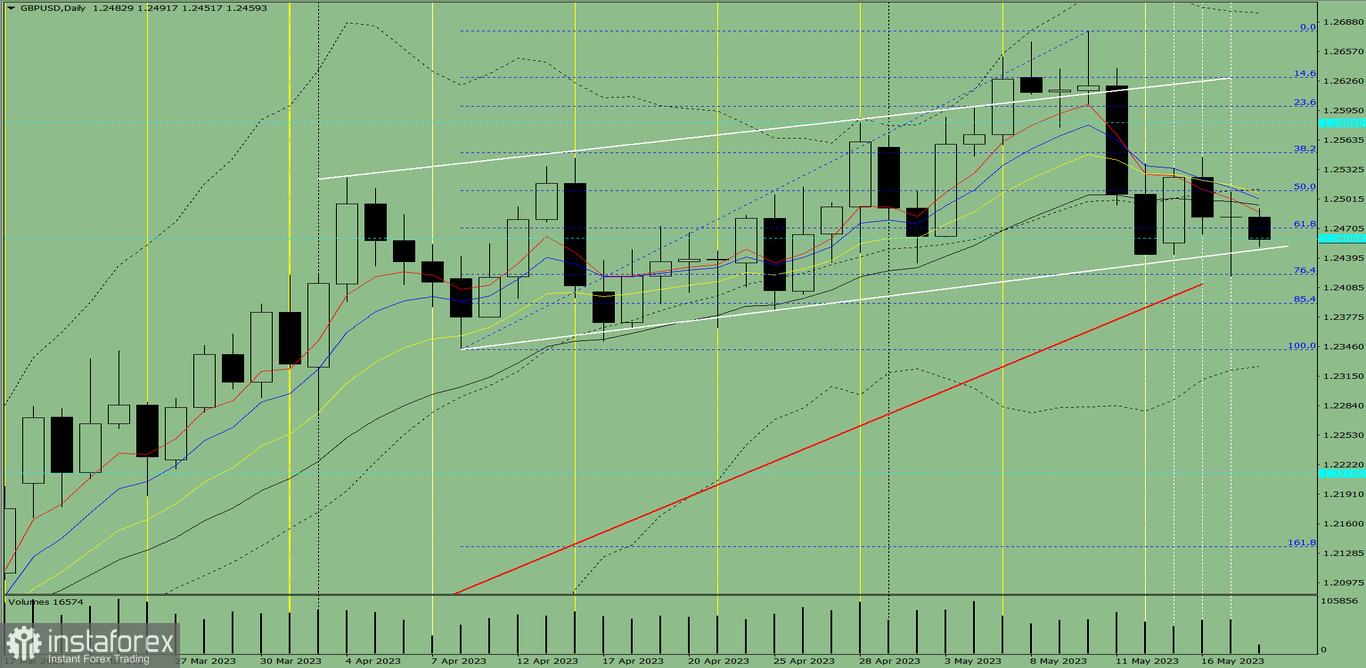

Trend analysis (Fig. 1)

GBP/USD has signs of continuing its decline from 1.2483 (closing of yesterday's daily candle) to 1.2422, which is the 76.4% retracement level (blue dotted line). But most likely, upon reaching that price, the pair will turn around and move towards 1.2460, which is a historical resistance level (blue dotted line).

Fig. 1 (daily chart)

Comprehensive analysis:

Indicator analysis - downtrend

Fibonacci levels - downtrend

Volumes - downtrend

Candlestick analysis - downtrend

Trend analysis - uptrend

Bollinger bands - downtrend

Weekly chart - downtrend

Conclusion: GBP/USD is likely to dip from 1.2483 (closing of yesterday's daily candle) and head towards the 76.4% retracement level at 1.2422 (blue dotted line). Upon reaching this price, the pair will turn around and test the historical resistance level at 1.2460 (blue dotted line).

Alternatively, the pair could slide from 1.2483 (closing of yesterday's daily candle) to the 85.4% retracement level at 1.2392 (blue dotted line), and then rebound to the lower fractal at 1.2420 (blue dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română