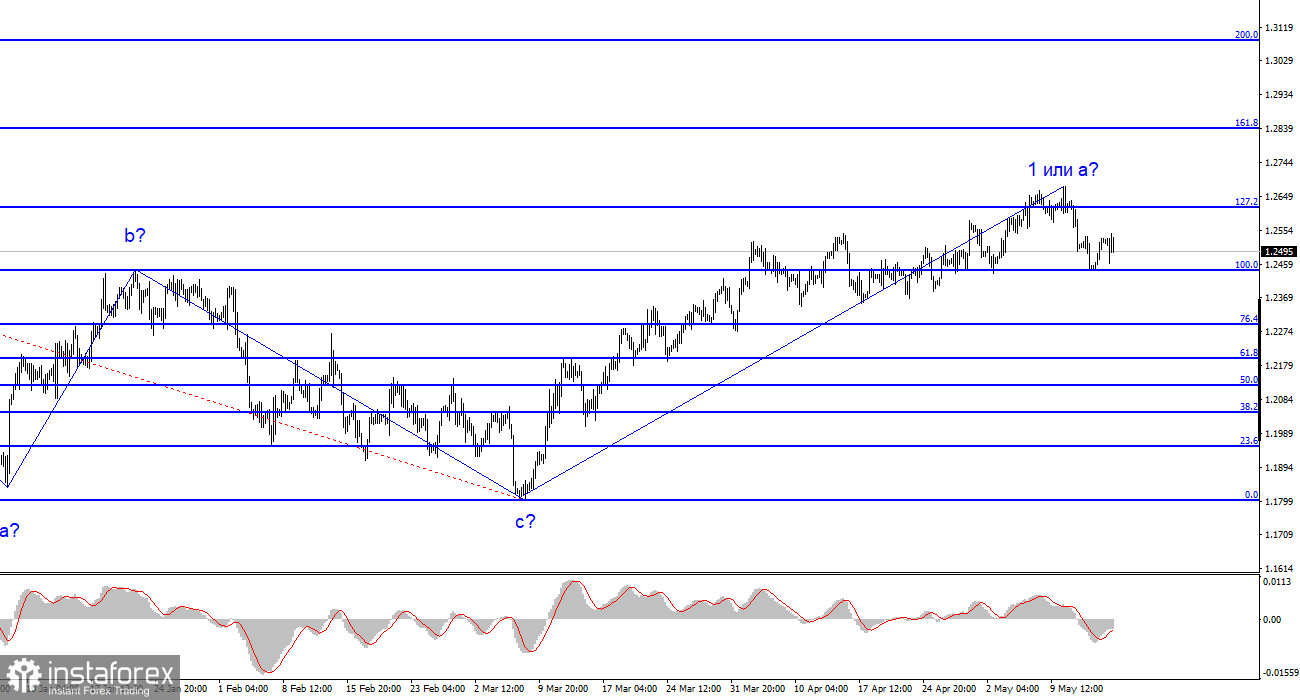

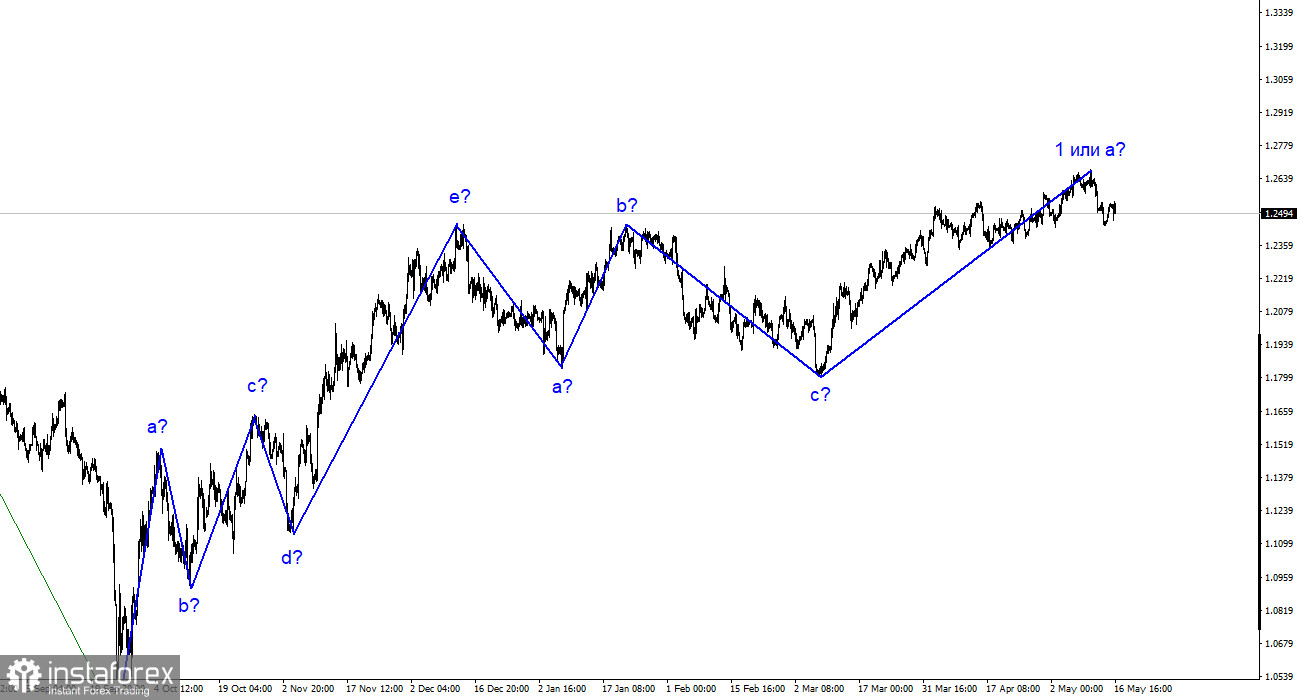

At the moment, the wave markup for the GBP/USD pair still looks complicated and ambiguous. It doesn't look like a classic corrective or impulse trend segment. Since the peak of the current upward wave has surpassed the peak of the last b wave, the entire downward trend segment, consisting of a-b-c waves, can be considered complete. Therefore, a new upward trend segment is now being built for the pound. Since March 8, I can identify only one wave of the current scale, so there is every reason to assume that forming the new trend segment will take a long time.

Both pairs should build similar wave formations. If this is indeed the case, then wave 2 or b for the pound may be extended, and at the same time, a descending three-wave formation may be built for the euro. Thus, I expect a deep wave b, as with the previous three-wave formation. Therefore, we can expect a decrease in the pair to the 1.1850 mark or slightly above. At the moment, wave 1 or a has every chance of being considered complete, but there are still certain doubts.

Corrective Monday.

The GBP/USD exchange rate fell by 30 basis points on Tuesday. The market activity needs to be stronger, and the presumed wave 2 or b needs to look more convincing. The first wave of the new trend segment may take an even more extended form. Today, the pair had the opportunity to decrease to match the wave markup, but British statistics disappointed buyers. They still marched during the day, saving the pound from a stronger and more justifiable decline. The unemployment rate in the UK unexpectedly rose in March to 3.9%, and the number of unemployment benefit claims was 65,000 above forecasts. These two reports were enough to reduce demand for the pound sharply, but the losses are only 30 points.

In the US, the statistics were slightly better. Retail sales volumes grew by 0.4% m/m in April, although the market expected +0.8%. Industrial production increased by 0.5% with much lower expectations. Thus, one report is positive, the second - negative. The offset has been made, but the US currency needs stronger support. Tomorrow, Bank of England Governor Andrew Bailey will speak, and clarification on rates is now expected. Some analysts believe that the regulator will refrain from the thirteenth consecutive increase at the next meeting. This is bad news for the pound but great for wave markup. Andrew Bailey may speed up the process of the pound's decline.

