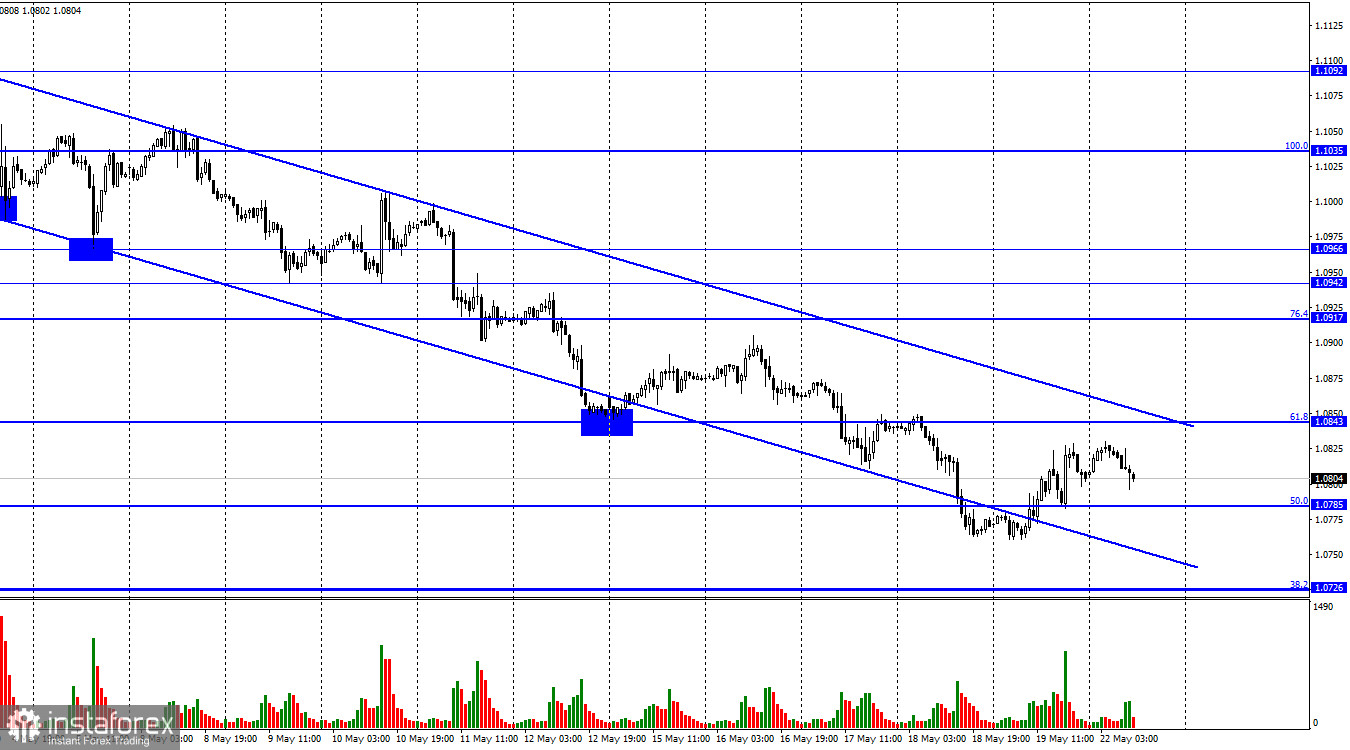

On Friday, the EUR/USD pair reversed, favoring the European currency, and consolidated above the corrective level of 50.0% (1.0785). Thus, the upward process can be continued toward the Fibonacci level of 61.8% (1.0843). A rebound from this level or the upper line of the descending trend corridor will favor the American currency and a resumption of the decline towards the corrective level of 38.2% (1.0726). Closing above the corridor will favor the continuation of the pair's rise toward the level of 1.0917. However, I expect further strengthening of the US dollar.

As is often the case, Monday is completely empty regarding economic events. The only scheduled event for today is James Bullard's speech from the Federal Reserve. In the late evening, there will be speeches by Bostic and Barkin from the Federal Reserve, but these officials are unlikely to impact the pair's movement as their views are similar to the consensus. I want to draw traders' attention to Bullard's speech, as he can balance what Powell said on Friday. To begin with, Bullard is the most aggressive member of the FOMC. He has regularly advocated for rate hikes with the largest steps and holds this view. Powell stated on Friday that the Fed might pause in June to assess the impact of rates on inflation, but Bullard insisted on further tightening just a week ago. Most likely, his rhetoric will remain the same.

Although Bullard does not participate in the rate voting process in 2023, other FOMC members may take his opinion into account. In any case, a hawkish statement made by a direct committee participant can support bears and the US dollar. The dollar is already reclaiming the positions it lost on Friday in the first half of the day. In the second half, the decline in the pair may continue.

