The Canadian dollar significantly strengthened its position last week. On Friday, the USD/CAD pair updated its three-week price low, reflecting the strengthening of the "loonie." This price movement was due to strong labor market data from Canada: all components of Friday's release came out in the "green zone." In response to the published report, USD/CAD sellers again approached the support level of 1.3310 (the lower line of the Bollinger Bands indicator on the daily chart) but could not enter the 32nd figure area. The previous attempt on April 14 ended similarly: bears retreated, allowing buyers to organize a large-scale 400-point counterattack.

Today, the "loonie" is gaining momentum again. If USD/CAD sellers overcome the target of 1.3310, they will open their way to the next support level at 1.3180: at this price point, the lower border of the Kumo cloud on the D1 timer coincides with the lower line of the Bollinger Bands indicator.

Despite today's northern pullback of USD/CAD, the Canadian dollar continues to hold its ground, imposing its game on the US currency. Even during the recent dollar rally, the "loonie" felt confident, strengthening its positions despite the growth of the US dollar index.

The Canadian labor market growth report usually remains in the shadow of the US nonfarm. However, this time, USD/CAD traders prioritized differently. The US release did indeed please dollar bulls with strong numbers. But after a short-term rise, the pair turned 180 degrees and fell 150 points in just a few hours. In short, according to the published data, 253,000 jobs were created in the non-agricultural sector in the US in April. The unemployment rate fell to 3.4%, while wages showed positive dynamics (4.4%).

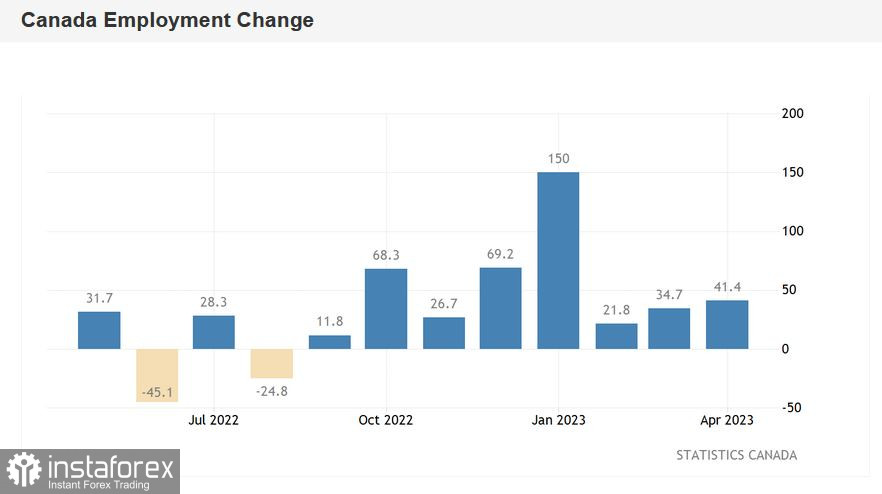

Interestingly, all components of the "Canadian Nonfarms" also came out in the green zone, reflecting the growth of Canada's labor market.

In particular, the number of people employed in the country increased by 40,000 in April, with a growth forecast of 20,000. The most important indicator exceeded the forecasted estimate, showing the best result since January. The upward trend continues for the second month in a row. The unemployment rate remained at 5.0%, with a growth forecast of 5.1%. The indicator has been at the 5% level for five months. Meanwhile, the share of the economically active population increased to 65.6%. The average hourly wage during the month was $33.38. The inflation indicator is growing - April's result reflected a 5% growth in annual terms.

