Firstly, the attempt to overcome the moving average for the first time in a long time failed. The bulls failed to push through the moving average line this time, which led to the pair's fall. This is a good signal for the dollar. Secondly, the pair is near the lower boundary of a somewhat unclear sideways channel and has a real opportunity to exit it. If this happens again, the probability of further growth for the US currency, which remains heavily oversold and unfairly depreciated, will increase.

It's also worth noting other factors that we've discussed earlier. The CCI indicator entered the overbought area twice, each of which was a strong sell signal. We only remember one case when the price entered the extreme area three times before moving in the opposite direction. Therefore, the probability of the pair falling is indeed high. Besides, remember that the pair has been rising for two months in a row, and it also needs to correct all this growth of 600 points. The fundamental background does not support the euro, as the ECB is close to ending the tightening monetary policy cycle, regardless of what European officials say. Remember that the dollar began to fall last fall when the first signs of inflation slowing down in the US appeared. That is, the market worked out all future rate hikes by the Fed half a year earlier. The same rule should apply in the case of the ECB.

The European economy is not stronger than the American one. Macroeconomic indicators are weaker, inflation is higher, and the rate is lower. On what basis should one continue to buy euros if they have risen by 600 points recently?

We have written several times about the debt limit problem in America. Let's recall that the US national debt is growing permanently, especially in recent years, and legislation sets a certain limit on the amount that the government can borrow for its needs. Thus, the problem of reaching the limit arises every year. Every year, the finance minister, with a sad face, warns about the possibility of default and threatens the US economy with catastrophe. Every year, Democrats and Republicans begin weeks-long negotiations regarding the conditions for approving an increase in the limit once again. And every year, the limit is raised in the end because neither Democrats nor Republicans want a default, even a technical one.

So, everything we observe now is nothing more than political games with the aim of bargaining for the most favorable conditions and preferences in exchange for approval of a bill from the opposing party. What amuses me most in this situation is the serious reaction of some market experts. When a public debt problem arises, everyone starts talking about the fall of the American currency because of it. Although in our case, the dollar was confidently falling even before this problem arose. Then, the dollar begins to rise (as in the last few days), and experts immediately start talking about the "growth of risk-off sentiment" in the market, which is the reason for the strengthening of the US currency. The fact that the dollar is oversold and cheapened for two months is not considered.

We believe the public debt problem does not affect the dollar rate. If there was a real threat of default, there were precedents in the past, and there was a low probability of an agreement between Democrats and Republicans, then we could expect a fall in the dollar. And "risk-off sentiments" would not be directed at the dollar. Because who needs the currency of a pre-default country? And even if, by some miracle, a "shutdown" is announced, as with Donald Trump, this still does not mean that the American economy has collapsed. It will remain the same, and you have to wait a few extra weeks for Democrats and Republicans to remember what their job is and what they get their salary for.

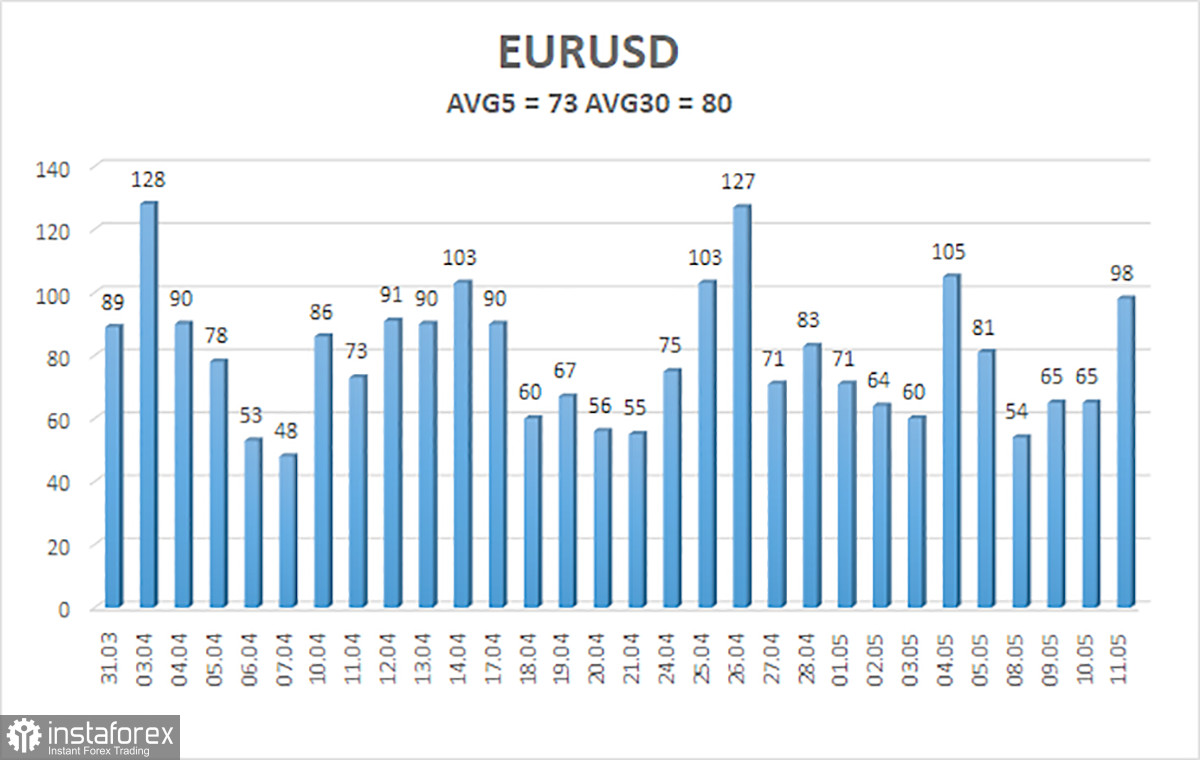

The average volatility of the euro/dollar currency pair for the last five trading days as of May 11 is 73 points and is characterized as "medium." Thus, we expect the pair to move between 1.0854 and 1.1000 on Friday. A reversal of the Heiken Ashi indicator back upwards will indicate a new round of upward movement within the flat.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair continues to move within a sideways channel. You can trade on reversals of the Heiken Ashi indicator or on the youngest TFs, where there are intraday trends that you can catch. Volatility is now low, so trading on the 4-hour TF is more difficult than usual.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which it is now appropriate to trade.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română