Trading recommendations

When the price tested 1.2447, the MACD indicator had already plunged considerably below the zero line, limiting the pair's downward potential. For this reason, I refrained from selling the pound. Later in the day, the test of 1.2423 coincided with the MACD's downward move, which confirmed the sell signal, resulting in a nearly 30-point downward shift.

Today, aside from a speech by MPC Member Jonathan Haskel, there is no significant fundamental data. Hence, traders may attempt to buy the pound near the weekly lows, anticipating a minor upward correction. The strategy for the first half of the day leans more towards scenario No.2, as there are no strong or unilateral movements.

Buy signal

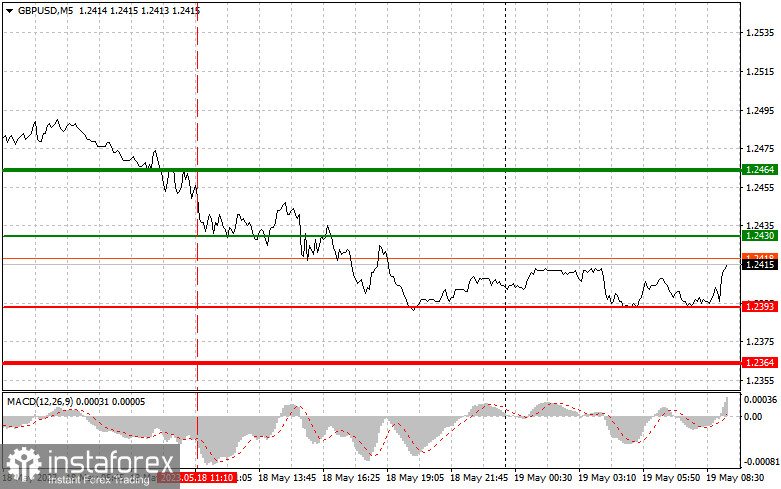

Scenario No.1: You may consider longs on the pound today at the 1.2430 entry point (green line on the chart), betting on a rise to 1.2464 (thicker green line on the chart). It would be good to close the long position at 1.2464 and open a short one, expecting a 30-35 point move in the opposite direction. We can anticipate the pound's rise as early as the first half of the day. Important! Before buying, ensure that the MACD indicator is above the zero line and only just beginning its ascent.

Scenario No.2: You may also buy the British pound today after two consecutive tests of 1.2393 when the MACD indicator is in the oversold area. This would limit the pair's downward potential and prompt a market turnaround upwards. We may expect a rise towards the opposite levels of 1.2430 and 1.2464.

Sell signal

Scenario No.1: You may sell the pound today after the pair reaches 1.2393 (red line on the chart), leading to a swift decline of the pair. The sellers' primary target would be the level of 1.2364, where you may close the short position and open a long one, expecting a 20-25 point move in the opposite direction. Pressure on the pound is likely to intensify after a failed correction attempt in the first half of the day. Important! Before selling, ensure that the MACD indicator is below the zero line and just starting its descent.

Scenario No.2: Another selling opportunity for the pound today could be after two consecutive tests of 1.2430 when the MACD indicator is in the overbought area. This would limit the pair's upward potential and trigger a market downtrend. We can also expect a drop to the opposite levels of 1.2393 and 1.2364.

Chart description:

The thin green line denotes the entry price for buying the trading instrument.

The thick green line is the anticipated price level to place a take profit order or to manually lock in profits, as the likelihood of further growth above this point is minimal.

The thin red line indicates the entry price for selling the trading instrument.

The thick red line represents the proposed price level to place Take Profit or to manually secure profits, as the chance of further decline below this level is low.

The MACD indicator is also crucial. When entering the market, it's important to consider overbought and oversold zones.

Important Note: Novice Forex traders should be very cautious when making market entry decisions. It is better to refrain from trades before the release of important fundamental reports to avoid sharp exchange rate fluctuations. If you choose to trade during news releases, always set stop loss orders to minimize losses. Without such orders, you may rapidly lose your deposit, especially if you are trading large volumes without using money management.

Remember that successful trading requires a clear trading plan, similar to the one I've outlined above. Spontaneously making trading decisions based on the current market situation is a losing strategy for a day trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română