The situation with central bank rates is currently quite simple to understand. The Federal Reserve has most likely completed the monetary tightening process, while the European Central Bank and the Bank of England are just about nearing the finish line as well. In the case of the British and European central banks, we are talking about a maximum of 2-3 increases of 25 basis points, and personally, I consider such a scenario overly optimistic. It should be acknowledged that the European and British economies are coping well with high rates, and fears of a recession, which were voiced for most of last year, have not materialized. What bothers me is the fact that many analysts pay excessive attention to the American economy, which they consider "hopeless."

The US economy has indeed experienced several shocks in recent months in the form of bankruptcies of large banks, but the Fed has promptly and successfully resolved this issue. Depositors' money has been returned, and troubled banks have been absorbed by other banks. Nevertheless, the market has formed a persistent opinion that the American economy is in the worst shape, which explains the low demand for the dollar, which, in my opinion, does not correspond to the truth. I want to remind you that inflation in the United States is decreasing at the highest rates, the rate has reached its highest value (which means there will be no new tightening, nor will there be additional pressure on the economy), the labor market is in good shape, and the unemployment rate is at the lowest 50-year level.

In Britain and the European Union, all the aforementioned indicators are at much lower levels. The only thing that could increase demand for the pound and the euro is expectations of ECB and BoE rate hikes after the Fed completes its tightening program. Today, two ECB representatives stated that the interest rate may rise stronger and longer than previously thought last year. Martins Kazaks said that the rate hike may not end in July. "The ECB can raise rates or keep them at the same level while the Fed starts cutting," Kazaks said.

Peter Kazimir also noted that rates could rise longer, and September is the earliest time to assess the effectiveness of the central bank's measures. He pointed out that wage growth and core inflation remain high, and slowing down the pace of rate hikes would allow the ECB to tighten monetary policy for a longer period. Thus, two Governing Council members allowed for a stronger rate hike, which could increase demand for the euro in the coming weeks.

