EUR/USD

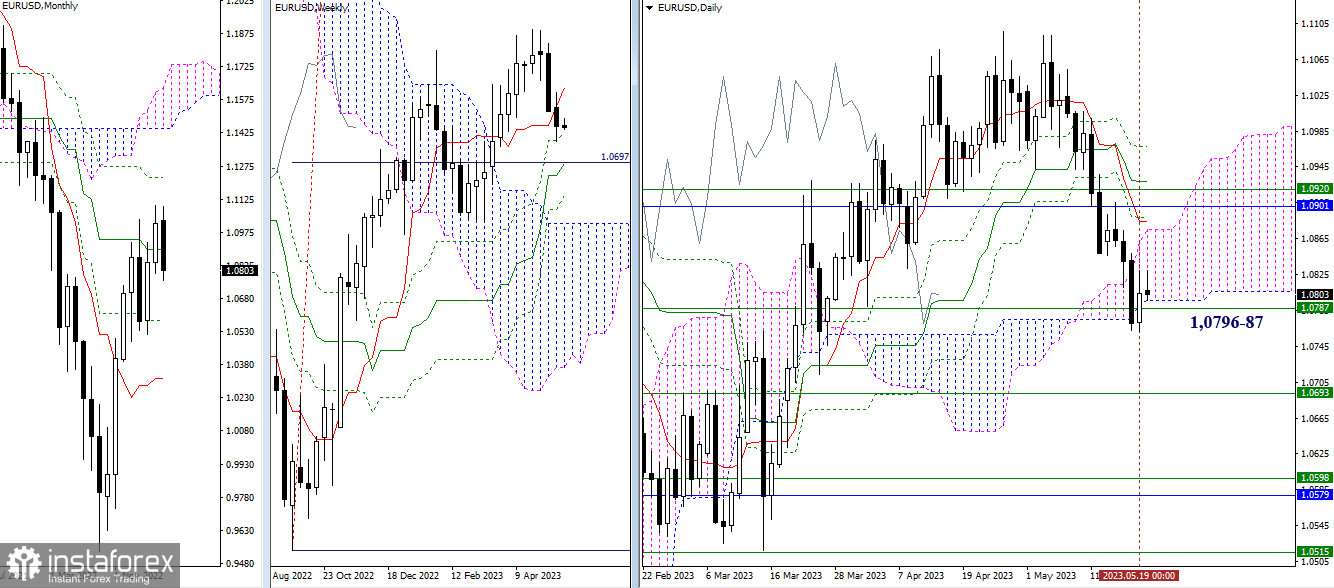

Higher timeframes

The encounter with the weekly support halted the downward momentum, resulting in a rebound on the daily timeframe. At the same time, the pair returned to the daily Ichimoku Cloud. If the bulls manage to consolidate the achieved result, further recovery of positions will encounter resistance at the daily levels 1.0875 - 1.0884 (upper boundary of the daily cloud + daily short-term trend) and higher timeframes at 1.0901 - 1.0920 (monthly medium-term trend + weekly short-term trend). However, if the bears manage to break through the zone of 1.0796 - 1.0787 (lower boundary of the daily cloud + weekly Fibo Kijun), a bearish target will be formed for breaking the daily cloud, opening the path to the next support at 1.0693 (weekly medium-term trend).

