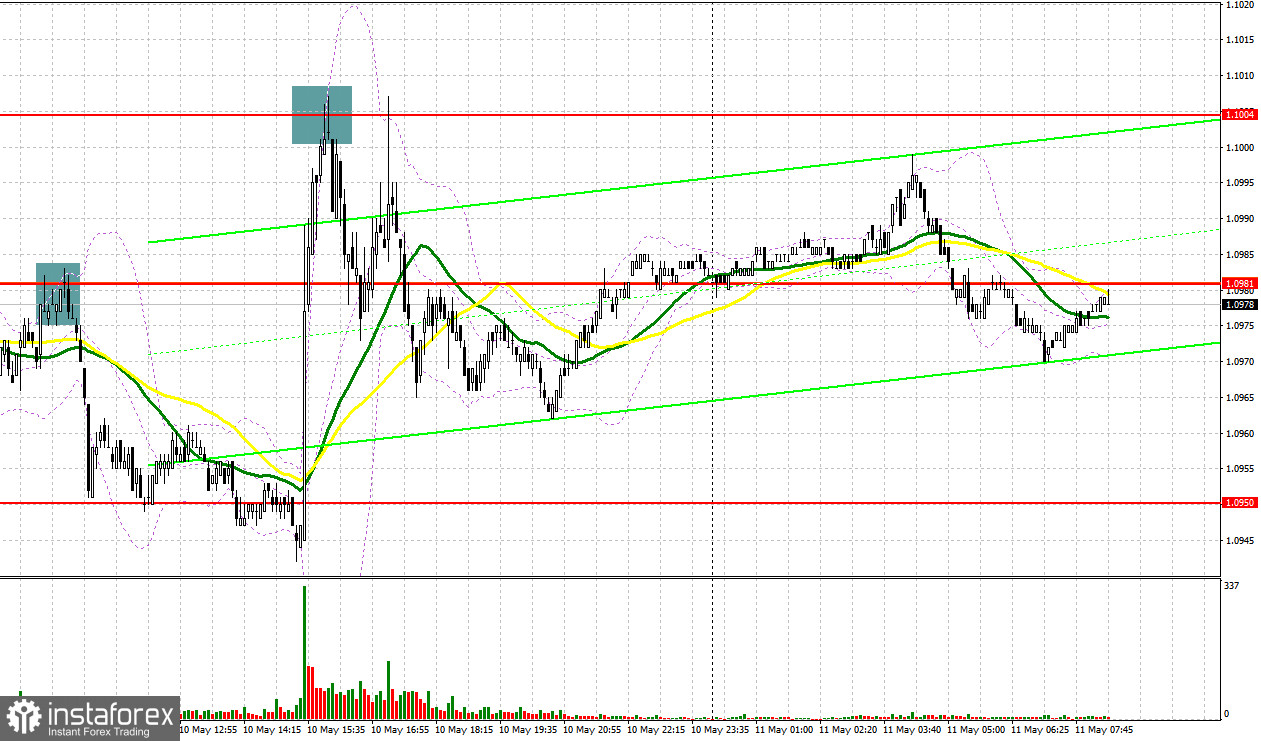

Yesterday, several entry signals were made. Let's look at the 5-minute chart to get a picture of what happened. Previously, I considered entering the market from the 1.0973 level. Growth and a false breakout at 1.0973 generated a sell signal. The pair went down by almost 30 pips. In the second half of the day, after the release of US inflation, failed consolidation above 1.1004 produced a sell signal, and the price fell by more than 35 pips.

When to open long positions on EUR/USD:

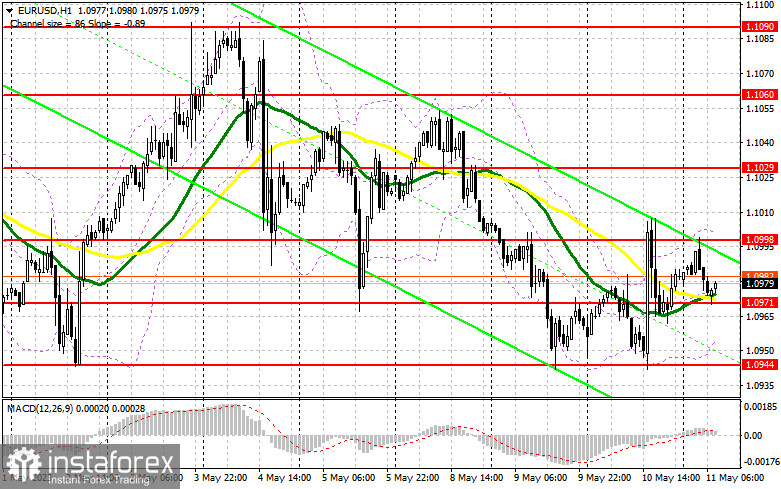

An insignificant drop in US inflation in April is clearly not enough for the Federal Reserve to seriously consider the need for a pause in the rate hike cycle. For this reason, the bulls failed to approach the daily high, and the price returned to the sideways channel. Amid an empty macroeconomic calendar in the eurozone today and a speech from ECB Executive Board member Isabel Schnabel, known for her hawkish policy, the bulls will likely make another attempt to push the pair higher. However, their most important task will be not to let the pair go below the 1.0971 level.

