Details of the economic calendar on May 11

The Bank of England, following the Federal Reserve and the European Central Bank, has indeed raised the rate by 25 basis points to 4.5%, although 2 board members voted for a pause.

According to the regulator, the trajectory of demand will be "significantly stronger" than previously assumed. Inflation in the first quarter was "above expectations" due to an "unexpected" rise in goods and food prices.

The Bank of England believes that over a 2–3 year horizon, inflation will fall to 1%–2% primarily due to a natural process, although it is ready for additional rate hikes. However, a further rate increase to 5% seems unlikely. Overall, the meeting's results were as expected, but the pound sterling still began to fall.

Analysis of trading charts from May 11

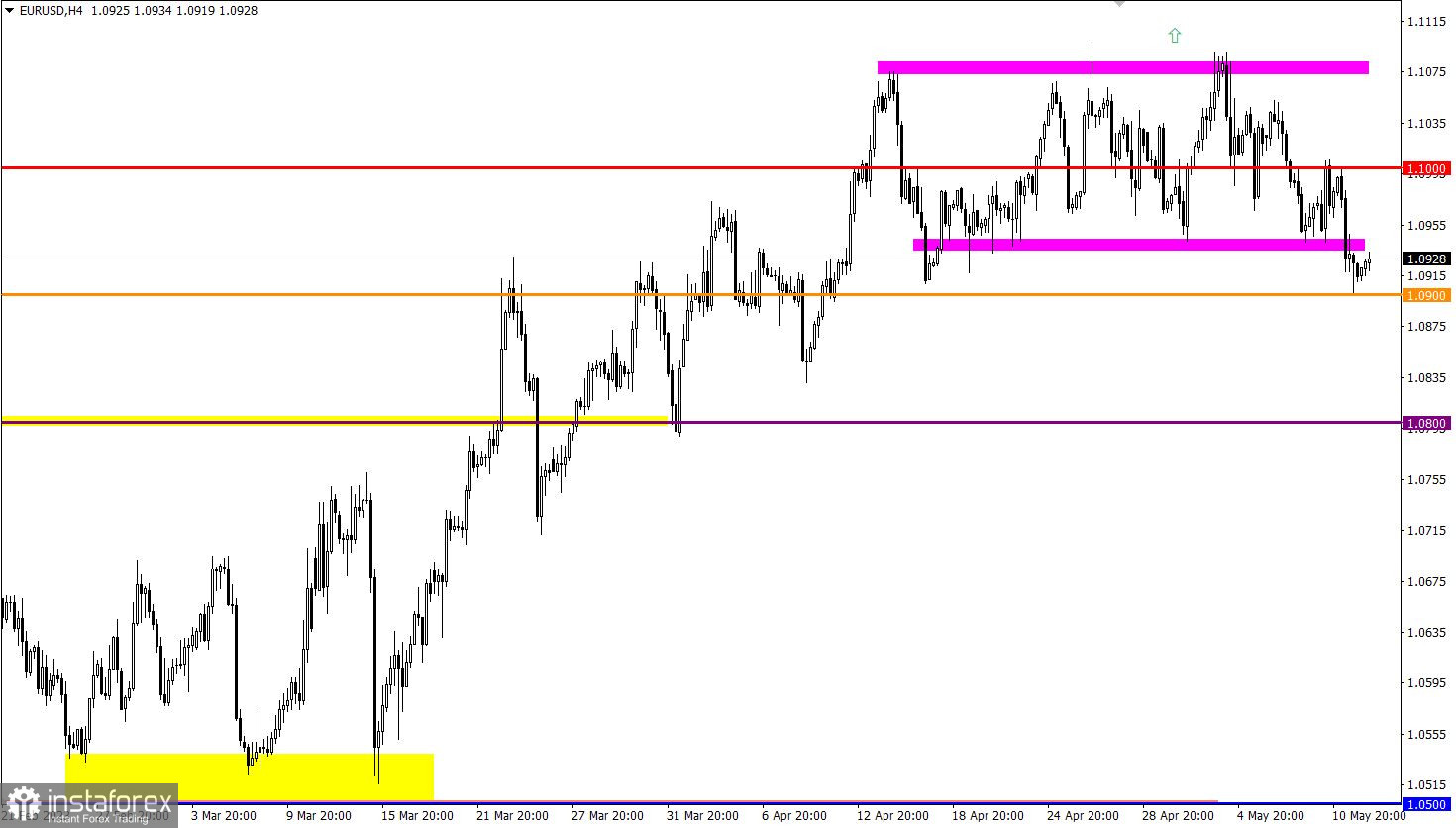

During the intense downward movement, EUR/USD reached the level of 1.0900, which led to a reduction in short positions volume. As a result, there was a stagnation and a pullback from this level.

