Last week, financial markets were influenced by the ongoing political struggle in the United States as Republicans and Democrats clashed over the debt ceiling issue. Speculations surrounding this issue affected investor sentiment, leading to reduced activity across all markets, with the American market being primarily affected.

Despite the political standoff, we believe that the debt ceiling will eventually be raised, as both opposing sides will likely reach a consensus, given their mutual interest in resolving the crisis.

Today, the key event will be the release of US consumer inflation data, which could significantly impact the Federal Reserve's decision to raise interest rates in June and pause the tightening cycle. According to the consensus forecast, the Consumer Price Index (CPI) for April is expected to stay at 5.0% on a yearly basis, similar to March, while its monthly reading is anticipated to increase more significantly to 0.4% compared to a 0.1% increase in the previous month.

How will the US dollar react to this data?

If the reported figures indicate a slightly higher inflationary pressure, it could trigger a wave of sell-offs in stock markets, along with a temporary increase in demand for the US dollar. This may be driven by concerns that the Federal Reserve will take advantage of the latest strong labor market data and, of course, higher inflation to increase the benchmark interest rate by 0.25% at its June meeting.

However, another opinion, which aligns with our view, suggests that the base-case scenario will likely prevail. Despite a small increase or slowdown in inflation, the Federal Reserve may not raise interest rates and may strongly consider ending the rate hike cycle altogether. Overall market sentiment currently points to an expectation of a pause in rate hikes and the suspension of the rate-hike cycle by the summer of this year.

In this scenario, we should expect a resumption of the decline in the US dollar exchange rate against major currencies, as the Bank of England, the European Central Bank, and other global central banks – with the exception of the Bank of Japan – are likely to continue raising interest rates, catching up with the Federal Reserve. On the other hand, if the inflation figures show a decline, the US dollar will noticeably depreciate.

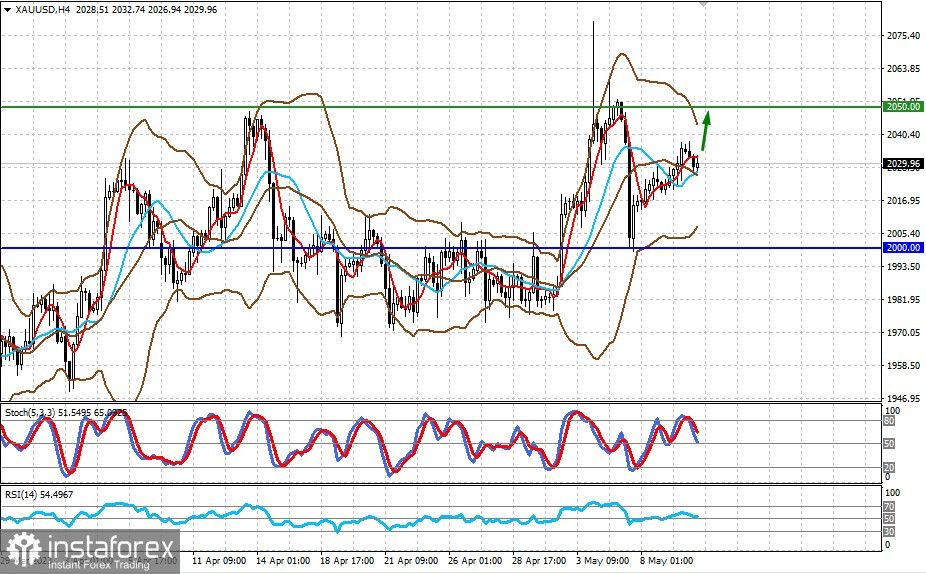

XAU/USD

Gold bounced off the support area of 2,000 dollars per troy ounce. The price may continue to move higher up to the level of 2,050.

USD/CHF

The pair is currently trading above the 0.8870 level. If the US dollar comes under more pressure after the CPI data is out, the pair may break below this level and head for 0.8790.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română