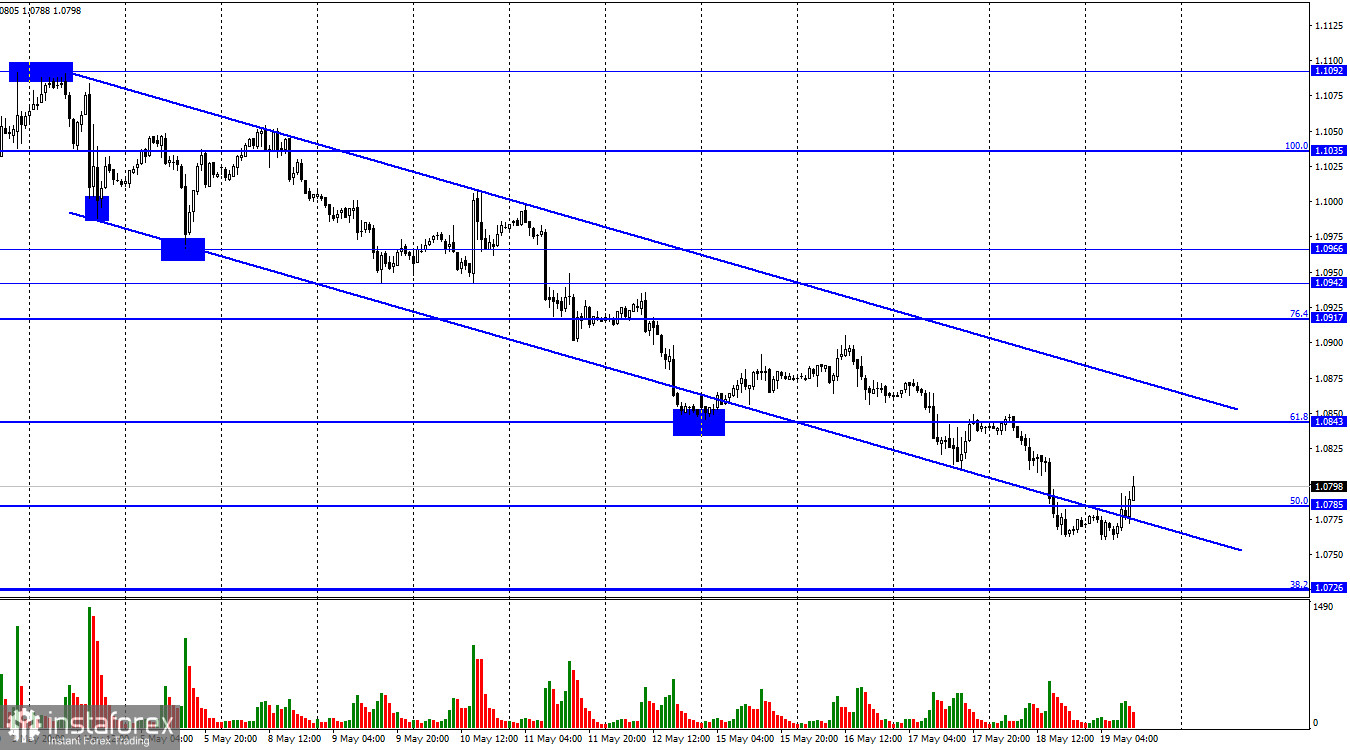

On Thursday, the EUR/USD pair continued its downward trajectory, settling below the 50.0% correction level at 1.0785. On Friday, a reverse closure occurred above the level of 1.0785, hinting at a slight uptick toward 1.0843. If the pair closes below 1.0785, it may decline toward the next correction level of 38.2% - 1.0726.

Yesterday, the fundamental backdrop was relatively quiet. There is no news about Christine Lagarde's speech yet. Hence, traders were only able to evaluate the US initial jobless claims report, which turned out slightly better than expected. Nevertheless, this report was released quite late, and the strengthening of the US currency during the first half of the day was not tied to this data since there were no reports from the EU.

However, traders did get some information from Federal Reserve official James Bullard in the evening. Bullard stated that in order to hedge against a slowdown in the future decline in inflation, interest rates will need to be raised one or two more times. Bullard believes that inflation is falling too slowly and expects it to fall at an accelerated pace. The FOMC member also fears that inflation could get out of hand, recalling the situation in the 1970s. However, his hawkish statement has a catch. Bullard will not be allowed to vote at this year's FOMC meeting. Thus, his opinion is simply that of an official who does not directly affect interest rates. Bullard has always been hawkish. However, not all members of the Board of Governors share his stance. The probability of the Fed raising rates in June remains low.

