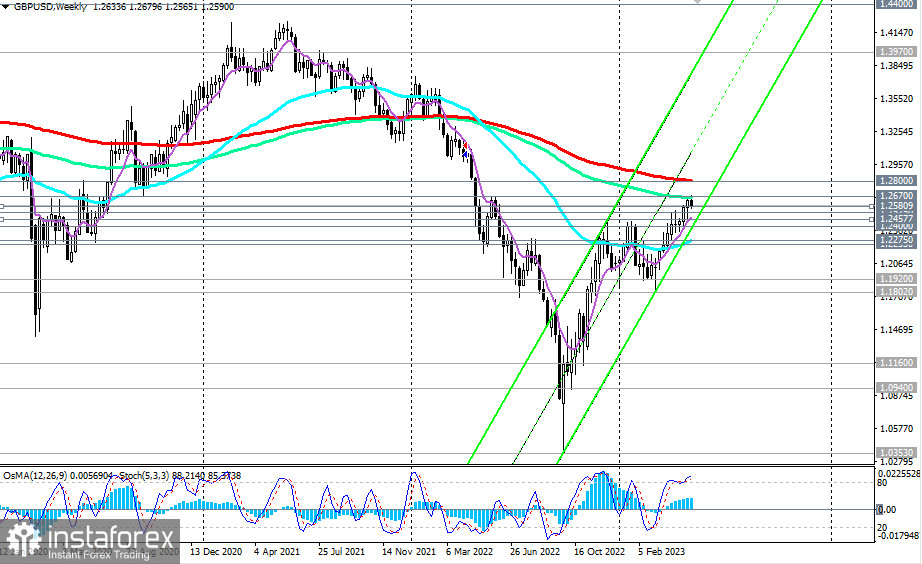

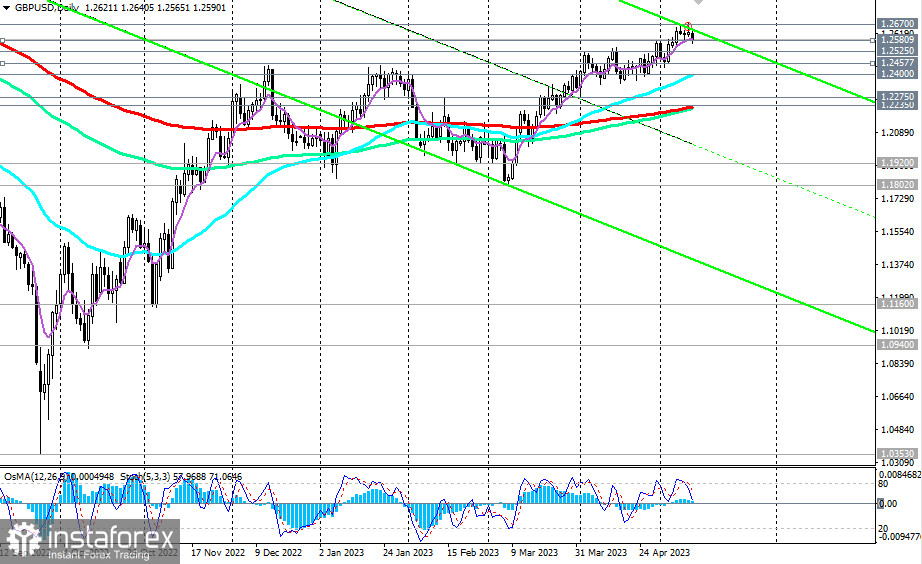

GBP/USD is developing an upward correction, moving towards the key resistance level of 1.2800 (200 EMA on the weekly chart), which separates the long-term bull market from the bear market, but cannot break through the resistance level of 1.2670 (144 EMA on the weekly chart).

If today's Bank of England interest rate decision does not disappoint pound buyers, the pair may finally test the 1.2800 resistance level, breaking through the level of 1.2670. Whether the pair will continue to rise after this is unclear—new drivers and arguments are needed for that.

In an alternative scenario, a breakdown of the 1.2580 support level (200 EMA on the 1-hour chart) and then the local support level 1.2520 will signal the resumption of short positions.

A breakdown of the 1.2457 support level (200 EMA on the 4-hour chart) may provoke a deeper decline, and a breakdown of the key support level 1.2235 (200 EMA on the daily chart) will once again return GBP/USD to the long-term bear market zone.

Support levels: 1.2580, 1.2525, 1.2500, 1.2457, 1.2400, 1.2300, 1.2275, 1.2235

Resistance levels: 1.2600, 1.2670, 1.2700, 1.2800

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română