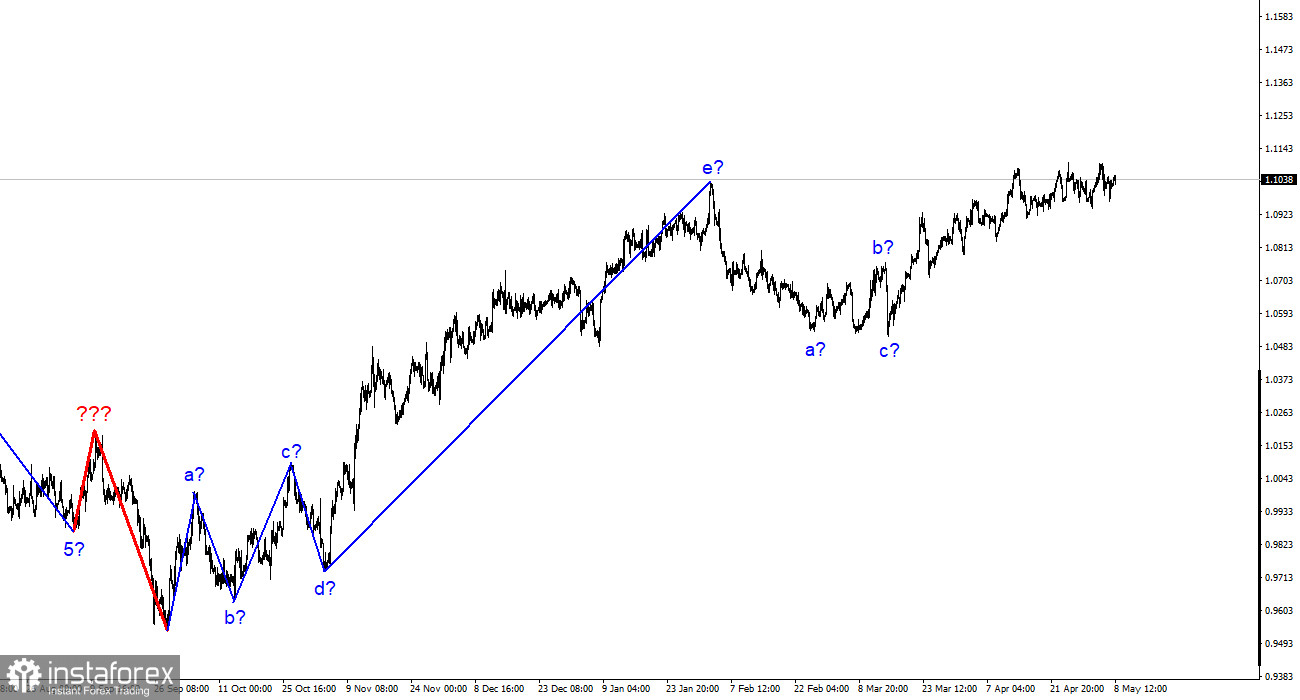

The wave markup of the 4-hour chart for the euro/dollar pair continues to get tangled due to the recent upward waves, but it has not changed in the last few days and weeks. These waves can be an independent upward trend section (since the last descending one can be considered three-wave and completed), and they can also be approaching completion if they take a three-wave form. Thus, the wave picture for the euro currency can be very complex, and it isn't easy to work with it. At the current positions, the formation of an upward set of waves may be completed as the peak of the third wave goes beyond the peak of the first. The same thing was seen in the last descending formation (minimal update of the low and completion of the section).

At the same time, there are other options for wave markup. For example, a full-fledged five-wave (but still corrective) structure. It is advisable to proceed from a scenario with a decrease in the pair because the ascending three-wave set looks complete and finished. Therefore, the formation of a new descending three-wave set may begin soon, but a successful attempt to break through the 1.1030 mark will indicate the market's readiness for new purchases.

German industrial production collapsed in March.

The euro/dollar pair increased by ten basis points on Monday. The amplitude of price changes remains quite low, which is seen in the last few weeks on any chart. The movement is almost 100% horizontal, and the market is reassessing the news background. The euro has squeezed everything it could out of the last two months. At the moment, the wave markup indicates readiness to build a descending set of waves.

Last week, the Federal Reserve (Fed) and the European Central Bank (ECB) raised interest rates by 0.25%. The only difference is that this could be the last increase for the Fed, while the ECB may tighten its monetary policy several more times. This is the only factor in the market that can support demand for the euro for some time. The European Union's economy is in a worse position than the US economy. Even with constant concerns about the American economy, Friday's statistics again showed that the situation is not critical or dangerous. Nonfarm payrolls in April increased by 253,000, higher than expected, and the unemployment rate fell to 3.4%. Based on this, the Fed's policy does not harm the labor market.

In this case, the Fed can raise the rate even higher than the current 5.25%, although this is the first time anyone in the market has thought about it for several months. There is an opinion that the FOMC is ending the tightening process and that the rate is still increasing, which needs to be perceived. Therefore, demand for the euro currency will decrease, but there is a risk of a longer-lasting horizontal movement. This week, the only important event will be the US inflation report, which promises to be quite neutral.

General conclusions.

Based on the analysis, the formation of an upward trend section is approaching completion or has been completed. Therefore, it is advisable to sell now, and the pair has quite a large space for a decrease. The targets in the 1.0500–1.0600 can be considered quite realistic. With these targets, I advise selling the pair on the reversals of the MACD indicator "down" as long as the pair is below the 1.1030 mark, corresponding to 0.0% Fibonacci.

On the older wave scale, the wave markup of the ascending trend section has taken on an extended form but is likely completed. We saw five waves, which are most likely an a-b-c-d-e structure. The formation of the downward trend section may still need to be completed, and it can take any form in terms of structure and duration.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română