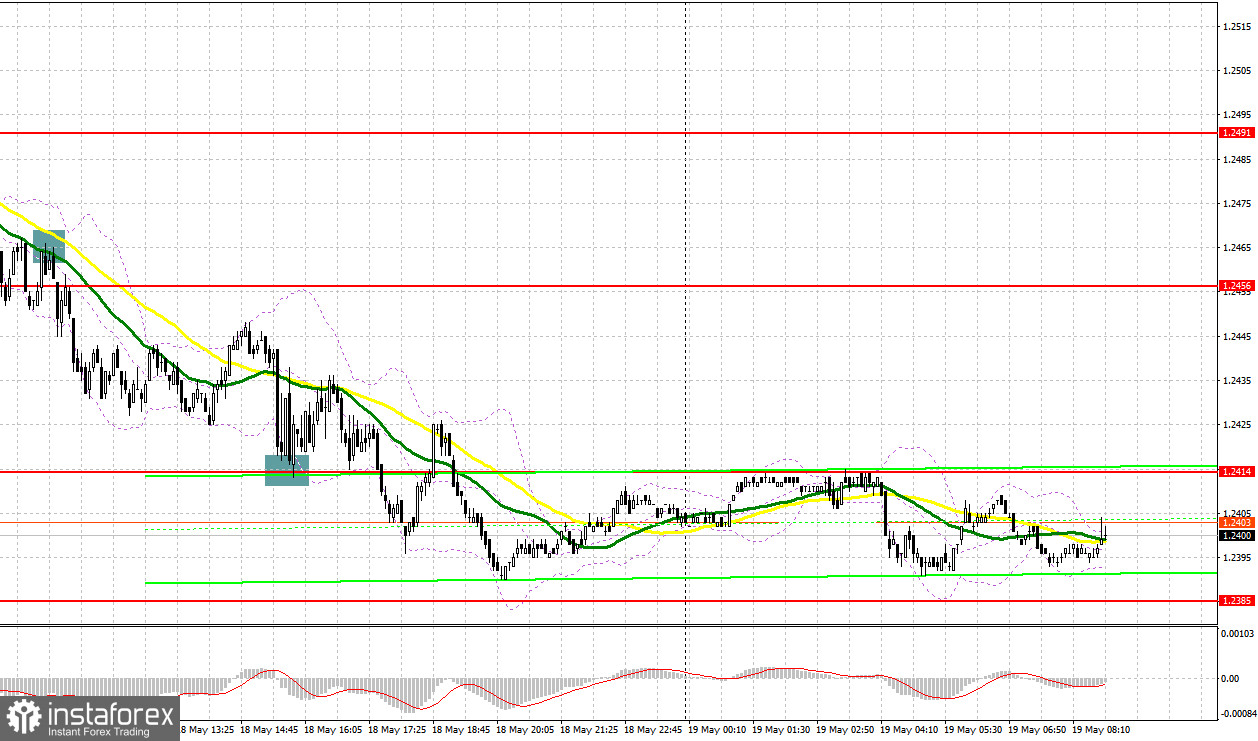

Yesterday, the pair formed several entry signals. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.2460 as a possible entry point. Its breakout and an upward retest formed a great sell signal, sending the price down by more than 30 pips. In the afternoon, the bulls managed to defend the support at 1.2414, and the price bounced off it by 20 pips. Then, the pair came under pressure again.

For long positions on GBP/USD:

The absence of key economic data from the UK, Andrew Bailey's speech, and a drop in US initial jobless claims have contributed to the further decline of the pound against the US dollar, pushing it to new monthly lows. Given that today there are no major events apart from the speech by Jonathan Haskel, a member of the Bank of England's Monetary Policy Committee, there is little for the bulls to rely on. The pair may develop an upside correction due to profit-taking. Yet, amid such a strong bear market, a correction is unlikely.

