After the May FOMC meeting, investors were confident in the end of the Fed's monetary restriction cycle and in a "dovish" pivot. This allowed EUR/USD to climb to annual highs. However, when the labor market remains hot and inflation high, the central bank will not cut rates. As soon as traders understood this, the U.S. dollar demonstrated its intention to end the week with the best result since February.

The market was inspired by Jerome Powell's words that investors are entitled to their own opinion. An easing of monetary policy usually creates an ideal environment for a rally of risky assets, including stock indices. But did the Fed Chairman say that the central bank is going to cut rates? Investors mistook wishful thinking for reality, and that was their main mistake.

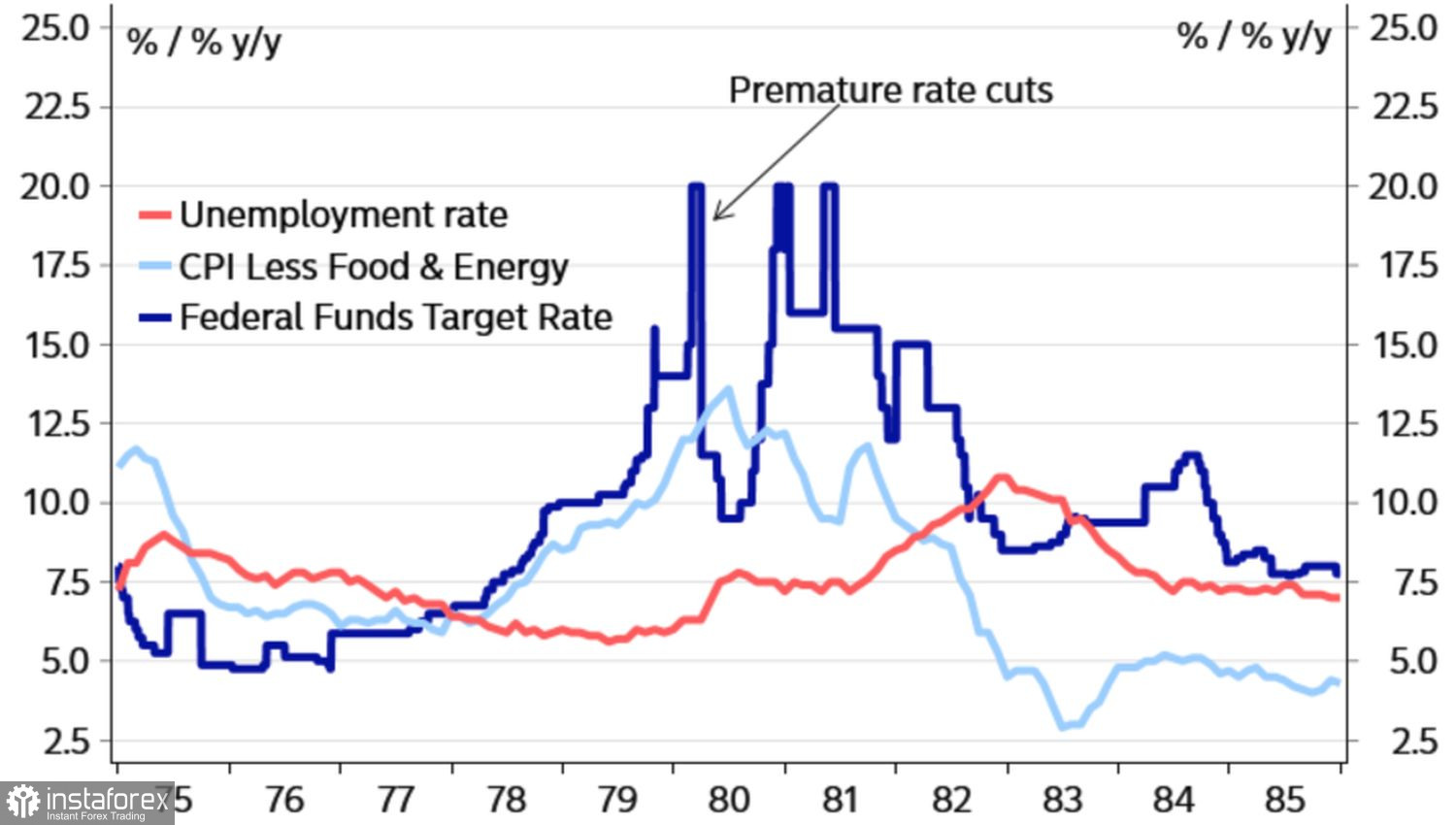

In fact, each cycle of monetary restriction has its own story. The current one is similar to the series of federal funds rate hikes that ended in 1981. Back then, there was also high inflation. And the Federal Reserve made a mistake, starting to reduce borrowing costs prematurely. This resulted in a new increase in rates and a deep recession.

Dynamics of unemployment, inflation, and the Fed rate

Jerome Powell and his colleagues don't want to make the same mistakes as their predecessors. That's why they keep repeating the mantra about the duration of keeping the federal funds rate at its peak. So far, investors have not believed this. And they've paid for it.

