Measure twice, cut once. Before making a deal, you need to think carefully. It is incredibly difficult to do this when markets are driven by emotions, either rising or falling. Although strong employment statistics in the U.S. led to the strengthening of the euro, there was little logic in it. In the end, reason triumphed: EUR/USD plummeted at the speed of a bullet train. The correction has a great opportunity to continue.

When investors think about the strength of the upward trend in the main currency pair, they recall the divergence in economic growth and monetary policy. The Federal Reserve has completed its rate hike cycle, while the ECB intends to continue it. Thanks to the drop in gas prices in europe from €330 to €35 per megawatt-hour, the eurozone will avoid a recession. On the contrary, the U.S. will face a recession due to problems with the debt ceiling and a banking crisis. The issue is that this is no longer news. It is already accounted for in EUR/USD quotes. The market needs fresh data.

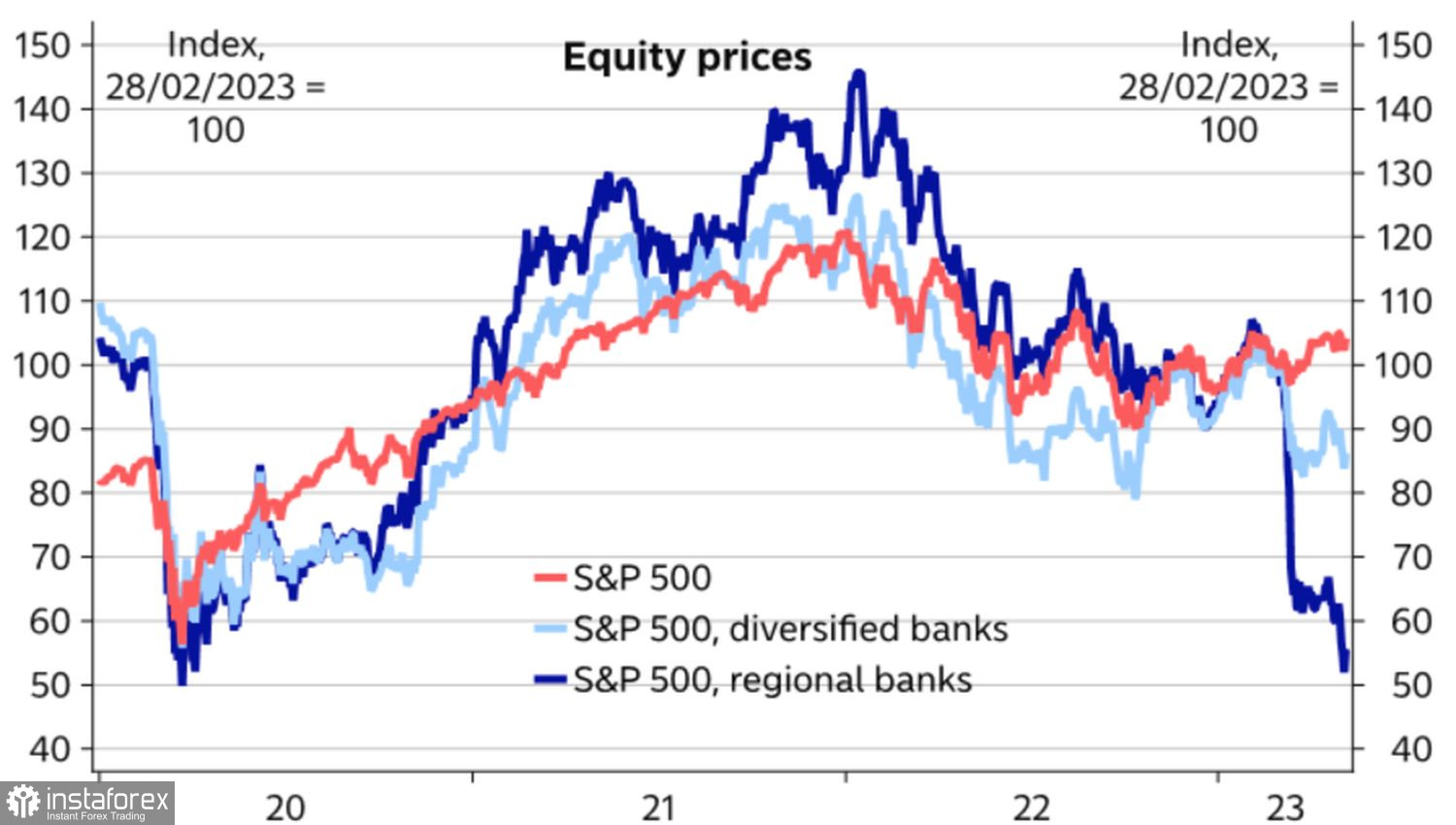

The belief in the acceleration of the economy of the currency bloc against the background of a slowdown of its U.S. counterpart led to an overflow of capital from the U.S. to Europe. From September's low levels, the MSCI index of the Old World rose 28% in euros and 45% in dollars due to the EUR/USD upward trend. The S&P 500 rose only 15% over the same period.

