Pound continues to update the monthly highs even though the UK is still fighting high inflation.

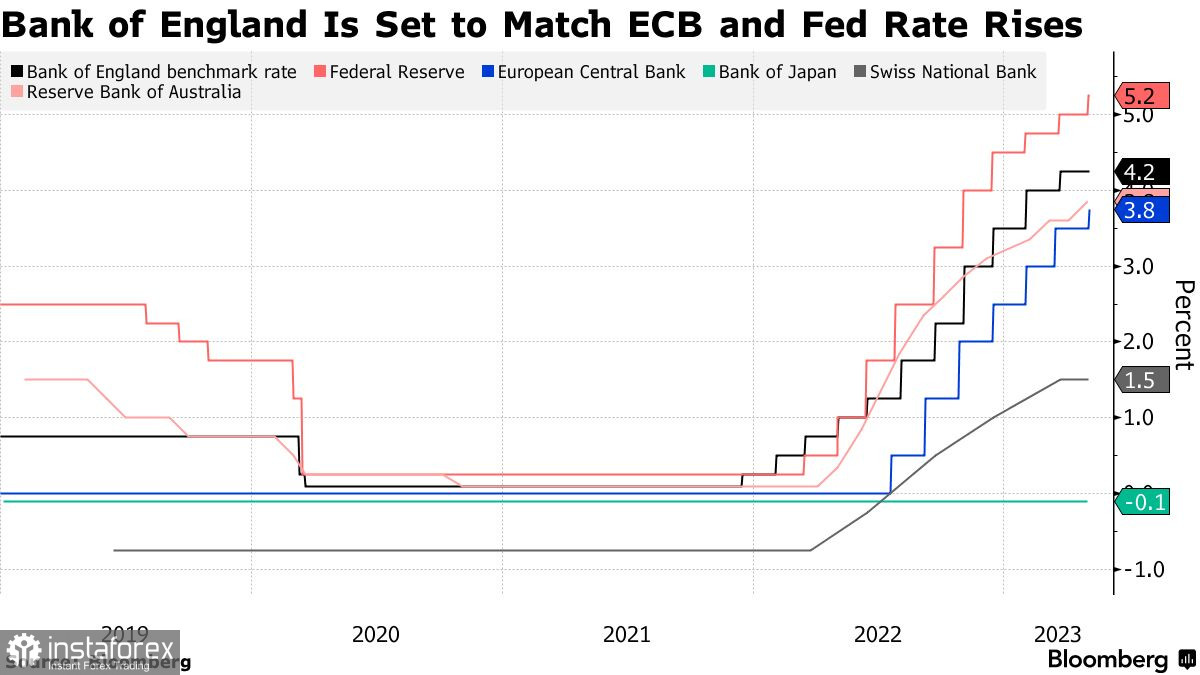

Markets assume that the Federal Reserve already did everything that is necessary to stabilize prices, after raising the interest rate by a quarter point last Wednesday. The European Central Bank followed a similar path, changing its aggressive tone to a softer one by increasing the rate to 3.75%.

Markets assume that the Federal Reserve already did everything that is necessary to stabilize prices, after raising the interest rate by a quarter point last Wednesday. The European Central Bank followed a similar path, changing its aggressive tone to a softer one by increasing the rate to 3.75%.

The two central banks have already made progress in combating high interest rates, while the Bank of England, which first started tightening policy in December 2021, cannot boast of results yet. Most likely, the BoE will have to raise rates by a quarter point to 4.5% this week, and then do a similar one in August. The final increase to 5% will be in September.

Most traders see rates peaking at 5% as inflation in the UK remains in double digits. On the bright side, this maintains demand for pound, especially against dollar, which is about to lose even more positions as the Fed is ready to take its first pause in the rate-hike cycle.

On the downside, inflation is still a big problem, causing additional headaches not only for the central bank but also for the entire government. This means that monetary policy in the UK will continue to remain tight, which does not fit into Prime Minister Rishi Sunak's plans to stimulate economic growth and support the population.

The UK has had similar problems to that of the Uk and Europe, such as acute labor shortages and energy price shocks. The difference is that the labor market tensions in the US are now easing, and energy prices in Europe are falling, while problems in the UK remain in place. This means that the region is now in an exceptionally dangerous position, especially as overall consumer price inflation is at 10.1%, which is five times its mandate. This is happening with interest rates close to 5.0%.

Economists forecast that in the coming months there will be a 2% drop in inflation, followed by another percentage point decrease in July. But even this is an extremely insufficient reason to loosen monetary policy, so pound has a good chance of continuing to grow.

Core indicators also provide a clearer signal of long-term price pressures. Core inflation is 6.2%, and the problem of wage growth continues to stimulate inflation and further entrench it in the economy. According to recent data, the average weekly earnings in the UK have already grown by 6.6% annually.

In terms of the forex market, pound bulls are controlling the market. But to see further growth, the quote has to consolidate above 1.2630 as only that will trigger a much larger rise to 1.2665 and 1.2710. In case there is a decline, bears will attempt to take 1.2600, which could lead to a fall to 1.2560 and 1.2520.

In EUR/USD, bulls still have a chance to continue a rally, but in order to do so, the quote has to stay above 1.0960 and take control of 1.1000. This will allow a rise beyond 1.1030, heading towards 1.1060. In case of a decline around 1.0960, the pair will fall to 1.0940 and 1.0910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română