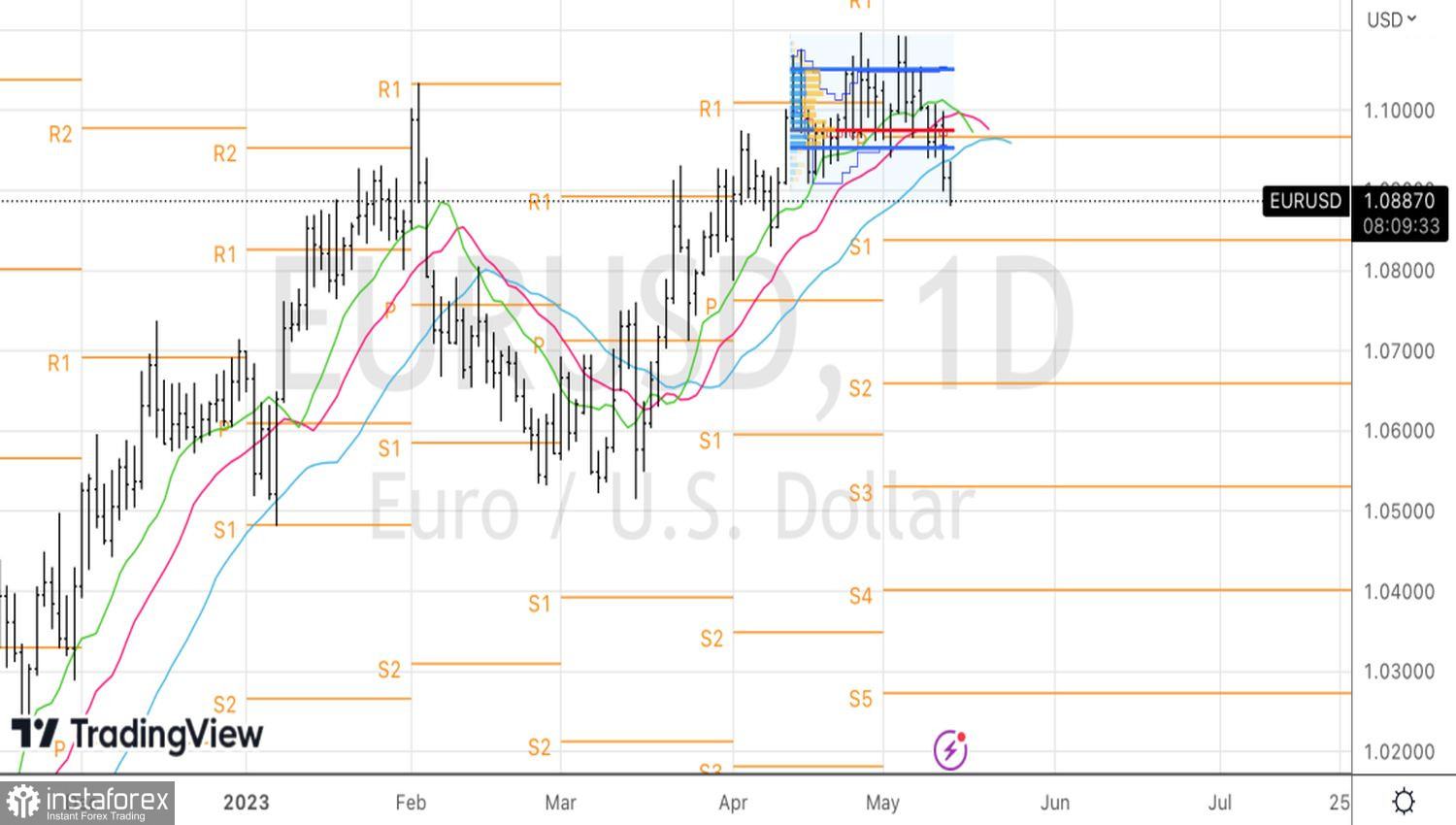

The fall of EUR/USD below 1.09 suggests that the market has doubts that the cycle of tightening monetary policy is over. FOMC representative Michelle Bowman stated that the central bank will have to continue monetary restriction if price pressure does not ease and the labor market does not cool down. Nordea expects another increase in borrowing costs by 25 bps, to 5.5%, in the cycle, followed by maintaining it at a plateau until mid-2024. This view is also supported by Citi. It points out that the April inflation figures were not weak. Growth of 0.4% MoM is a lot.

Thus, the EUR/USD "bulls" underestimated their competitors and went against the Fed. For which they were punished. They were not helped by either the growth of inflation expectations in the eurozone, or Christine Lagarde's statement that the ECB's work is not yet finished, or glitches in the operation of the monetary policy transmission mechanism. Despite the increase in the deposit rate to 3.25%, credit market rates do not want to rise. The gap between them is 10.5 bps, which is close to a record high. If the ECB's monetary restriction does not affect the credit market and the economy, it will be difficult to tame inflation.

Technically, thanks to the Double Top pattern, a correction of EUR/USD has started. A confident breakthrough of dynamic supports in the form of moving averages confirms the pullback. The pair is heading towards pivot levels at 1.084 and 1.076. Short positions formed from 1.01 should be held.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română