EUR/USD

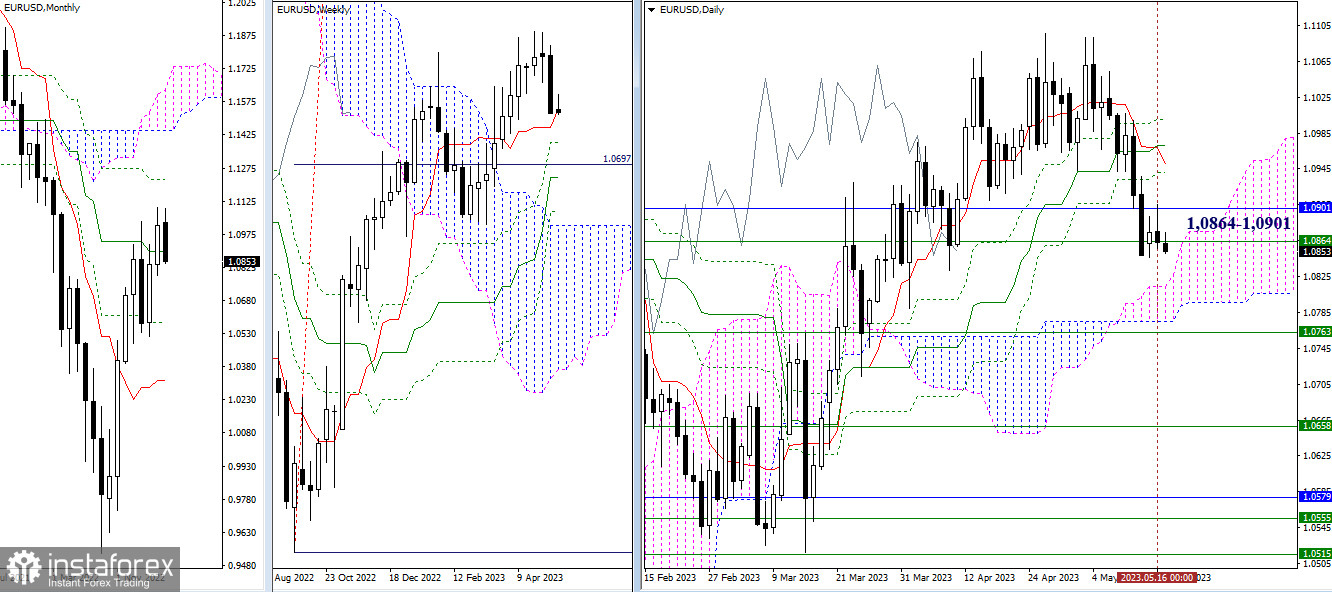

Higher timeframes

The pair continues to remain in the lower part of the current attraction and influence zone of 1.0864 – 1.0901 (weekly short-term trend + monthly medium-term trend). If the low (1.0846) is updated, the decline may continue, with the daily cloud (1.0814 – 1.0775) and monthly support (1.0763) as its targets. However, if the bulls manage to rise above 1.0901, their attention will then be focused on overcoming the resistance of the daily Ichimoku cross (1.0941 – 1.0981 – 1.1000) and the local high (1.1096).

