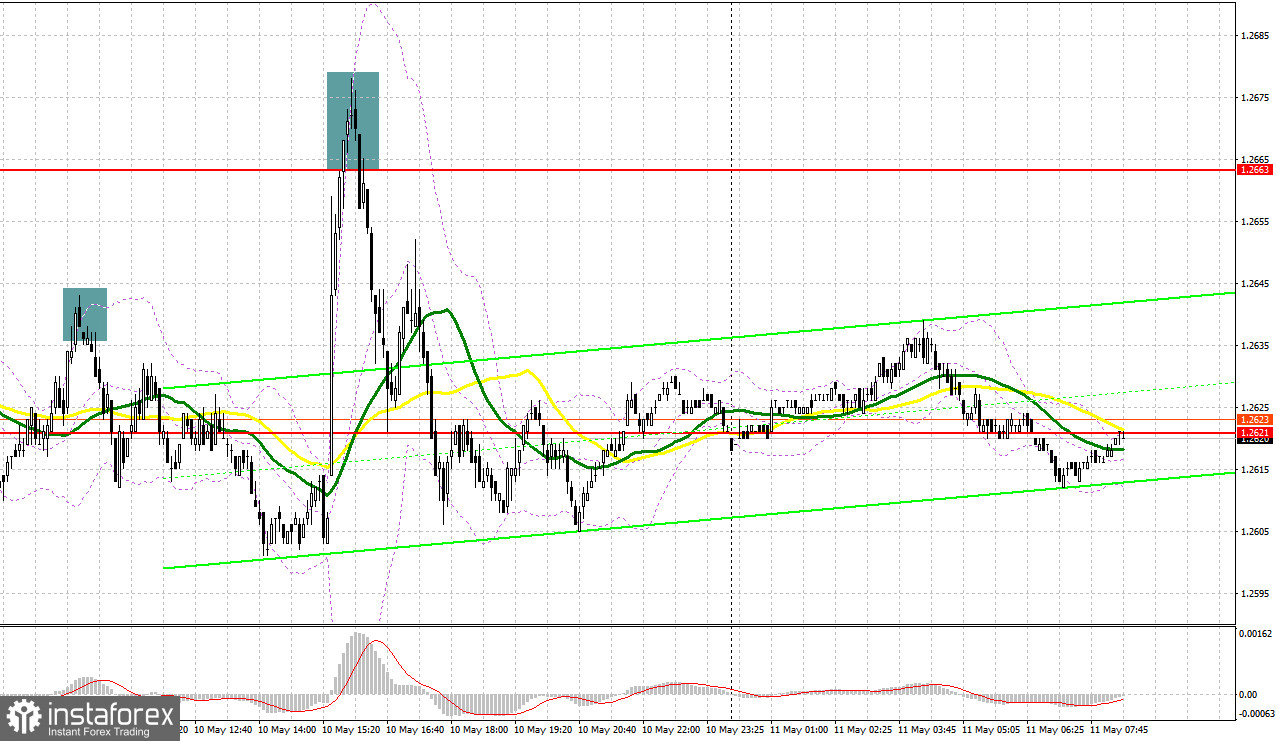

Yesterday, several entry signals were made. Let's look at the 5-minute chart to get a picture of what happened. I considered entering the market from the level of 1.2631. Growth and a false breakout through the mark produced a sell entry point, and the price fell by 20 pips. In the second half of the day, failed consolidation above 1.2663 produced a sell signal, and the price fell by more than 40 pips.

When to open long positions on GBP/USD:

US inflation continues to decrease although at a slower-than-expected pace. Meanwhile, the Bank of England is expected to announce its monetary policy plans today. Interest rates are highly likely to be raised to 4.5%. However, if the Bank of England gives no further hawkish hints, the pound will likely go down as traders will hardly find any other reason to buy it.

