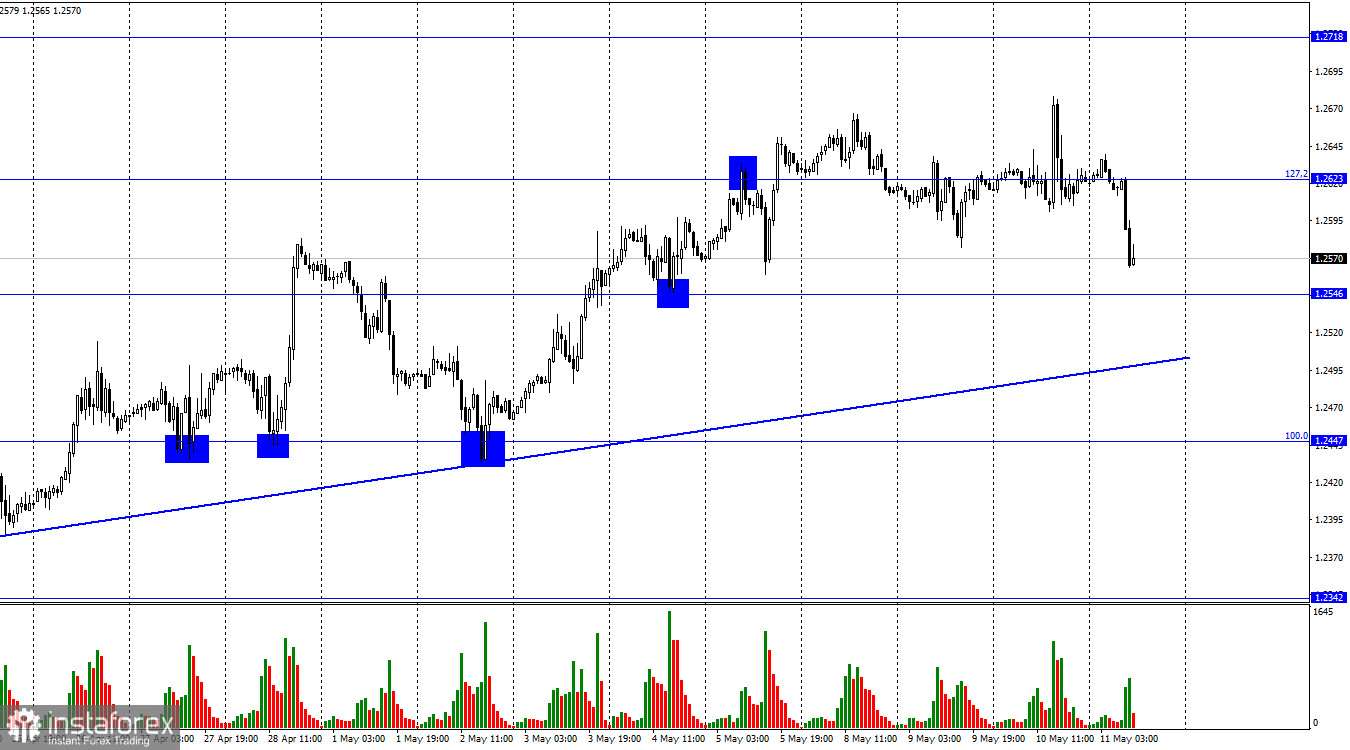

On the hourly chart, the GBP/USD pair has reversed in favor of the US dollar and started falling towards 1.2546 and the ascending trend line, which so far characterizes traders' mood as "bullish." The bulls will remain dominant if the pair does not secure a position below the trend line. Today is quite an important day for the British pound, and we see that ahead of the meeting, it tends to fall. However, this could be an illusion; after the meeting, the pound may rise again.

So, what can we expect from the Bank of England and Andrew Bailey? The Bank of England will likely raise the interest rate by 0.25%, which will not surprise the market. This scenario is currently the most common among economists. Any other will be considered unexpected. In this case, the pair may show strong dynamics for the rest of the day.

The speech by Andrew Bailey will be more significant for traders, who can provide temporary benchmarks during which the interest rate may continue to increase. And this will depend on the dynamics of the pound in the coming weeks and months. Recently, the pound has been actively rising in price, but the reasons for such growth were only sometimes there. If the Governor of the Bank of England hints at the end of the monetary policy tightening procedure, the pound may start to fall much faster and stronger than in the last two days.

