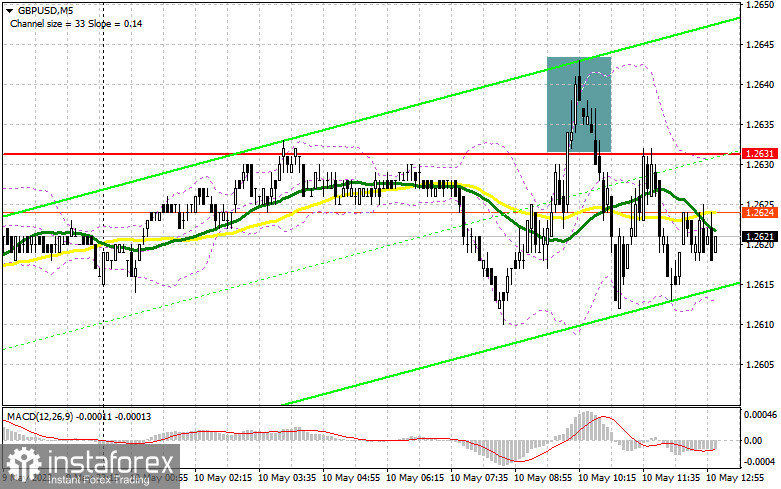

In my morning forecast, I drew attention to the level of 1.2631 and recommended making decisions about entering the market from there. Let's look at the 5-minute chart and figure out what happened there. The growth and false breakout at this level allowed for an excellent entry point for short positions, which led to a 20-point drop. The technical picture changed for the second half of the day.

To open long positions on GBP/USD, it is necessary:

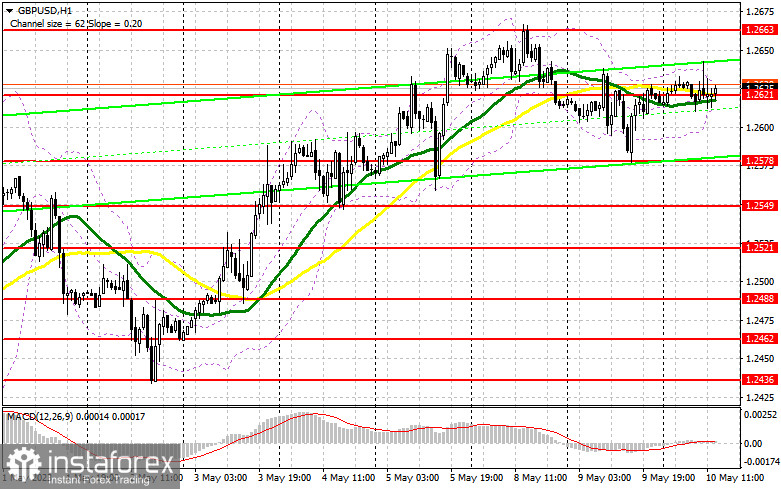

Since we focus on US inflation data, acting based on relatively close levels will not be a good idea. As a result, I changed my strategy and chose to take the middle of the sideways channel, or the area of 1.2621, which has been a popular trading area for a while and will probably be crucial in the future. If US inflation rises above economists' forecasts, the pound will react with a drop, and buyers will come into play. I expect their first manifestation at 1.2578, from where the pound bounced back nicely yesterday. Forming a false breakout there will provide a signal to buy with the prospect of recovery in the 1.2621 area. A breakout and consolidation above this range will create an additional signal to buy with a surge to 1.2663. The furthest target will be the area of 1.2709, where I will fix profits.

In the scenario of a decline to 1.2578 and the lack of activity from buyers in the second half of the day, which is quite possible due to the return to strong and stable inflation in the US, I will postpone purchases to a more significant level of 1.2549. I will open long positions there only on a false breakout. I plan to buy GBP/USD immediately on a rebound only from a minimum of 1.2521, aiming to correct 30–35 points within the day.

