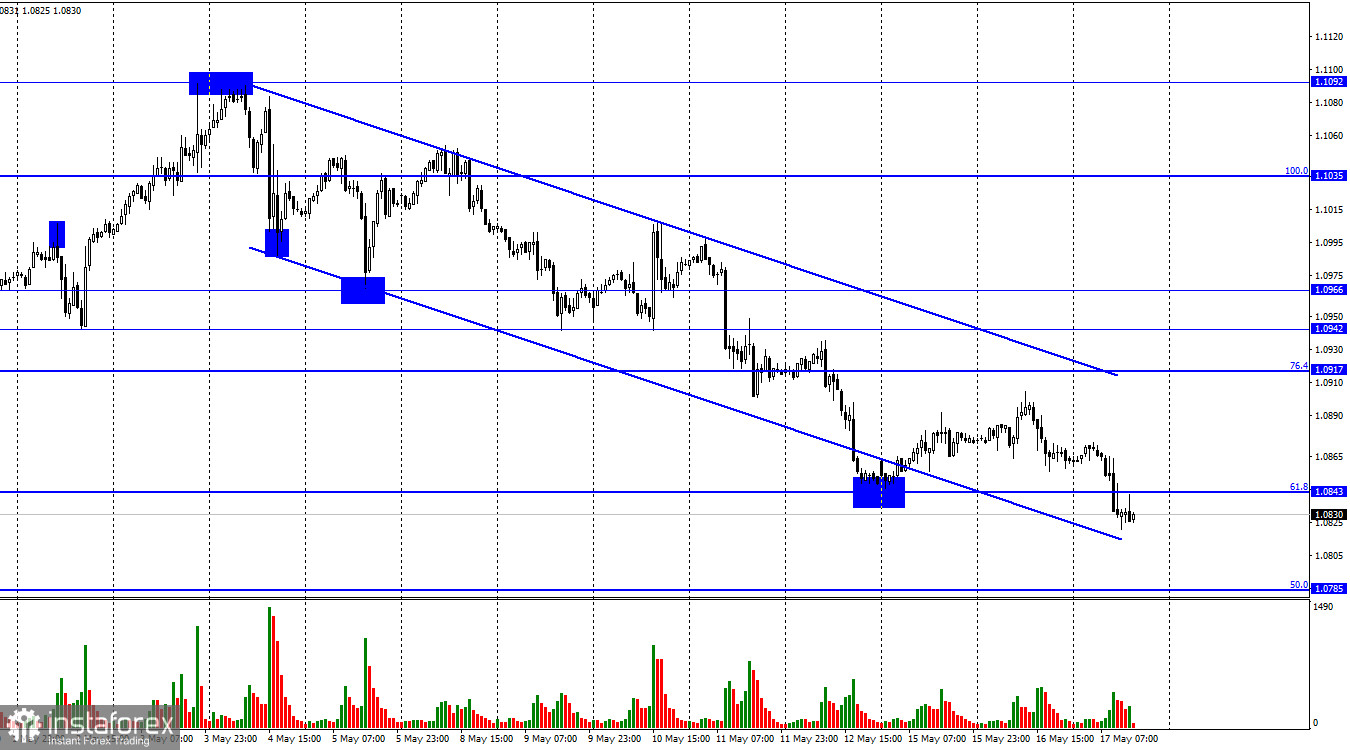

The EUR/USD pair continued to fall on Wednesday and has secured below the corrective level of 61.8% (1.0843). Thus, the fall of the euro currency can now continue towards the next Fibonacci level of 50.0% (1.0785). A pair's rate closing above the 1.0843 level will favor the EU currency and cause some growth toward the Fibonacci level of 76.4% (1.0917). The downward trend corridor continues to characterize the traders' sentiment as "bearish." The European currency has been falling for over a week after two months of growth.

During today's day, only one event could attract traders' attention. The inflation report in the European Union for April in the final assessment was 7.0% y/y, recording an acceleration of 0.1%. Core inflation fell by 0.1% from 5.7% to 5.6% y/y. It doesn't matter which of the indicators accelerated and which slowed down. Changes in both are so insignificant that they cannot affect future changes in the ECB's monetary policy. In addition to this, both indicators in the final estimate did not differ from the first estimate, which became known two weeks ago. And the European currency fell by 40 points today before these reports were released. Thus, the new fall of the euro currency is unrelated to economic statistics from the European Union.

Overall, statistics from the Eurozone continue to disappoint. Yesterday we learned that GDP for the second quarter in a row is almost not increasing today - that inflation is accelerating again. Some economists believe that the base indicator is more important than the overall one, but what reaction can be expected from the ECB if the base decreases and the main one grows? The regulator will not be satisfied with the fall of only that inflation indicator that reflects the price change for everything except food and energy carriers. After all, inflation primarily hits the pockets of people experiencing poverty, who are very dependent on gasoline, utility services, and food prices.