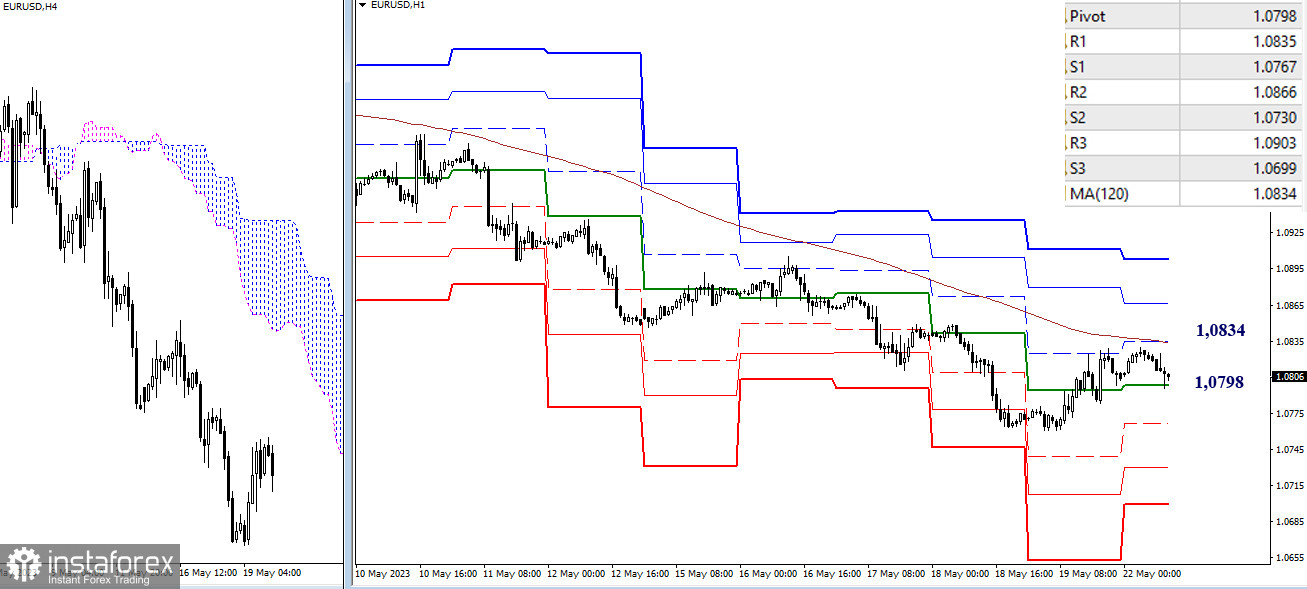

H4 - H1

Currently, despite the development of an upward correction, the main advantage belongs to the bears, as the market continues to remain under the influence of the weekly long-term trend (1.0834). A breakout and reversal of the moving average can change the situation. In this case, the benchmarks for the bulls within the day will be the resistances of the classic pivot points (1.0866 - 1.0903). Working below the weekly trend maintains the bears' advantage. After exiting the correction zone (1.0761), the supports of the classic pivot points (1.0730 - 1.0699) could become significant.