To open short positions on GBP/USD, it is necessary:

Sellers showed themselves in the first half of the day, providing an excellent entry point for selling the pound, but a significant drop did not occur. If US inflation decreases in April this year, the pound will have a chance to rise today, forgetting about tomorrow's Bank of England meeting. In this case, I was hoping you could wait for the first manifestation of sellers only in the area of the monthly maximum of 1.2663, similar to what I analyzed above. A false breakout there will provide a chance to return pressure on GBP/USD with a perspective of a decline to the 1.2621 level, where the main trade is currently taking place. A breakthrough and reverse test from the bottom to the top of this range will increase pressure on the pound, forming a signal to sell with a drop to 1.2578. The furthest target remains at the minimum of 1.2549, where I will fix profits.

In the case of GBP/USD growth and no activity at 1.2663, which is quite likely, as everyone is waiting for a decrease in inflation in the US and further interest rate hikes from the Bank of England, it is better to postpone sales until the test of the new monthly high of 1.2709. Only a false breakout there will provide an entry point for short positions. Without downward movement, I will sell GBP/USD on a rebound immediately from 1.2755, but only with the expectation of a 30-35 point correction of the pair downwards within the day.

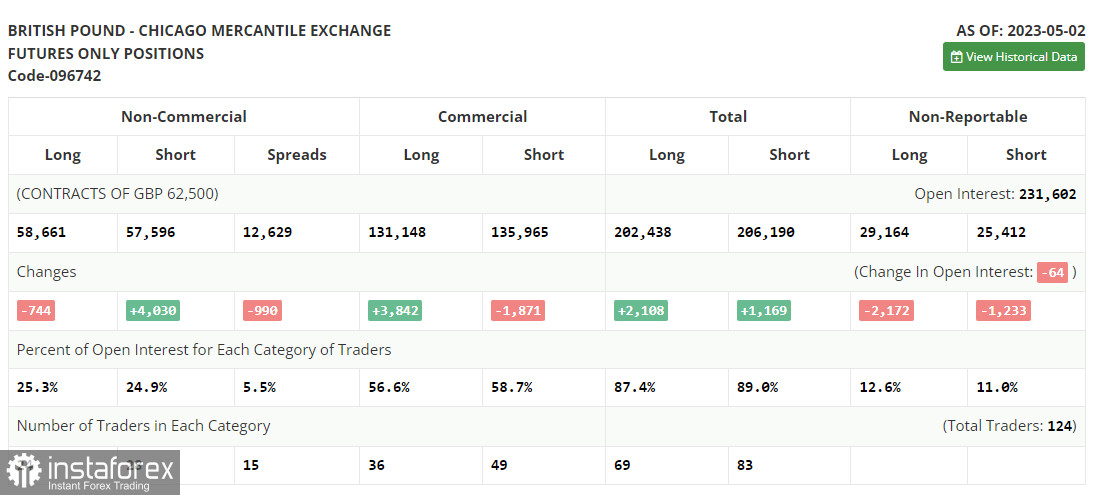

In the COT report (Commitment of Traders) for May 2, there was an increase in short positions and a decrease in long positions. Everyone understands that the Bank of England has nowhere to go this week and will have to follow other central banks in raising interest rates. The fight against inflation in the UK will continue for quite a long time, especially considering that the regulator has not achieved any positive results in a year of raising rates. It is unlikely that the pound will react with growth to a rate increase of 0.25%, as this is already factored into the quotes, so do not be surprised if the pair demonstrates a deeper correction this week. The latest COT report states that non-commercial short positions increased by 4,030 to 57,596, while non-commercial long positions decreased by 744 to 58,661. This led to a decrease in the non-commercial net position to 1,065 against 5,839 a week earlier. This is the first decline in six weeks, so it can be considered a regular correction. The weekly price rose to 1.2481 from 1.2421.

Indicator signals:

Moving averages

Trading occurs around the 30- and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower border of the indicator at 1.2605 will act as support.

Description of indicators

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română