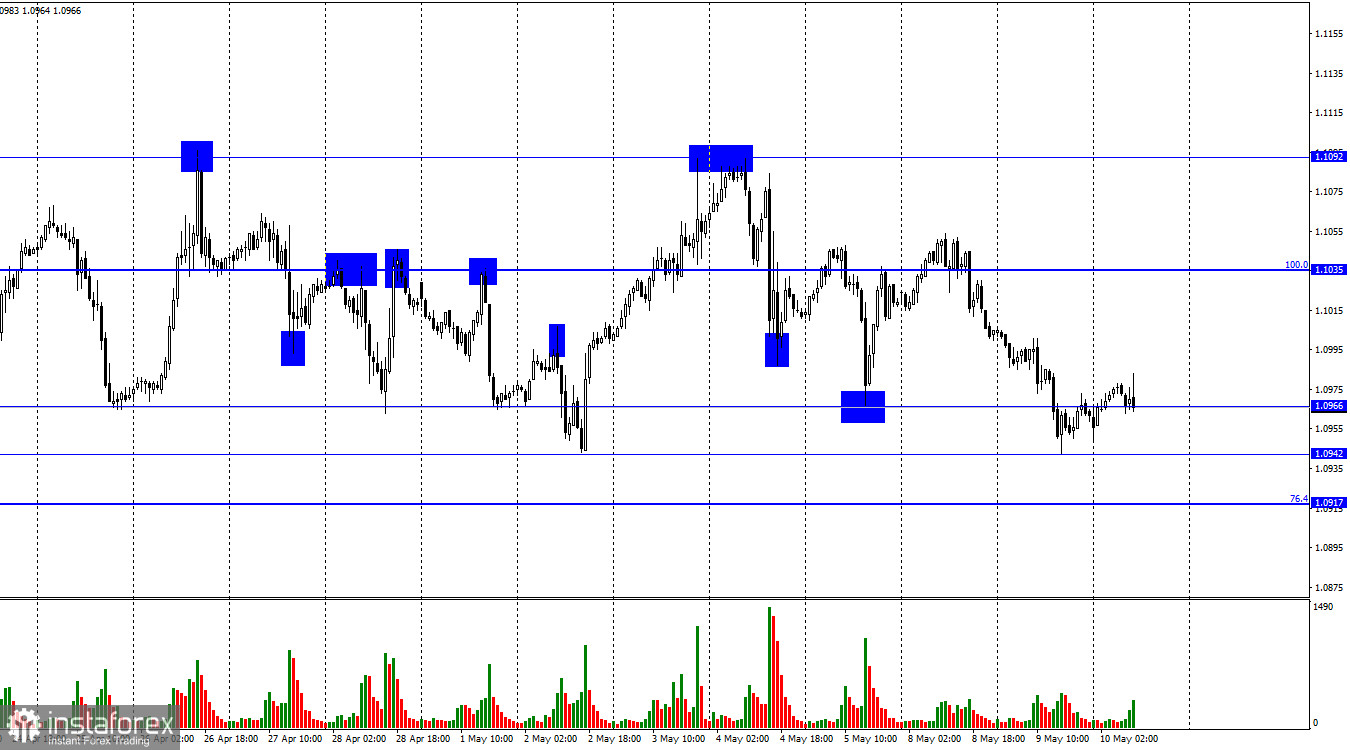

On Tuesday, the EUR/USD pair continued the decline process and ended the day between 1.0942 and 1.0966. The pair remains within the horizontal corridor, which means that growth can resume at any time. Consolidation below the level of 1.0942 increases the probability of a further decline, but there is also the level of 1.0917 just below, which bears need to overcome to spread their wings. A rebound from 1.0942 and 1.0917 may favor the euro with some growth up to 1.1092.

The background information for the pair remains weak, but interesting reports will be published today. In Germany, the consumer price index for April has already been released. Inflation fell from 7.4% to 7.2% y/y. However, the overall decline in inflation is less significant than it may seem. The peak value reached 8.8%, so the current slowdown is only 1.6%. Recall that inflation fell by 1.6% in the European Union just last month. Thus, Germany needs to show the expected inflationary dynamics as the European Union's first economy. The European currency, in connection with this report, continues to decline.