Dynamics of European and U.S. stock indices

Finally, JP Morgan states that it is time to get rid of overvalued European stocks. Tailwinds in the form of hopes for China's economic recovery and the eurozone's resilience to the energy crisis show signs of weakening. If these assumptions are correct, capital repatriation to the U.S. will lay the foundation for a EUR/USD correction.

As for the potential U.S. default and banking crisis, the devil is not so black as he is painted. Many investors perceive the debt ceiling debates as a political spectacle. The issue should be resolved on the falling flag. Why? Because that's how it always happens!

Bankruptcy of credit institutions? The S&P 500 suffered primarily due to falling bank stocks, while corporate reporting exceeded forecasts, as did macro statistics. Meanwhile, the acquisition of First Republic by giant JP Morgan outlined a scheme for the market by which the crisis could be overcome in the future. The strong April U.S. employment report ultimately killed the "bears" in the stock index.

Dynamics of S&P 500 and U.S. bank stocks

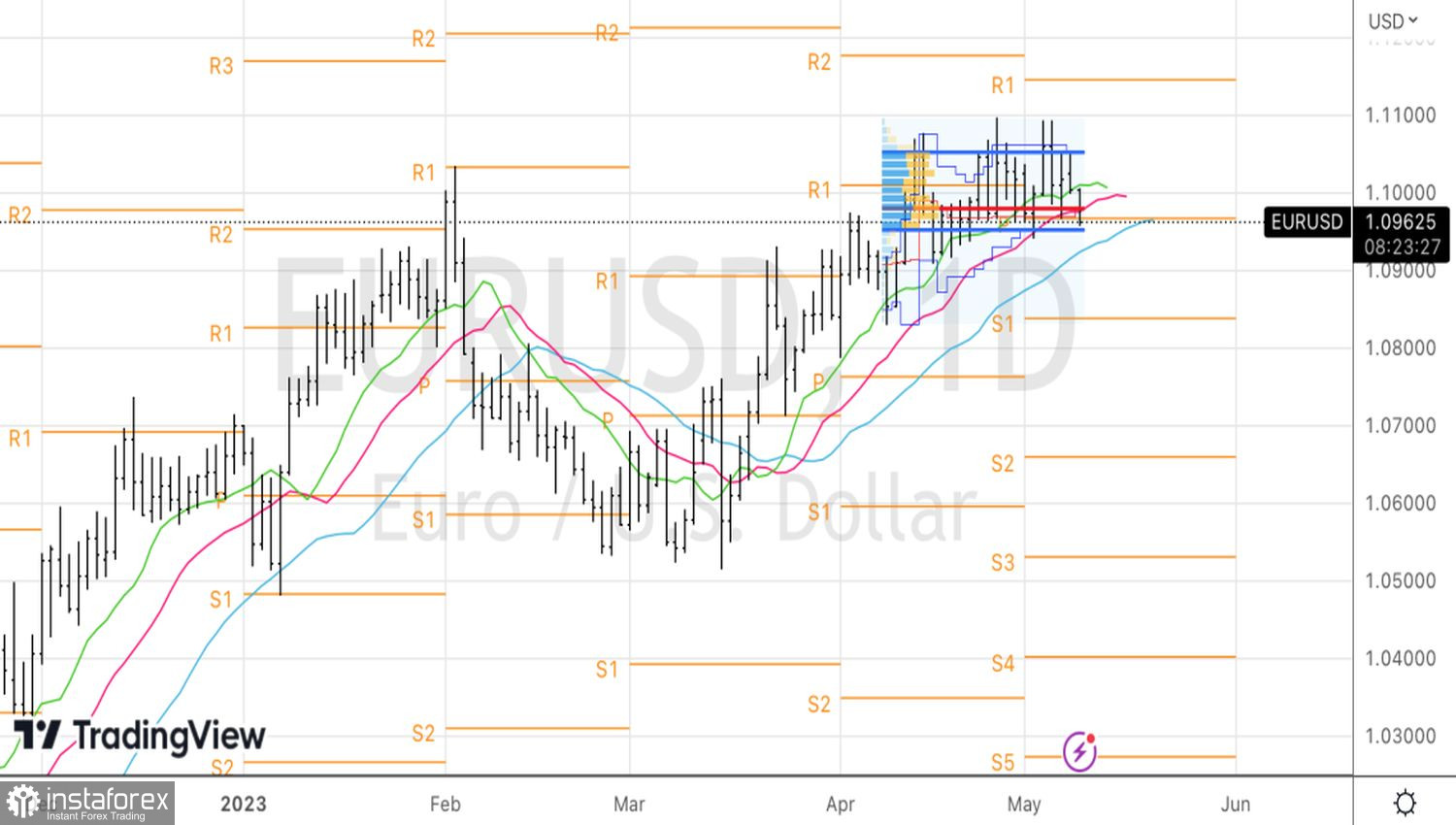

Thus, there is a situation in Forex where many "bullish" factors for EUR/USD have already been taken into account in the pair's quotes. At the same time, the banking sector and the U.S. economy are not as weak as they seem. Why not a reason for the main currency pair to retreat?

Technically, on the daily chart, EUR/USD continues to implement the reversal pattern Double Top. We hold short positions formed at 1.1010 and periodically increase them on a rebound from the fair value of 1.098 and on the breakout of the lower border of its range 1.095–1.105.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română