GBP/USD

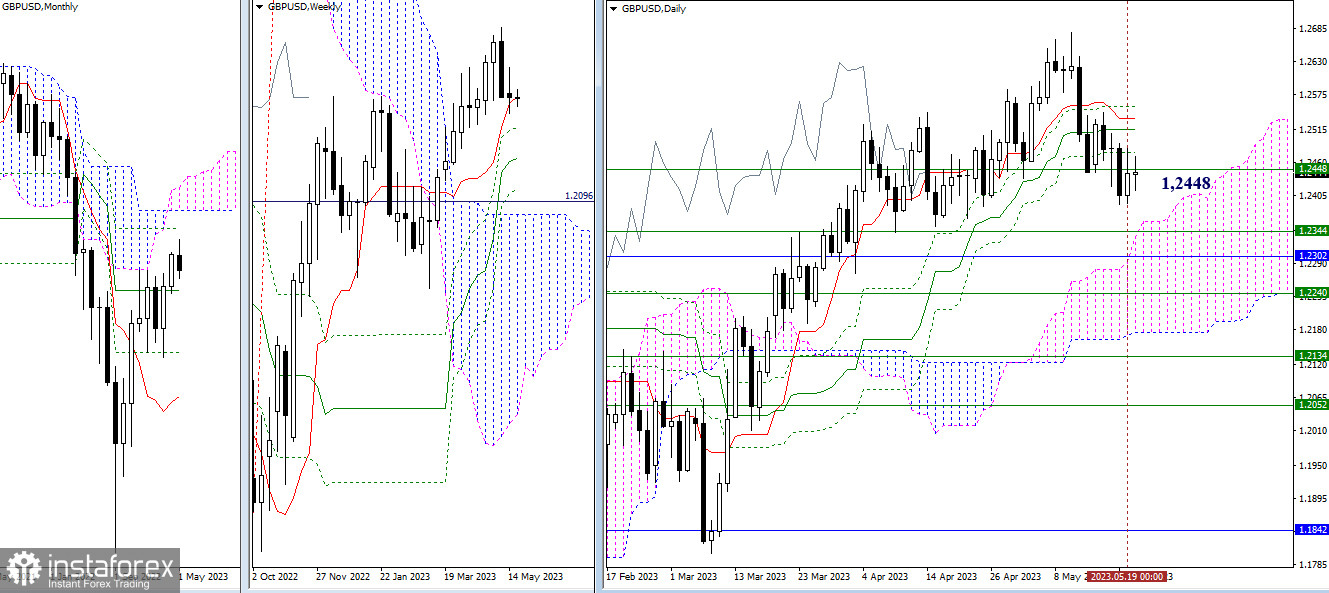

Higher timeframes

The downward movement has been halted, and the pair has returned to the attraction zone of the weekly short-term trend, currently located around 1.2448. Working in this area maintains uncertainty. However, if the movement continues, the following scenarios can be highlighted. For the bulls, the path goes through the resistances of the daily Ichimoku cross (1.2477 - 1.2515 - 1.2534 - 1.2553) and the local high (1.2678). For the bears, the nearest supports become important in case of a decline, which are currently marked at 1.2361 (upper boundary of the daily cloud) - 1.2344 (weekly Fib Kijun) - 1.2302 (monthly medium-term trend).

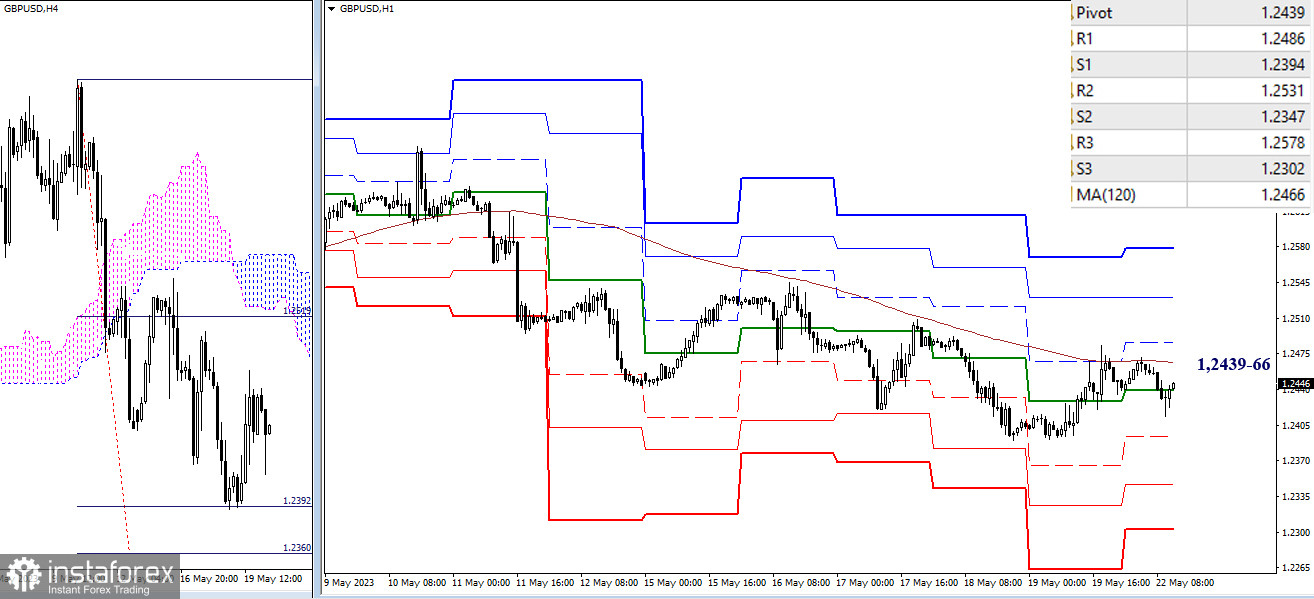

H4 - H1

After reaching the first target level on the H4 timeframe (1.2392), the initiative on lower timeframes has shifted to the bulls. Currently, they are testing the resistance of the weekly long-term trend (1.2466). A breakout and reversal of the moving average can change the current balance of power. The reference points for possible movement scenarios on lower timeframes today are located at 1.2486 - 1.2531 - 1.2578 (resistances of the classic pivot points) and at 1.2394 - 1.2347 - 1.2360 - 1.2302 (supports of the classic pivot points + target for breaking the H4 cloud).

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română