I consider buying on a correction from the 1.0971 support level, which is in line with the bullish moving averages. A false breakout will create a buy entry point with the target at the resistance level of 1.0998. A breakout and a downside test of this range after the ECB representative's speech will likely boost the demand for the euro and produce an additional buy entry point with the target at a high of 1.1029. The most distant target remains at 1.1060, where I will lock in profit.

In the case of a decline in EUR/USD and the absence of the bulls at 1.0971, which is the middle of the sideways channel, the bears will likely gain control over the market. Therefore, only a false breakout in the area of the next support level of 1.0944 will make a signal to buy the euro. I will open long positions immediately on a bounce from a low of 1.0911, allowing an upward correction of 30-35 pips intraday.

When to open short positions on EUR/USD:

The bears' task will be not to allow the bulls to reach new daily highs. If they manage to protect the upper limit of the narrow sideways channel at 1.0998 and a false breakout at this level occurs, a sell signal will come, targeting 1.0971. After consolidation below this range, as well as an upside retest, the price will likely head toward 1.0944. The most distant target is seen at a low of 1.0911, where I will lock in profit

In case of growth in EUR/USD during the European session and the absence of the bears at 1.0998, the bulls will try to regain control of the market and stop the downtrend. In this case, I will open short positions at the 1.1029 level but only after failed consolidation. I will open short positions immediately on a bounce from a high of 1.1060, allowing a downward correction of 30-35 pips.

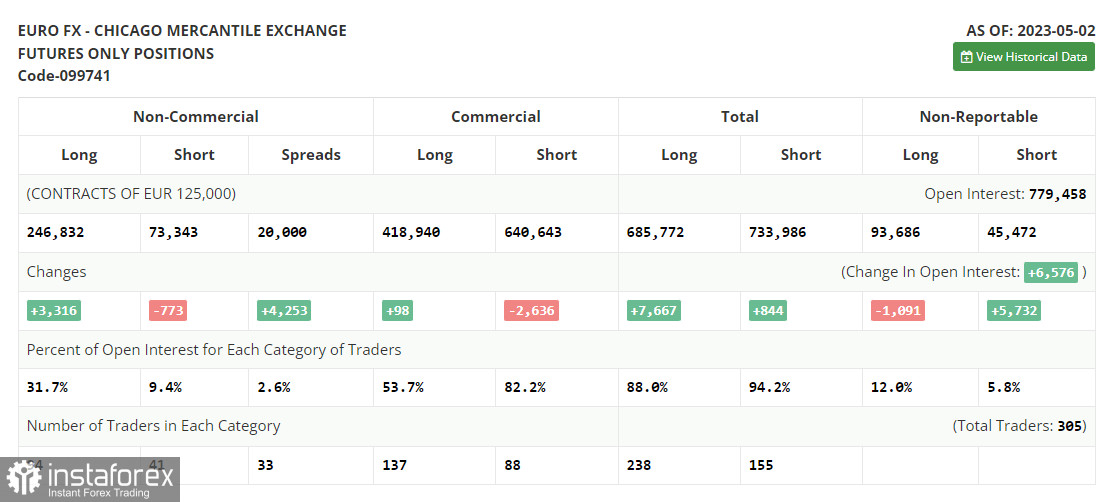

The COT report for May 2 logged an increase in long positions and a decrease in short positions. This report does not yet account for significant changes that took place in the market after the Federal Reserve and European Central Bank meetings last week. So, traders should not focus on it too much. Both central banks raised rates by 0.25%, maintaining market balance while allowing risk asset bulls to expect further growth. There is no important data this week. So, traders can relax a bit. According to the COT report, non-commercial long positions grew by 3,316 to 246,832, and non-commercial short positions dropped by 773 to 73,343. As a result, the overall non-commercial net position increased to 173,489 from 144,956, recorded a week before. The weekly closing price dropped to 1.1031 from 1.1039.

Indicators' signals:

Moving averages:

Trading is carried out in the area of the 30-day and 50-day moving averages, which indicates a sideways trend.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands:

Support stands at 1.0955, in line with the lower band.

Description of indicators

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română