An April inflation report will also be released in America in the second half of the day. Consumer prices are expected to slow down to 4.9% or remain at 5.0% y/y. If expectations are met, the dollar is unlikely to continue its growth. Therefore, traders' hope now lies in the fact that the forecast will not come true. At the same time, core inflation may accelerate again to 5.6%. Currently, core inflation exceeds usual levels, which is quite unusual. If core inflation does not decrease, main inflation may also stop decreasing since it considers the goods included in the core calculation.

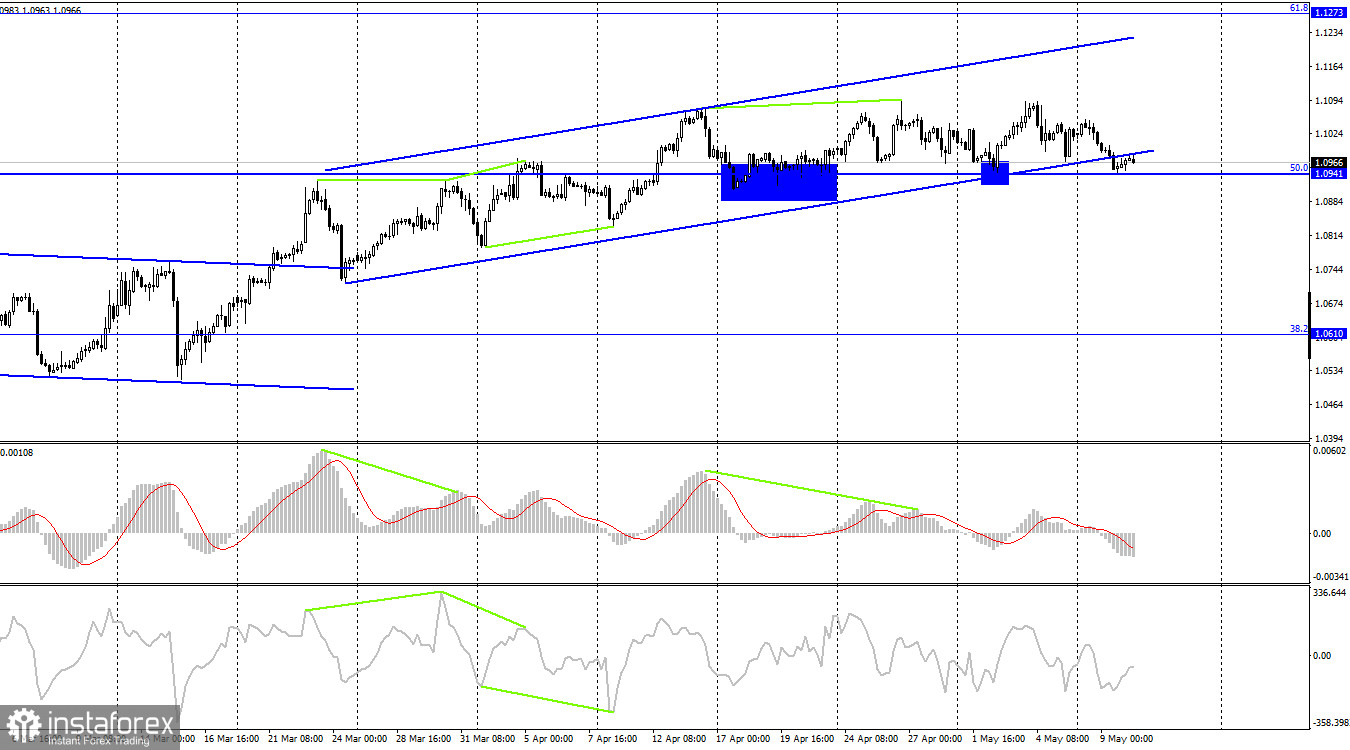

On the 4-hour chart, the pair has consolidated above the ascending trend corridor but has been moving horizontally above the corrective level of 50.0% (1.0941) for several weeks. Closing the pair's rate below this level will favor the American currency and cause some decline in the direction of the Fibonacci level of 38.2%, 1.0610. A new rebound from 1.0941 will favor new growth towards 1.1273. Closing below the corridor may mean that bears have begun to seize the initiative.