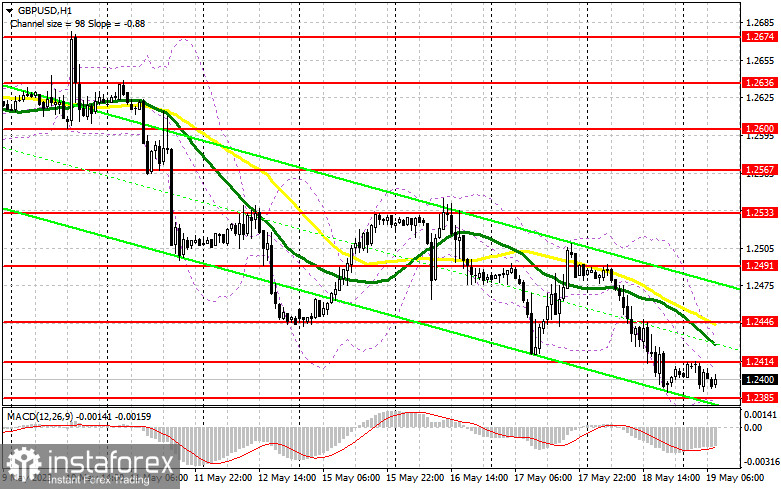

Therefore, I wouldn't rush to open long positions. Bulls will only be able to defend the nearest support level at 1.2385, which represents a new monthly low. Only then can we expect a recovery in the pair. If a false breakout occurs there, along with hawkish statements from the Bank of England representatives, it will provide a buy signal against the bearish market with a prospect of recovery towards the 1.2414 area. A breakthrough and consolidation above this range will generate an additional buy signal with a target at 1.2446, where the moving averages support the sellers. The ultimate target will be the 1.2491 area where I will take profit.

If the pair declines towards 1.2385, and bulls won't add any new positions there, the downtrend will continue. In that case, I will buy the pair only when the price hits the key level of 1.2353 after a false breakout. I plan to buy GBP/USD immediately on a rebound from the low of 1.2310, keeping in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

In the current situation, bears are dominating the market, and there is a strong possibility of a further decline. However, considering the end of the week, I will not rush to open short positions. Taking into account how bulls are taking advantage of relatively attractive prices, and how major market players can reverse the market, I will hold off on selling until a false breakout occurs above the nearest resistance at 1.2414 formed yesterday. From there, a downward movement should develop quite quickly. If there is no active sell-off at this point, it is better to exit short positions. In this case, the bears' target will be the new monthly low at 1.2385. A breakout and an upward retest of this range will increase the pressure on GBP/USD, forming a selling signal with a decline to 1.2353. The ultimate target remains the low of 1.2310 where I will take profit.

If GBP/USD advances, and bears are idle at 1.2414, it is best to postpone selling until the price tests the level of 1.2446. Only a false breakout there will provide an entry point for short positions. If there is no downward movement at that point, I will sell GBP/USD on a rebound immediately from the high of 1.2491, considering a downward correction of 30-35 pips within the day.

COT report

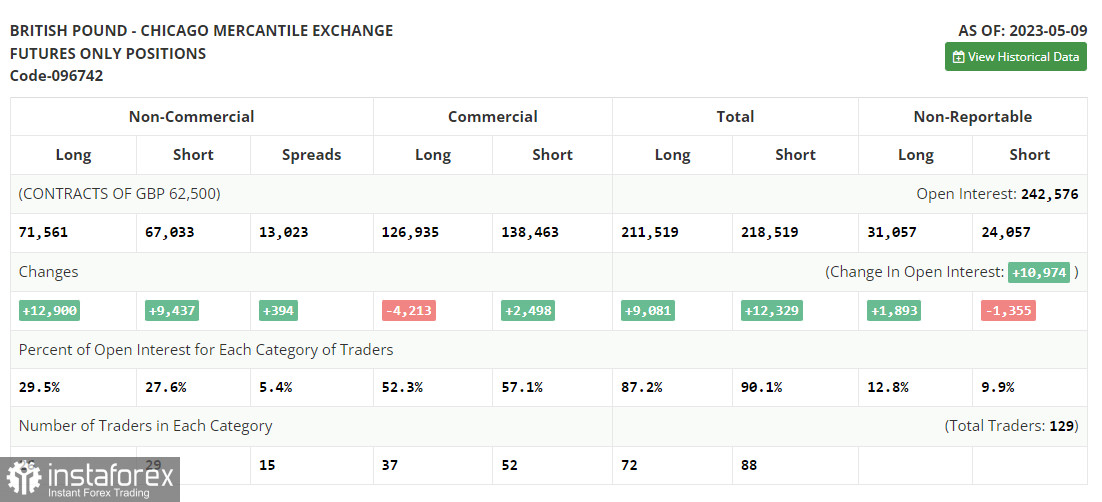

The Commitments of Traders report for May 9 recorded an increase in both long and short positions. Although the Bank of England's decision to raise interest rates is not yet reflected in these data, the active rise in long positions proves the presence of traders willing to buy the pound even at current levels. Given a noticeable correction at the end of last week, the demand for the pound may increase. The latest COT report states that short positions of the non-commercial group of traders grew by 12,900 to 71,561, while long positions jumped to 9,437. This led to an increase in the non-commercial net position to 4,528 against 1,065 recorded a week earlier. The pair resumed growth after a slight decline, which will have a positive impact on the pound in the future. The weekly closing price rose to 1.2635 against 1.2481.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a rise, the upper band of the indicator at 1.2545 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română