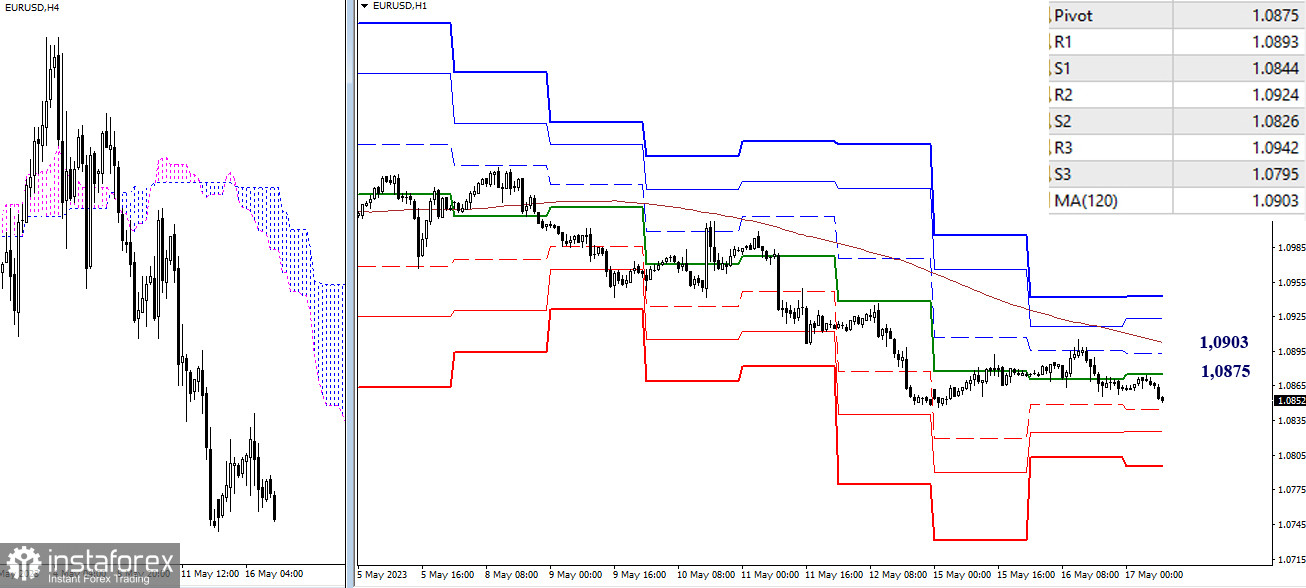

H4 – H1

On the lower timeframes, the bears are close to updating the low (1.0846). The completion of the corrective rise will help them continue the downward trend. The next bearish targets within the day are the supports of the classic pivot points (1.0844 – 1.0826 – 1.0795). The key levels of the lower timeframes are acting as the resistances today, they will defend the interests of the bears at 1.0875 (central pivot point) and 1.0903 (weekly long-term trend). Overcoming these resistances and a secure consolidation above can change the current balance of power. Further, for the rise, resistances R2 (1.0924) and R3 (1.0942) may be of importance.