It will also be interesting to find out how many Bank of England committee members will vote for tightening. There are expected to be seven of them, but some managers may change their opinion from the last meeting and vote to keep the rate at the previous level, which will be negative news for the pound. Today, with a high degree of probability, the pound will continue to fall.

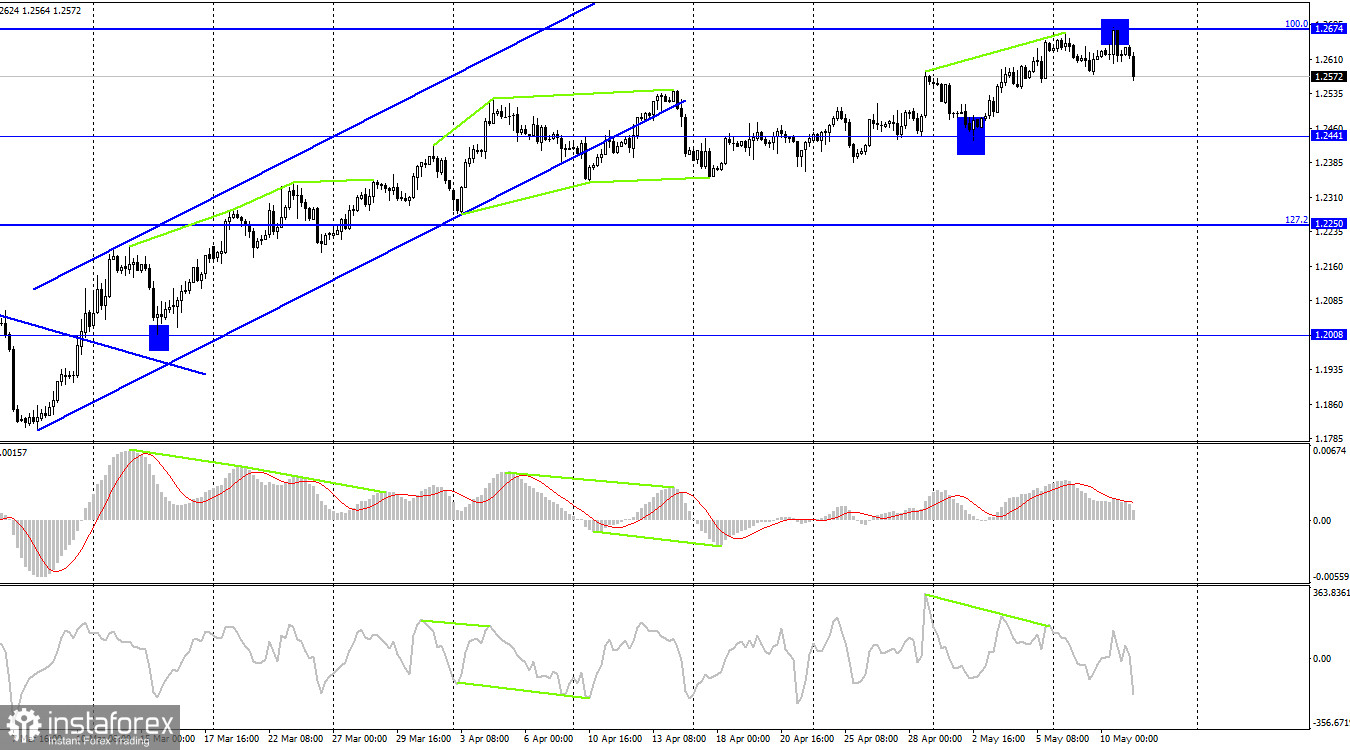

On the 4-hour chart, the pair secured a position below the ascending trend corridor, but nothing happened, and the fall did not begin. However, a rebound from the level of 1.2674 allowed a reversal in favor of the US currency and the start of a fall toward the level of 1.2441, which, I hope, will continue. A closing price of the pair above the level of 1.2674 will increase the chances of continued growth toward the next level of 1.2860.

