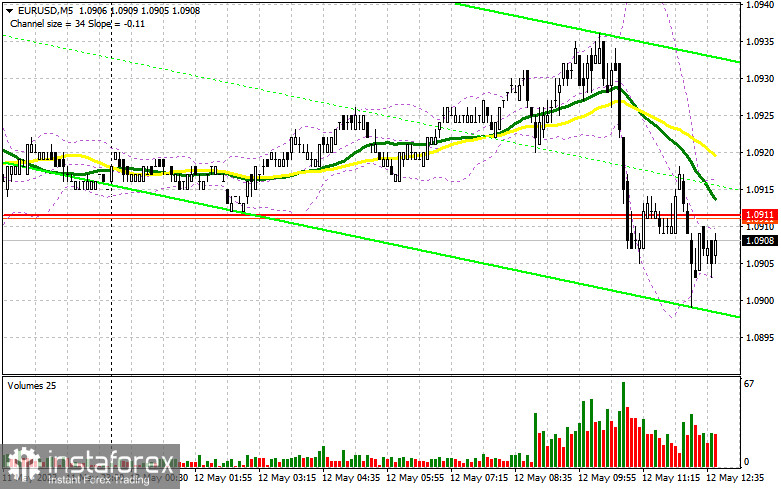

In my morning forecast, I drew attention to the level of 1.0911 and recommended using it as a basis for making market entry decisions. Let's look at the 5-minute chart and see what happened there. A decrease to around 1.0911 happened, but getting a normal entry point from this level was impossible. Buyers could not immediately hold onto 1.0911 and form a false breakout there, which led to a review of the technical picture for the second half of the day.

To open long positions on EURUSD, it is required:

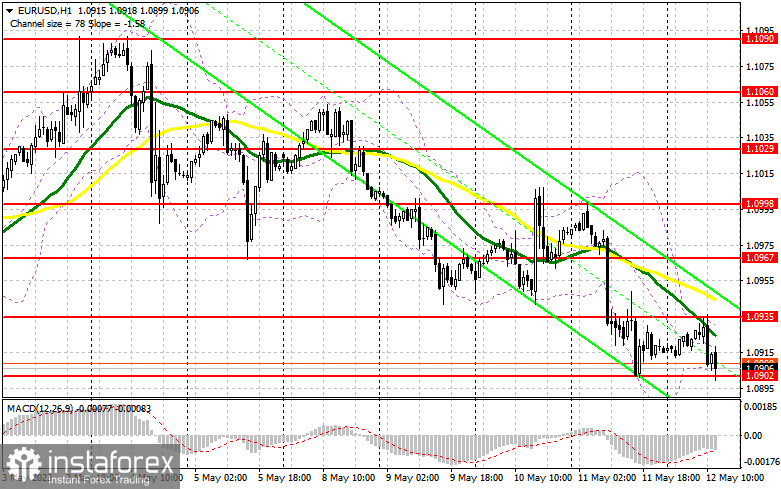

It can be seen that bulls only show activity when approaching weekly lows, from which I now recommend bouncing off. Surely, data on the consumer sentiment index from the University of Michigan and inflation expectations will lead to a surge in market volatility, and it is not excluded that another struggle for 1.0902 will unfold. They will focus on this level. I will open long positions there only after a false breakout in the area, leading to a buy signal with growth to a new resistance of 1.0935, formed in the first half of the day. A breakthrough and top-down test of this range against weak statistics will strengthen buyers' confidence, returning the chances of an upward correction at the end of the week, forming an additional entry point for increasing long positions with the renewal of the 1.0967 level. The farthest target will be the 1.0998 area, where I will fix profit.

