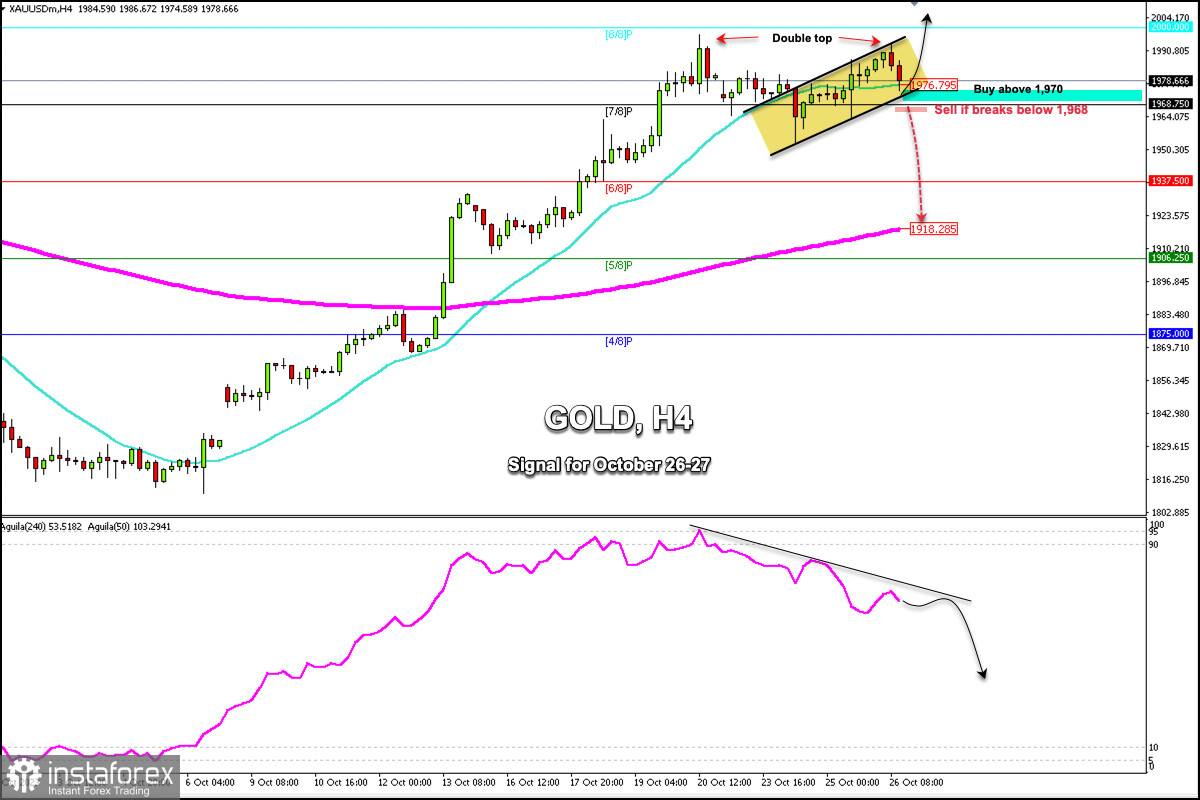

Early in the American session, gold (XAU/USD) is trading around 1,978.66, above the 21 SMA, and within an uptrend channel formed since October 20.

Gold has formed a double top between the highs of October 20 at 1,997 and on October 26 at 1,994. Trading below the 8/8 Murray, the instrument could fall to the support of 1,937 (6/8 Murray) and even 1,906 (5/8 Murray).

In the next few hours, gold could find a strong bounce around 1,970 or above this level, which could be seen as an opportunity to buy with targets at 1,985 and the psychological level of $2,000.

In case gold breaks sharply from the uptrend channel and falls below 7/8 Murray around 1,968, we could see a bearish acceleration. The price could fall to 6/8 Murray located at 1,937 and could even reach the EMA 200 located at 1,918.

Since October 19, the eagle indicator has been giving a negative signal. If the metal fails to break and consolidate above 1,970, it could begin a downward acceleration to the psychological level of $1,900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română