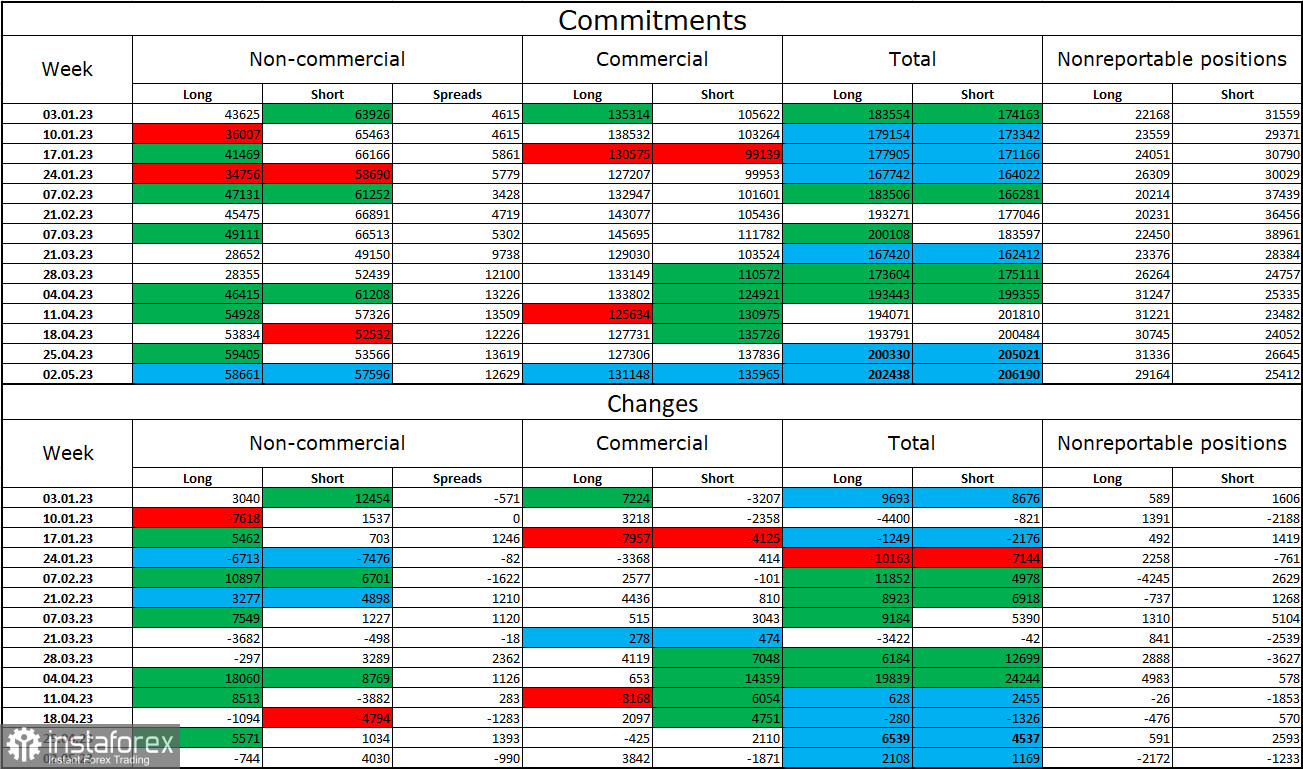

Commitments of Traders (COT) report:

The mood of the "non-commercial" category of traders has become less "bullish" over the last reporting week. The number of long contracts in the hands of speculators decreased by 744 units, and the number of short contracts increased by 4030. The overall mood of major players remains fully "bullish" (it has been "bearish" for a long time), but the number of long and short contracts is now almost equal - 57.5 thousand and 58.5 thousand, respectively. The pound continues to grow predominantly, although very few factors support its buyers. The prospects for the pound remain good, but soon, we can expect it to fall. The Bank of England's decision and rate increase will not surprise traders after eleven monetary policy tightenings.

News calendar for the US and the UK:

UK - Interest rate decision (11:00 UTC).

UK - Minutes of the Monetary Policy Committee meeting (11:00 UTC).

US - Producer Price Index (PPI) (12:30 UTC).

US - Initial Unemployment Claims (12:30 UTC).

UK - Speech by the Governor of the Bank of England Bailey (13:15 UTC).

On Thursday, the economic event calendar contains several entries, but the Bank of England's meeting is undoubtedly the first. The impact of the news background on traders' moods for the rest of the day could be strong.

GBP/USD forecast and trader advice:

I recommended selling the pound with targets at 1.2546 and 1.2500 in case of a rebound from the level of 1.2674 on the 4-hour chart. Now these trades can be kept open. Buying the pound is possible with a rebound from 1.2546 or the trend line on the hourly chart, with targets at 1.2623 and 1.2718.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română