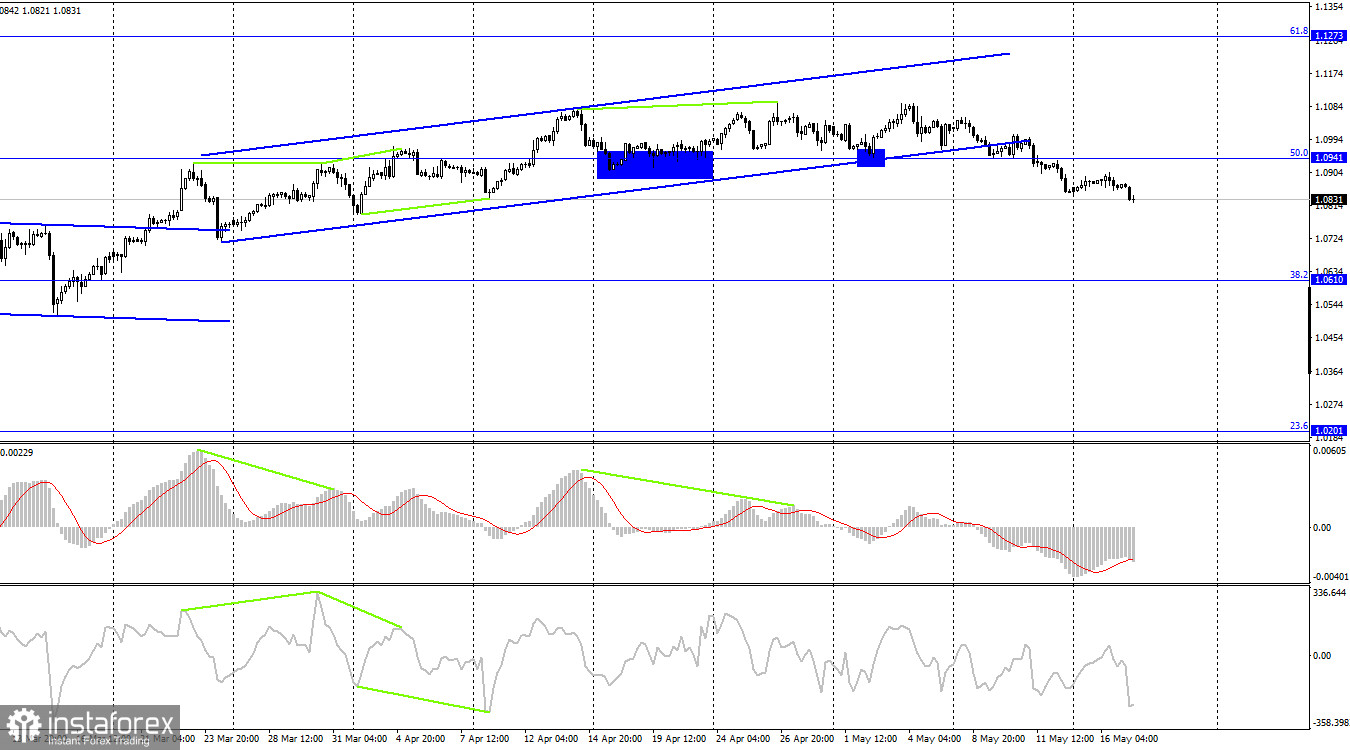

On the 4-hour chart, the pair secured below the ascending trend corridor and the corrective level of 50.0% (1.0941), allowing us to expect a fall continuation towards the next corrective level of 38.2% (1.0610). Securing the quotes above the 1.0941 level will favor the euro currency and the resumption of growth towards the 1.1273 level. No emerging divergences are observed today with any indicator.

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 13,503 long contracts and 7,570 short contracts. The sentiment of major traders remains "bullish" and continues to strengthen generally. The total number of long contracts concentrated in the hands of speculators now amounts to 260 thousand, and the number of short contracts – only 81 thousand. The European currency has been growing for over half a year, but the news background does not always support the pair's growth. The ECB lowered the rate hike step to 0.25% at the last meeting, which casts doubt on the further growth of the European currency. The difference between the number of long and short contracts is threefold, which speaks of the proximity of the moment when the bears will take the offensive. So far, a strong "bullish" sentiment has been preserved, but I think the situation will start to change soon. The euro has retained high positions in recent weeks but has not grown further.

News calendar for the USA and the European Union:

EU – Consumer Price Index (CPI) (09:00 UTC).

US – Number of building permits issued (12:30 UTC).

On May 17, the economic events calendar contains two relatively important entries. The most important inflation is already known. The influence of the news background on the traders' sentiment for the rest of the day may be weak.

EUR/USD forecast and trader advice:

New pair sales could be opened upon closing below the 1.0843 level on the hourly chart, with a target of 1.0785. Now these deals can be kept open. Purchases are possible upon securing above the 1.0843 level on the hourly chart, with a target of 1.0917.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română