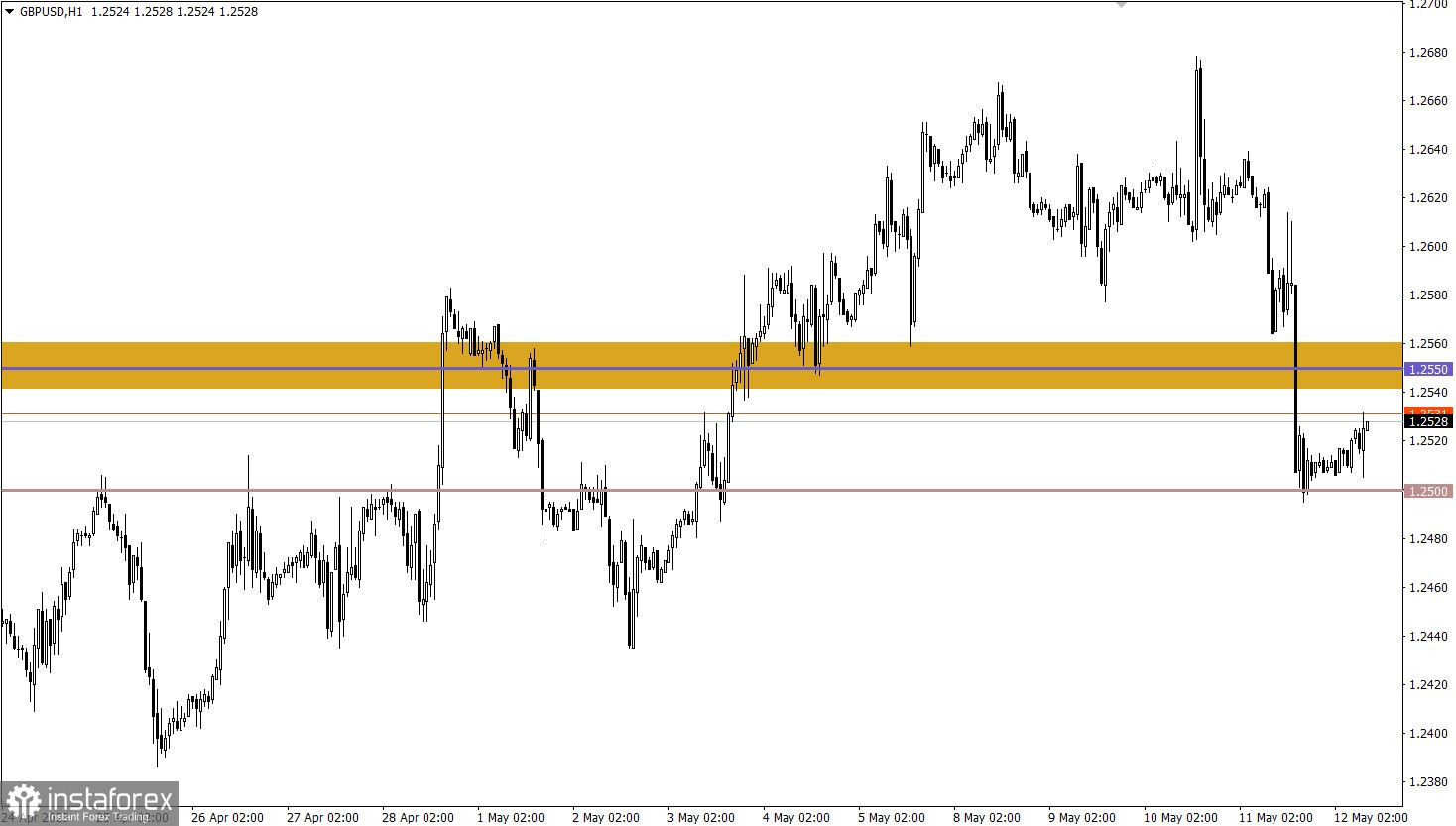

GBP/USD lost about 100 points in the course of inertial movement. The significant price change not only led to the breakdown of 1.2550, but also a drop in the quote to 1.2500. Subsequent fluctuations were characterized by stagnation, which was due to a technical signal of the British currency being oversold.

Economic calendar for May 12

With the opening of the European session, the first estimate of UK GDP for the first quarter was published, which was lower than forecasts, indicating a slowdown in economic growth from 0.6% to 0.2%. It was expected that economic growth would slow down to 0.3%, which increases the risk of recession.

EUR/USD trading plan for May 12

In this situation, traders are considering the possibility of forming a pullback, which will eventually lead to the return of the Euro to its previous price range. However, if the pullback turns out to be false and the quote stays below the 1.0900 level in the daily period, it may signal the emergence of a full-fledged correction in the structure of the upward trend.

GBP/USD trading plan for May 12

In this situation, to continue the downward cycle, the quote needs to stay below the 1.2500 level for at least a four-hour period. Until that point, traders will consider a pullback scenario, within which the quote could easily rise above 1.2550.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română