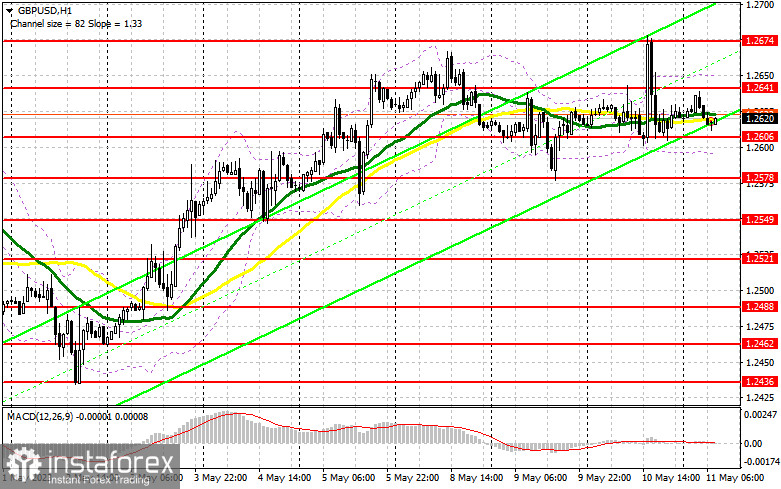

In my view, the bulls should act on a correction in the area of 1.2606 support. In fact, a test of this level may occur ahead of the BoE meeting. A false breakout will give a signal to buy with the target at 1.2641. A breakout and consolidation above the range may take place if the regulator maintains its aggressive approach. An additional buy signal may come with the target at a monthly high of 1.2674. The most distant target stands at 1.2709, where I will lock in profit.

If the price goes down to 1.2606 and there is no bullish activity there, I will open long positions at 1.2578 after a false breakout. I will also consider buying from a low of 1.2549, allowing a correction of 30-35 pips intraday.

When to open short positions on GBP/USD:

Short positions could be opened today only if the BoE announces a pause in rate hikes. Therefore, my trading plan will be to wait for a rise to monthly highs. If the bulls fail to break above this mark, the price may touch 1.2606 after a false breakout. Pressure on the pair will increase after an upside retest of this range, and a sell signal will come with the target at 1.2578. The most distant target is still seen at a low of 1.2549, where I will take profit.

If GBP/USD goes up and there is no bearish activity at 1.2674, I will sell after a test of a new high of 1.2709. A false breakout there will create a sell entry point. If no drop follows, I will sell GBP/USD right on a bounce from a high of 1.2755, allowing a downward correction of 30-35 pips intraday.

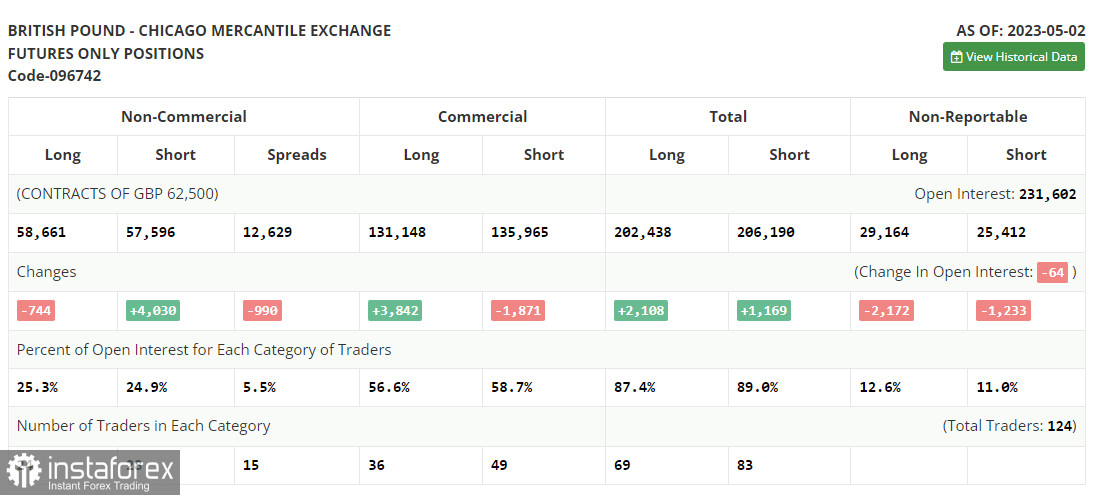

According to the COT report for May 2, there was an increase in short positions and a decline in long ones. The Bank of England is widely expected to hike rates this week. The regulator has long been trying to tame inflation. However, no progress came. The pound sterling will hardly go up if the BoE raises the key rate by 0.25% basis points. Traders have already priced it in. Hence, a deeper correction looks likely this week. The latest COT report showed that short non-profit positions increased by 4,030, to 57,596, while long non-profit positions slid by 744, to 58,661. It led to a decrease in the non-commercial net position to 1,065 against 5,839 a week earlier. This was the first decline in six weeks. So, it was just a correction. The weekly price rose to 1.2481 against 1.2421.

Indicators' signals:

Moving averages:

Trading is carried out in the area of the 30-day and 50-day moving averages, which indicates a sideways trend.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Support stands at 1.2600, in line with the lower band.

Description of indicators

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română