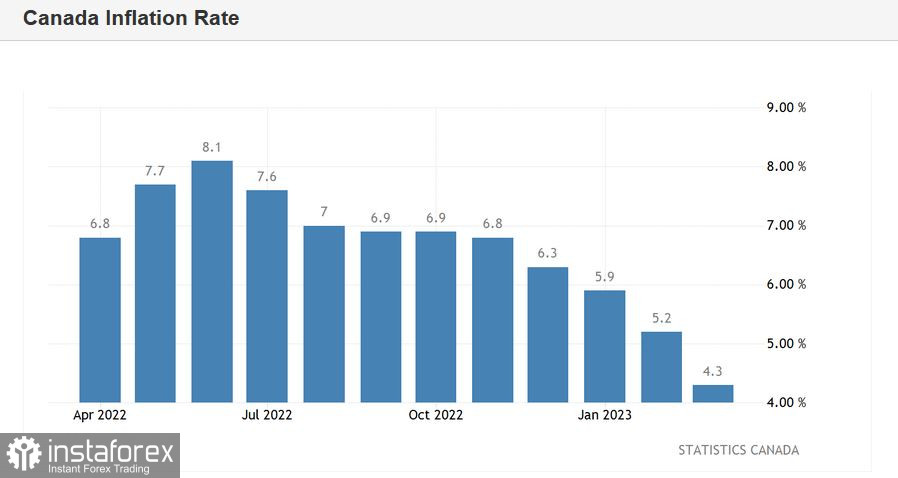

This release provided significant support for the "loonie." However, not by strengthening "hawkish expectations" – no, following the April meeting, the head of the Bank of Canada made it clear that the regulator would resume the cycle of raising interest rates only if there were a corresponding need. That is if inflation starts to pick up again. Whereas at present, the opposite trend is observed: inflation indicators are actively decreasing.

According to the latest data, the consumer price index in Canada fell sharply in March – to 4.3%, compared to 5.2% in the previous month. This is the weakest growth rate for the indicator since August 2021. The index has been consistently decreasing for four months in a row. The release structure indicates that gasoline prices have plummeted almost 14% – this is the fastest decline of this component since July 2020. In addition, the growth in food prices has slowed down. The cost of mortgages has become the main factor raising the cost of living: mortgage interest expenses have increased by almost 27% annually.

So why did strong "Canadian Nonfarm" data support the "loonie," given that the US data also came out in the green zone?

The Canadian data finally offset the rumors that the Bank of Canada could lower interest rates in the foreseeable future. Relevant rumors circulated on the eve of the April meeting, putting pressure on the "loonie." However, at the moment, the probability of such a scenario is extremely low. Canada's labor market is in good shape, and the pro-inflationary indicator (wages) demonstrates an upward trend. This combination favors maintaining a wait-and-see stance by the Canadian Central Bank.

In addition, representatives of the Canadian regulator last week also denied rumors that the central bank might resort to lowering rates in the second half of the year. Tiff Macklem's rhetoric at the latest press conference was "cautiously hawkish": he made it clear that in the foreseeable future, the most likely scenario is maintaining a wait-and-see position. As an alternative – raising the rate, but not lowering it.

In the short term, the fate of the USD/CAD's southern trend will be in the hands of the American currency. Dollar pairs are frozen in anticipation of key data on US inflation growth. The producer price index will come out on Thursday, after the consumer price index on Wednesday. Suppose these reports turn out to be in favor of the greenback. In that case, buyers of the pair will take advantage of the situation and try to rise to the 1.35-figure boundaries, testing the resistance level at 1.3490 (at this price point, the Bollinger Bands' middle line coincides with the Tenkan-sen and Kijun-sen lines on the daily chart). However, if the indicators come out at least at the level of forecasts (most experts expect a further slowdown in US inflation), the ball will be on the side of USD/CAD sellers. In this case, USD/CAD sellers will overcome the barrier of 1.3310 and open their way to the next support level at 1.3180 (at this price point, the lower border of the Kumo cloud on the D1 timer coincides with the lower line of the Bollinger Bands indicator).

Overall, before publishing the main report (on the growth of the consumer price index), scheduled for Wednesday, it is advisable to maintain a wait-and-see position for the pair, given the high uncertainty. The US dollar is currently suspended, while inflation releases can either strengthen or "sink" the greenback.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română