In the event of a further decline in EUR/USD and the absence of buyers at 1.0902, a level that has already been worked out twice, pressure on the euro will only intensify, continuing the bearish trend. In such a case, only a false breakout around the next support at 1.0870 will be a reason to buy the euro. I will open long positions on EUR/USD immediately on a rebound from the minimum of 1.0834, or even lower – in the area of 1.0792 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, it is required:

Sellers continued pushing the pair down but met strong resistance around the weekly minimum. As in the morning forecast, I do not advise selling at current levels. It is best to wait for an upward correction and act from the new resistance at 1.0935, where the moving averages pass, playing on the bears' side. The formation of a false breakout near this range will form a good entry point for short positions with the prospect of a return to 1.0902. Consolidation below this range and a reverse test from bottom to top is a direct path to 1.0870. The farthest target will be the minimum of 1.0834, where they will fix profit.

In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0935, which is quite likely, as profit-taking at the end of the week may only increase, I will postpone short positions to the 1.0967 level. There, I will also only sell after unsuccessful consolidation. I plan to open short positions immediately on a rebound from the maximum of 1.0998, with the target of a downward correction of 30–35 points.

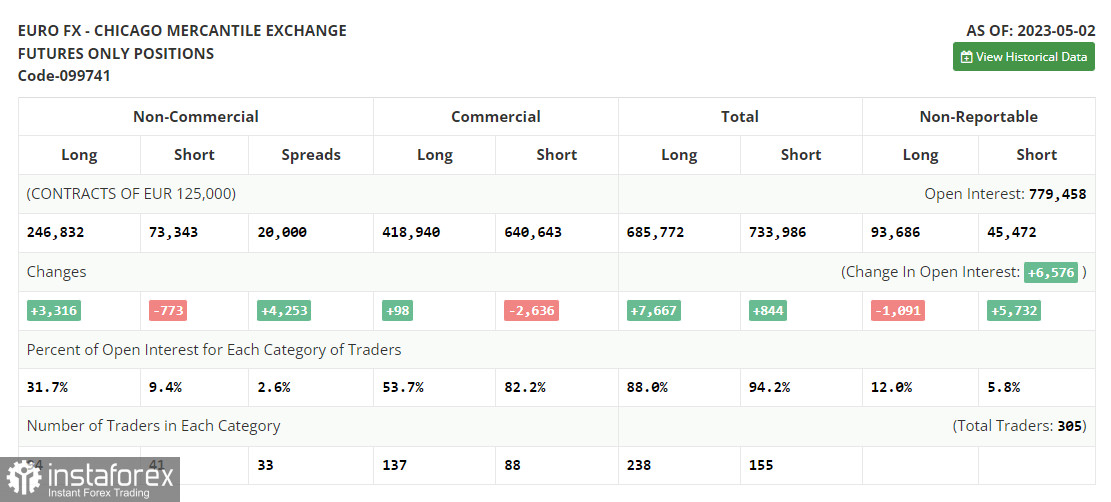

The COT (Commitment of Traders) report for May 2 showed a continued increase in long positions and a decrease in short ones. It should be noted that this report still needs to consider serious changes that occurred in the market after the meetings of the Federal Reserve and the European Central Bank last week, so it is not worth paying special attention to it. Both central banks increased interest rates by 0.25%, keeping the market in balance and giving buyers of risky assets hope for further growth. There are no important statistics this week, so traders can exhale and relax. The COT report indicates that non-commercial long positions increased by 3,316 to 246,832, while non-commercial short positions decreased by 773 to 73,343. As a result of the week, the total non-commercial net position increased and amounted to 173,489 against 144,956 a week earlier. The weekly closing price decreased and amounted to 1.1031 against 1.1039.

Indicator signals:

Moving averages

Trading is taking place below the 30 and 50-day moving averages, indicating a further decline in the pair.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of an increase, the upper border of the indicator will act as resistance around 1.0935.

Description of indicators

• Moving average (smooths volatility and noise by determining the current trend). Period 50. Marked in yellow on the chart.

• Moving average (smooths volatility and noise by determining the current trend). Period 30. Marked in green on the chart.

• MACD (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română