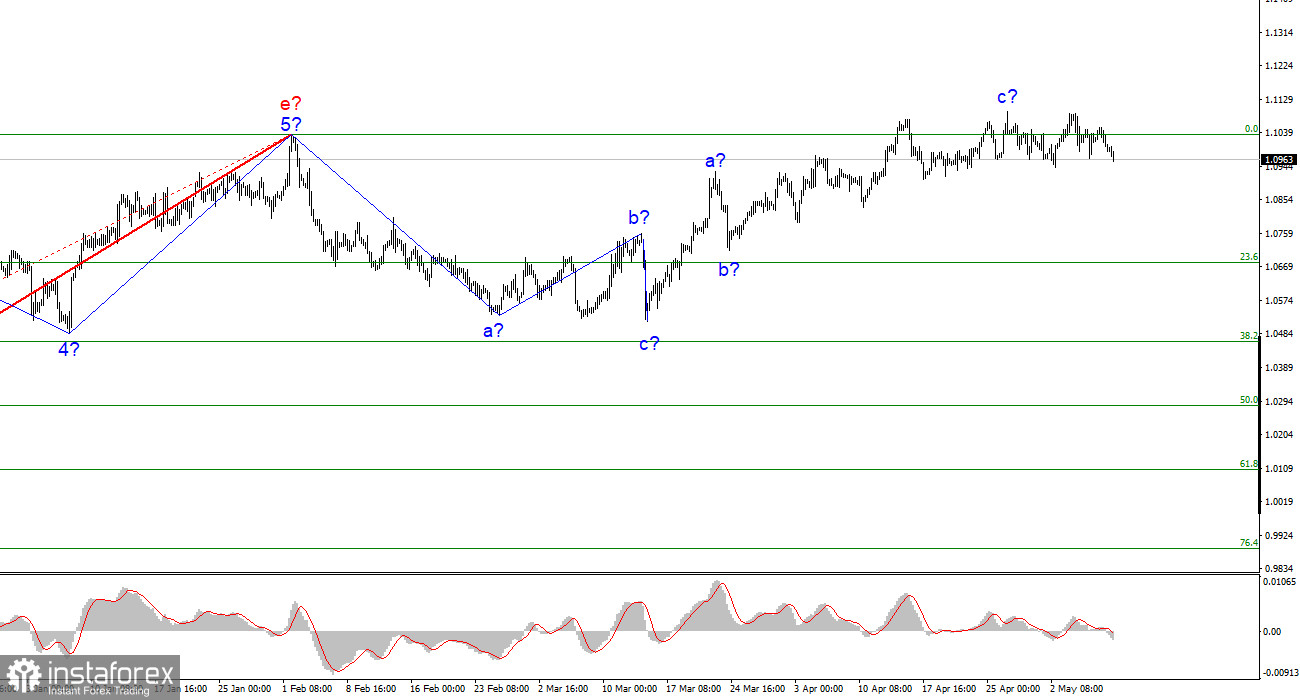

I still primarily rely on wave marking. The 1.1030 level has not yet allowed the instrument to go higher, so I expect the construction of a descending wave set. However, a successful attempt to break through this level will indicate that the market has not ignored the words of Kazaks and Kazimir.

Based on the analysis, I conclude that the construction of an uptrend section is approaching completion or has already been completed. Therefore, you can now open short positions, and the instrument has quite a large space for decline. I think that targets in the range of 1.0500-1.0600 can be considered quite realistic. With these targets, I recommend selling the instrument on the downward reversal of the MACD indicator as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

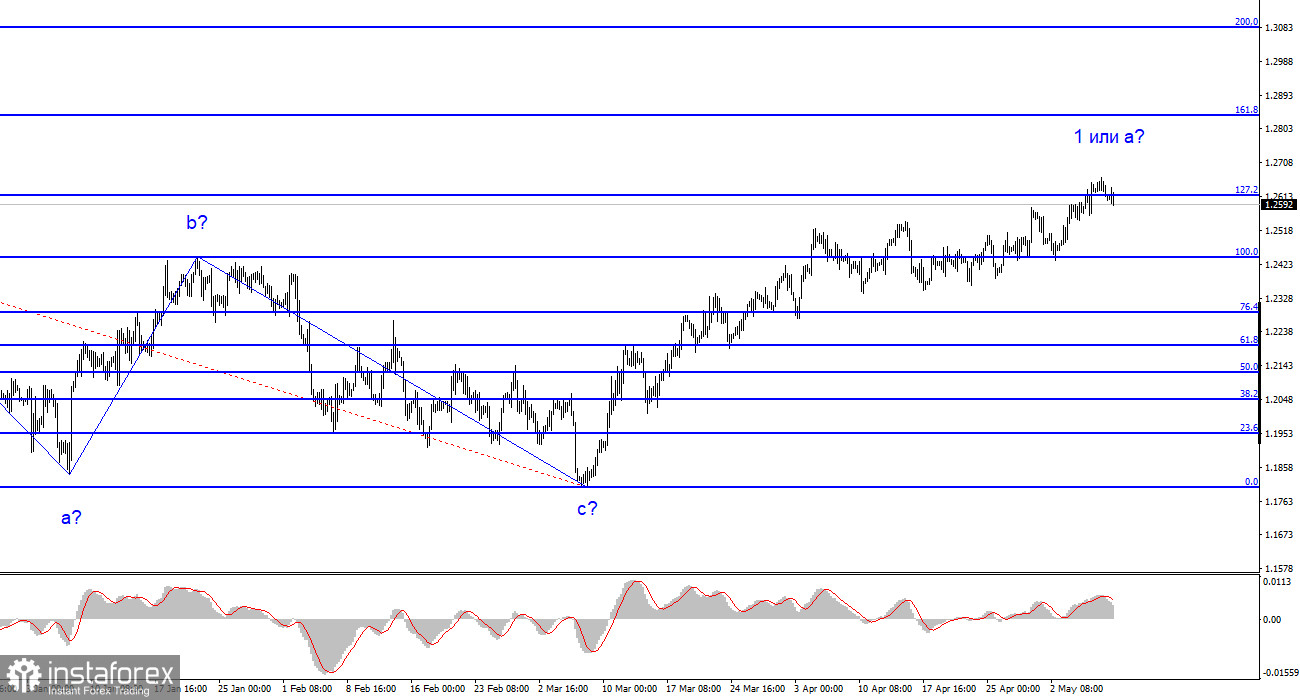

The wave pattern of the GBP/USD pair has long implied the construction of a new downward wave. The wave marking is not entirely unambiguous now, as is the news background. I do not see factors that would support the British pound in the long term, and wave b can turn out to be very deep, but it hasn't even started yet. I believe that a decline in the instrument is more likely now, but the first wave of the ascending section continues to become more complex. An unsuccessful attempt to break through the 1.2615 level, which corresponds to 127.2% Fibonacci, will indicate the market's readiness for shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română