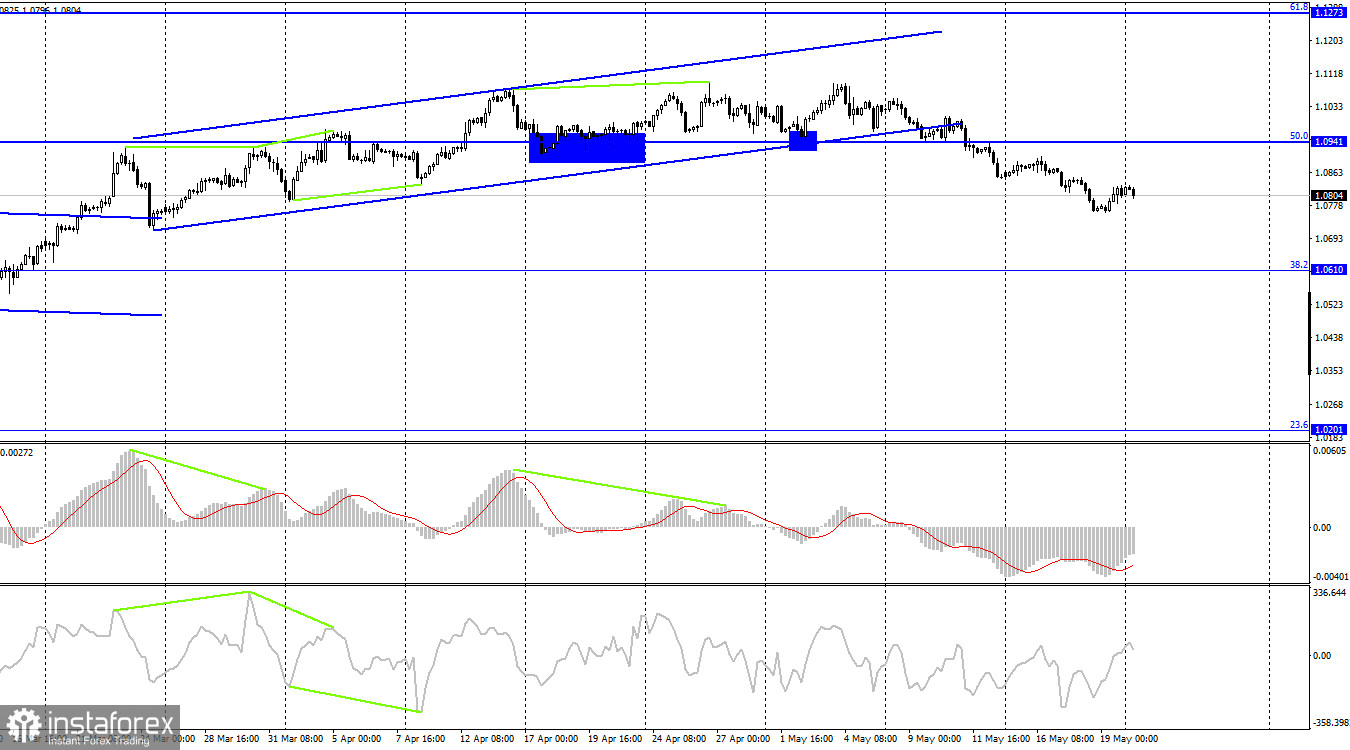

On the 4-hour chart, the pair has consolidated below the ascending trend corridor and the corrective level of 50.0% (1.0941), which allows for further decline towards the next corrective level of 38.2% (1.0610). Consolidation above the level of 1.0941 will favor the euro, as will a resumption of the rise toward the level of 1.1273. The bullish divergence forming on the MACD indicator has ultimately been canceled.

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 13,503 long contracts and 7,570 short contracts. The sentiment of major traders remains bullish and continues to strengthen overall. The total number of long contracts held by speculators now amounts to 260,000, while short contracts total only 81,000. The European currency has grown over the past six months, but the background information does not always support the pair's rise. The ECB lowered the rate hike step to 0.25% at the last meeting, which casts doubt on the further growth of the European currency. The difference between the number of long and short contracts is threefold, indicating the proximity of the moment when bears will take over. Strong bullish sentiment persists for now, but the situation will change soon. In recent weeks, the euro has maintained its high position but is not growing further.

News calendar for the United States and the European Union:

On May 22, the economic events calendar contained no important entries. The influence of the information background on traders' sentiment for the remaining part of the day will be absent.

Forecast for EUR/USD and trader advice:

New pair sales can be opened on a breakout below the level of 1.0843, with targets at 1.0785 and 1.0726. Alternatively, on an hourly chart, buying is advised after a close above the descending trend corridor with a target of 1.0917.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română