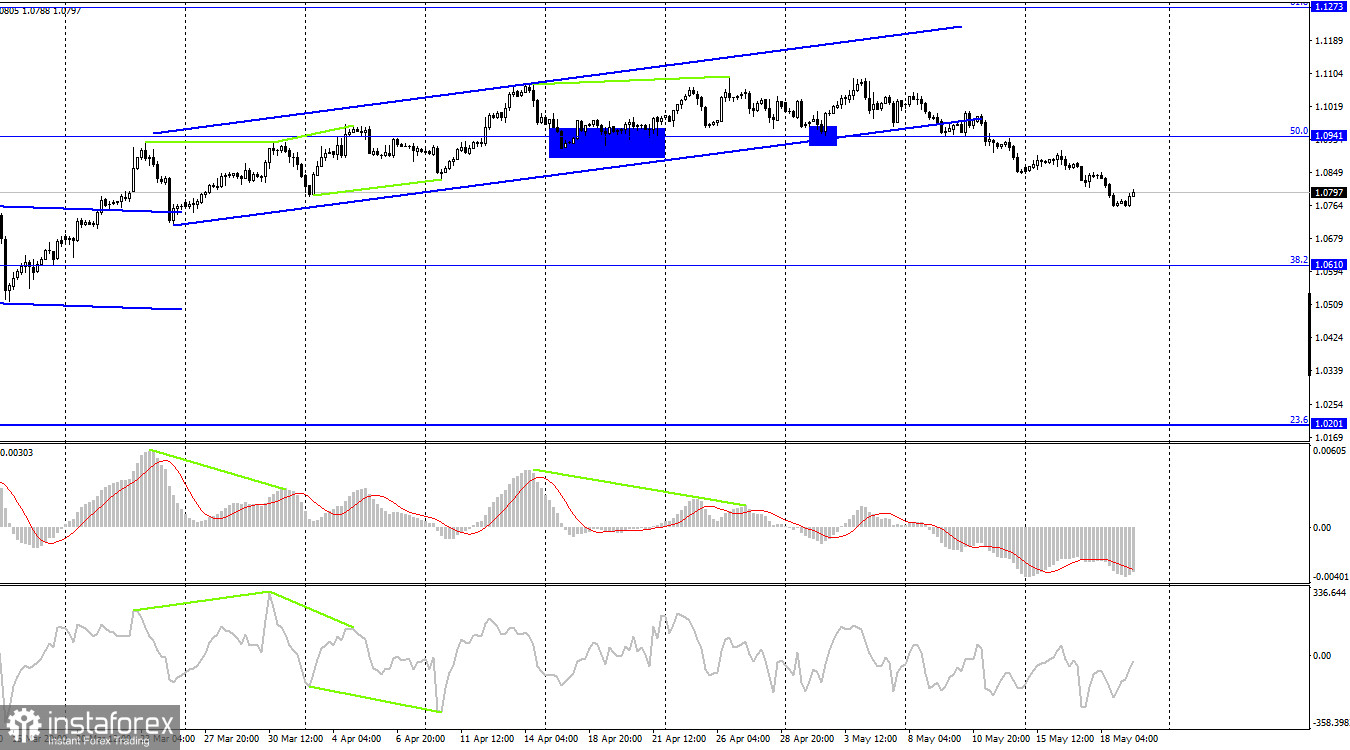

On the 4-hour chart, the pair secured a position below the ascending trend corridor and the 50.0% correction level at 1.0941. This suggests a continued decline towards the next correction level at 38.2% – 1.0610. Fixing above 1.0941 would help the euro and allow it to resume growth towards 1.1273. The impending bullish divergence on the MACD indicator has finally been erased.

COT report:

During the last reporting week, speculators opened 13,503 long and 7,570 short positions. The sentiment of the large traders remains bullish and continues to strengthen overall. The total number of long contracts held by speculators is now 260,000, while the number of short contracts is only 81,000. The euro has been on the rise for over six months, but the news backdrop has not always been supportive of the pair's growth. At its most recent meeting, the ECB reduced the rate hike step to 0.25%, which raises questions about the further growth of the euro. The difference between the long and short contracts has tripled, suggesting that bears may soon control the market. At the moment, there is still a strong bullish sentiment, but the situation is likely to change soon. The euro has just been holding high positions without any further growth in the last few weeks.

US and EU economic calendar:

US – Federal Reserve Chairman Powell Speaks (15-00 UTC).

EU – ECB President Lagarde Speaks (19-00 UTC).

On May 19, the economic calendar contains precisely two entries and both are very significant. The influence of the news backdrop on market sentiment for the rest of the day could be strong.

EUR/USD forecast and recommendations for traders:

You could open short positions once the price closes below 1.0843 on the hourly chart with the target at 1.0785. The target has been reached. New short positions can be opened with a new pair's closure below 1.0785, aiming for 1.0726. Long positions are out of consideration as the descending trend corridor signals a bearish trader sentiment, though an upward correction is possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română