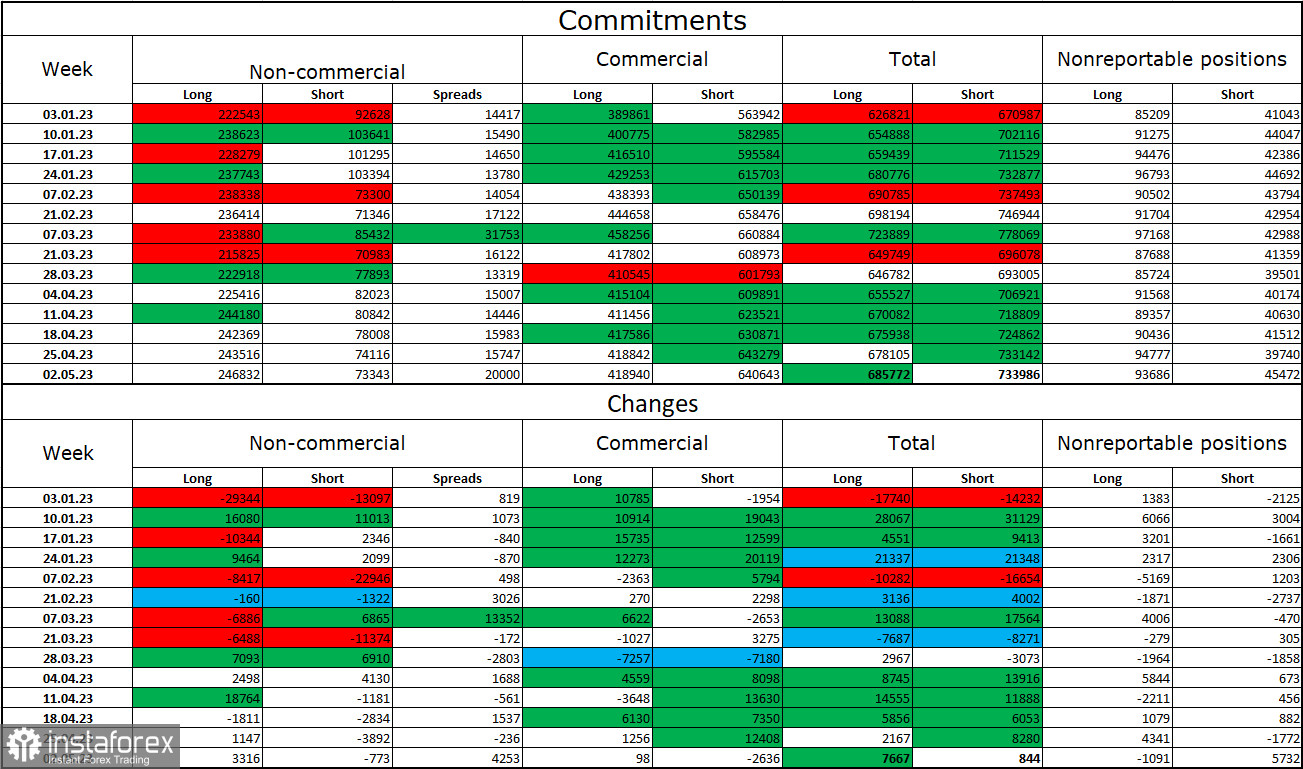

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 3,316 long contracts and closed 773 short contracts. The sentiment of large traders remains "bullish" and continues to strengthen overall. The total number of long contracts concentrated in the hands of speculators now amounts to 247 thousand, while short contracts total 73 thousand. The European currency has been growing for more than half a year, but the information background only sometimes supports further strong growth of the pair. The ECB lowered the rate hike step to 0.25% last week, but bulls have not yet retreated from the market. The threefold difference between the number of long and short contracts speaks for itself about the proximity of the moment when bears will take the offensive. So far, the strong "bullish" sentiment persists, but I think the situation will change soon. In recent weeks, the euro has maintained high positions but has not grown further.

News calendar for the US and the European Union:

Germany - Consumer Price Index (06:00 UTC).

US - Consumer Price Index (12:30 UTC).

On May 10, the economic events calendar contains only one important entry on Wednesday. The impact of the information background on traders' sentiment for the remainder of the day may be of medium strength.

EUR/USD forecast and trading advice:

Selling the pair can be opened upon closing below the level of 1.0917 on the hourly chart, with a target of 1.0843. Purchases are possible with a rebound from 1.0942 or 1.0917 on the hourly chart, with a target of 1.1035.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română