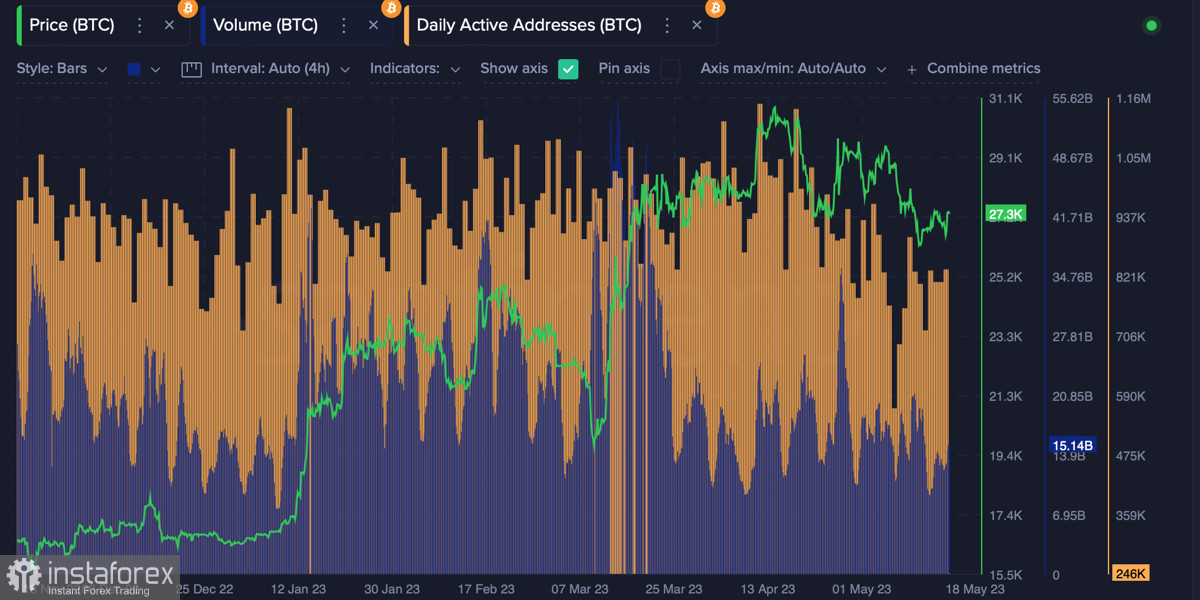

Bitcoin is approaching the end of the trading week near the $27k level. The cryptocurrency's quotes have not changed significantly over the past five days, indicating a period of consolidation and reaching a strong support level near the $27k mark.

Despite the slowdown in the rate of Bitcoin's price decline, the bearish positions remain strong. A spike in volatility would be enough to collapse the price below the $27k mark. Bearish sentiments on Bitcoin do not prevent investors from accumulating BTC coins as the price drops.

Interest in BTC is growing

The local correction does not negate the fact that Bitcoin is becoming an important investment tool. This is influenced by the early stage of the bull market, the update of local price highs, as well as high inflationary pressure on the USD and the likelihood of a U.S. default.

According to the latest surveys of professional investors, Bitcoin has entered the top 3 diversified assets alongside gold. This suggests that the cryptocurrency is resuming its status as a protective asset. Tether was the first company to announce a monthly purchase of BTC.

The USDT issuer announced that up to 15% of its net profit would be used to purchase BTC/USD. At the same time, smaller investors are also actively accumulating the first cryptocurrency. According to Santiment data, wallets with a balance of 1,000–10,000 BTC have started actively accumulating cryptocurrency over the past five weeks.

It's also worth remembering that, last week, Tether "printed" another $1 billion USDT. Over the past six months, the increase in the volumes of the main stablecoin indicated the imminent start of an upward movement of the main cryptocurrency.

Considering this, the next stage of the bull rally should be expected soon, where the BTC price will finally consolidate above the $30k level. However, as of May 18, trading volumes are at a minimum, and Bitcoin itself is correcting.