GBP/USD

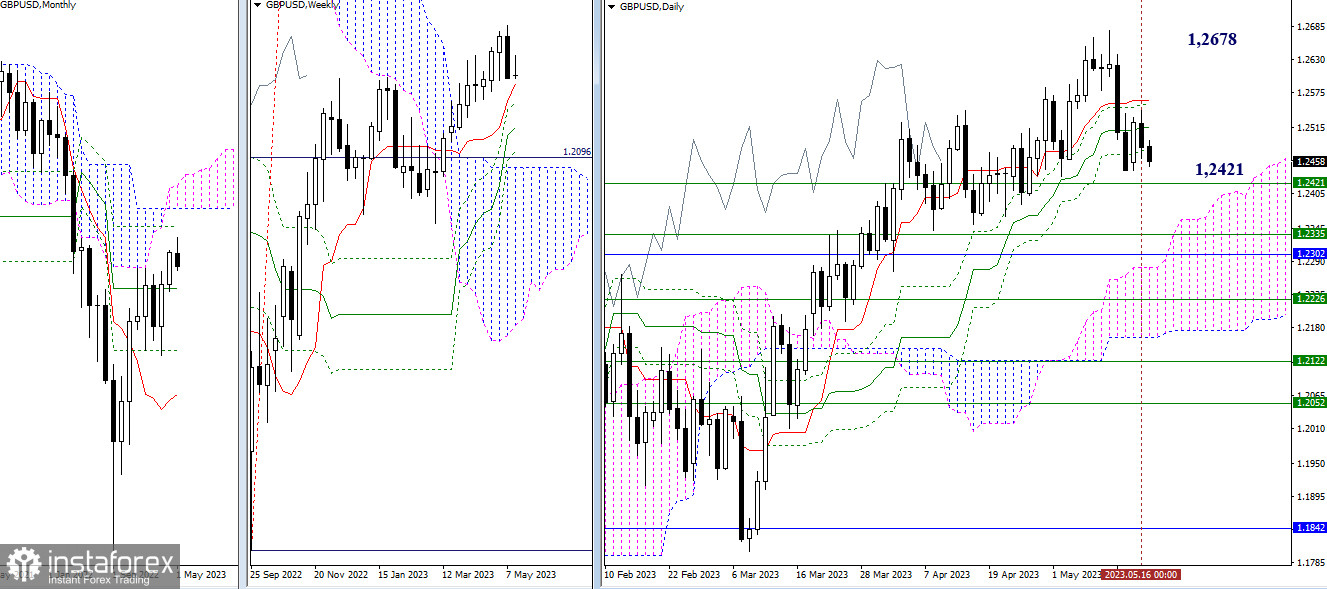

Higher timeframes

The daily cross is holding back the development of the movement, so the pair has been working in the zone of attraction of its levels (1.2477 – 1.2515 – 1.2561) for several days now. To change the situation, the market needs to leave the zone of influence of the daily golden cross of Ichimoku and overcome the nearest lines. The bulls need to consolidate above the local high (1.2678), which will help to complete the current corrective decline, while after the liquidation of the daily cross, the bears need to take over the weekly short-term trend (1.2421).

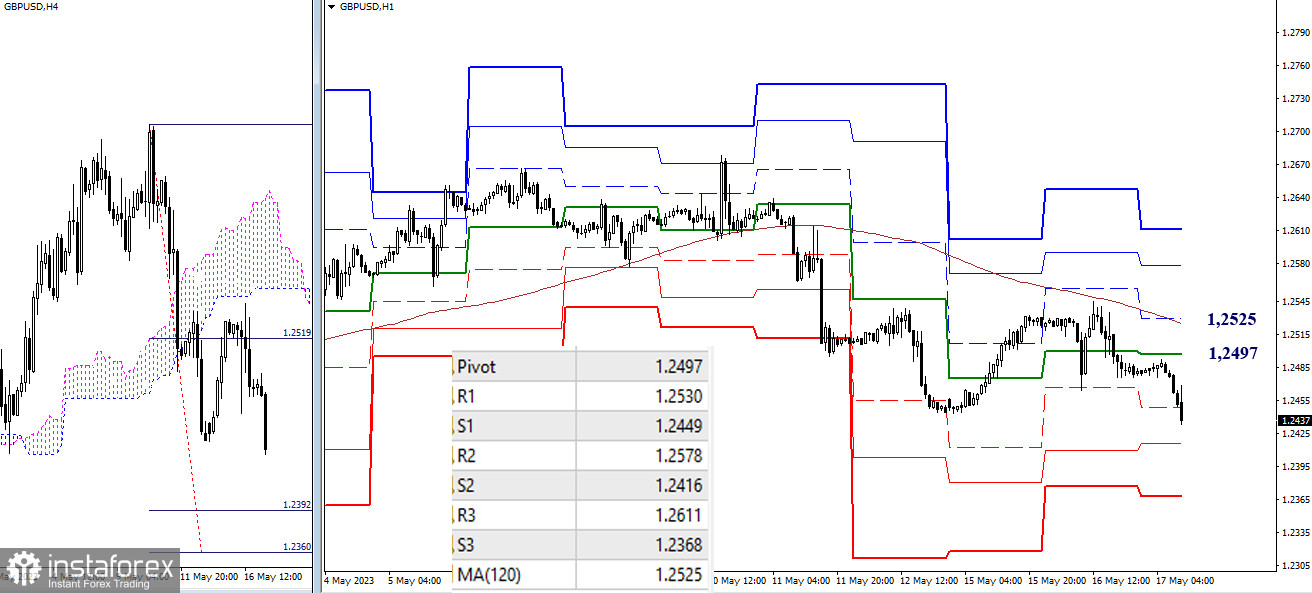

H4 – H1

The rise that the bulls implemented earlier did not lead to the loss of the weekly long-term trend. Now the bears have already been able to update the low and continue to decline. The bearish targets within the day today are the supports of the classic pivot points (1.2416 – 1.2368) and the target for the breakdown of the H4 cloud (1.2392 – 1.2360). The key levels of the lower timeframes currently form a resistance zone around 1.2497 – 1.2525 (central pivot point of the day + weekly long-term trend), the breakthrough of which could be a good basis for changing the current balance of power.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română