General conclusions.

The wave pattern of the GBP/USD pair has long suggested the formation of a new downward wave. The wave markup, as is the news background, is somewhat unambiguous. I do not see factors supporting the pound in the long term, and wave b may turn out to be very deep, but there is no full confidence that it has started. A decrease in the pair is now more likely, but the first wave of the ascending segment may become even more complicated. The unsuccessful attempt to break through the 1.2615 mark, which corresponds to 127.2% according to Fibonacci, indicates the market's readiness for sales. Still, there was also an unsuccessful attempt to break through the 1.2445 mark, which is equated to 100.0% according to Fibonacci.

The picture is similar to the euro/dollar pair on a larger wave scale, but some differences remain. The downward corrective trend segment is completed, but at this time, the formation of a downward wave may begin. And this wave may turn out to be deep and extended, and the entire trend segment - horizontal, like the previous one.

General conclusions.

The wave pattern of the GBP/USD pair has long suggested the formation of a new downward wave. The wave markup, as well as the news background, is somewhat unambiguous. I do not see factors supporting the pound in the long term, and wave b may turn out to be very deep, but there is no full confidence that it has started. A decrease in the pair is now more likely, but the first wave of the ascending segment may become even more complicated. The unsuccessful attempt to break through the 1.2615 mark, which corresponds to 127.2% according to Fibonacci, indicates the market's readiness for sales. Still, there was also an unsuccessful attempt to break through the 1.2445 mark, which is equated to 100.0% according to Fibonacci.

The picture is similar to the euro/dollar pair on a larger wave scale, but some differences remain. The downward corrective trend segment is complete, but at this time, the formation of a downward wave may begin. And this wave may turn out to be deep and extended, and the entire trend segment - horizontal, like the previous one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română