BTC/USD Analysis

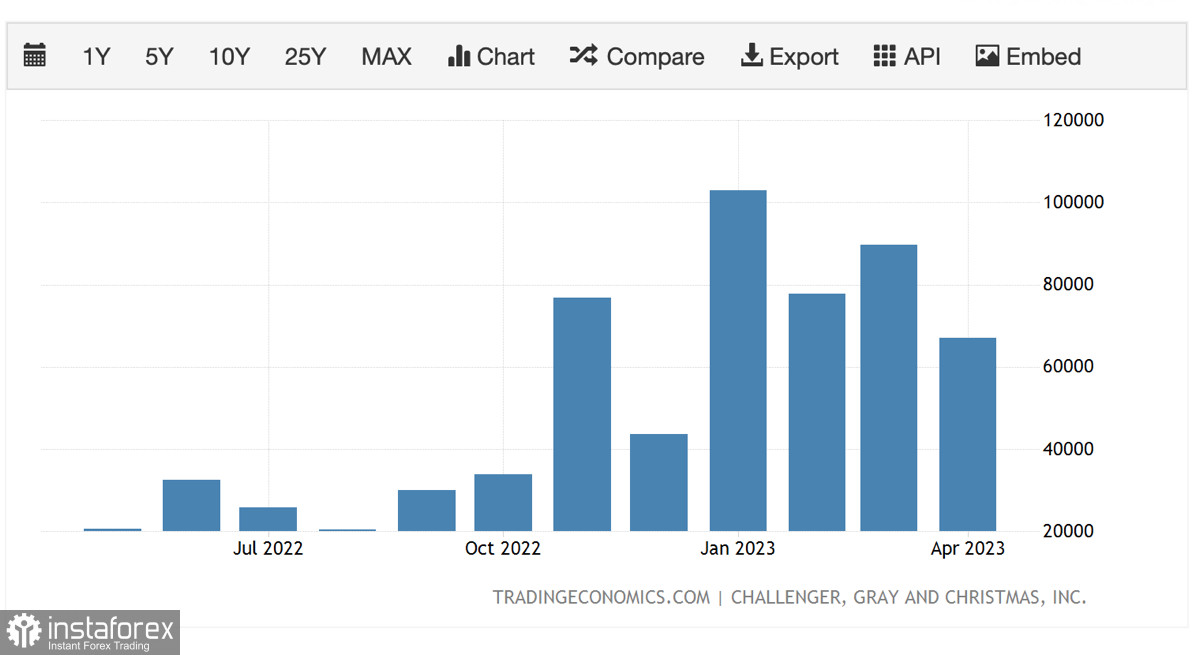

Today, May 18, we expect the first volatility catalyst in the crypto market—the publication of labor market data. An increase in the number of applications for unemployment benefits will be a positive signal for BTC. However, key changes in the price of Bitcoin should be expected tomorrow, May 19, when theses on monetary policy will be voiced.

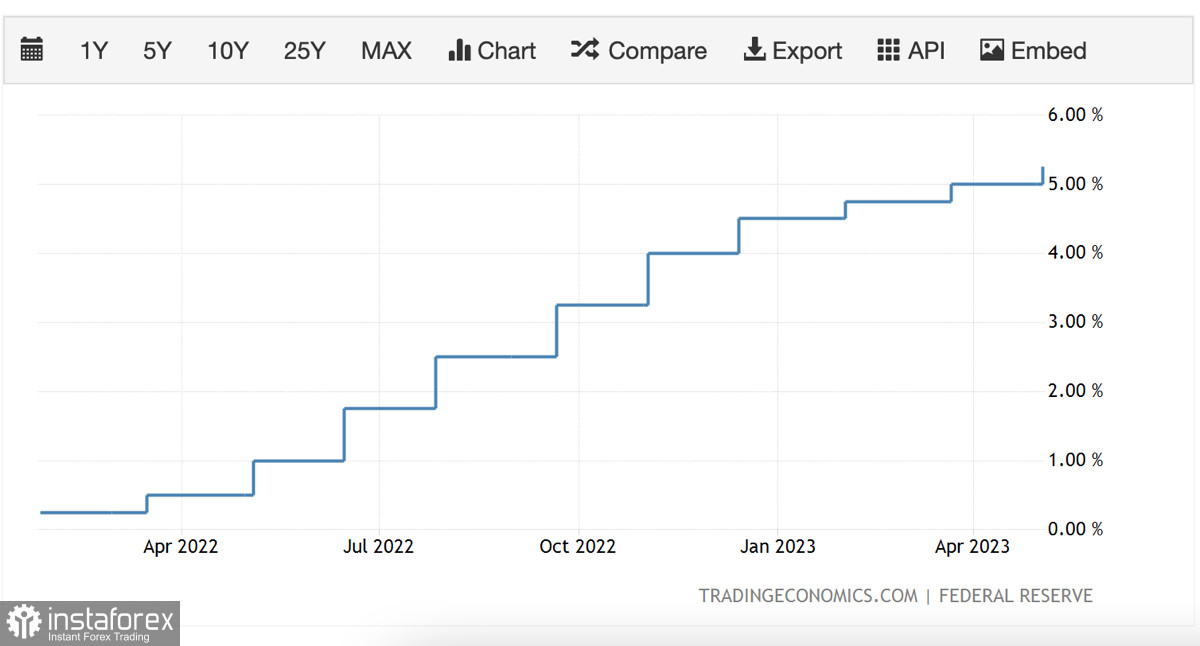

Jerome Powell and Christine Lagarde will make statements on the Federal Reserve's monetary policy and give market signals regarding the future key rate. Bitcoin is highly dependent on the regulator's actions, so a spike in volatility and sharp price movements should be expected.

As of 08:00 UTC, Bitcoin continues to trade near the $27.2k level. At the end of yesterday's trading day, the asset attempted a retest of the $26.6k support level, but due to active buyer actions, the price returned above $27k.

This is a bullish signal, as buyers are ready to defend the $26.6k level. At the same time, the bulls lack the volume to develop an upward impulse and move towards $27.5k. A situation is arising in which the $26.6k support level is maintained, but the bulls fail to make a local trend reversal.

Technical metrics do not demonstrate uniform dynamics, which is characteristic of a period of consolidation and low trading activity. Despite this, it can be assumed that BTC has a higher chance of going for a retest of the $26.6k level than resuming the upward movement.

Conclusion

With a high degree of probability, we can expect a resolution of the BTC situation tomorrow. The catalyst for this will be the speeches of Federal Reserve officials. The price can move in any direction, and everything will depend on the specific statements of the Federal Reserve. It is quite likely that a situation will develop that is characteristic of periods of high volatility, when the price manipulatively makes impulses in both directions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română