Trading recommendations

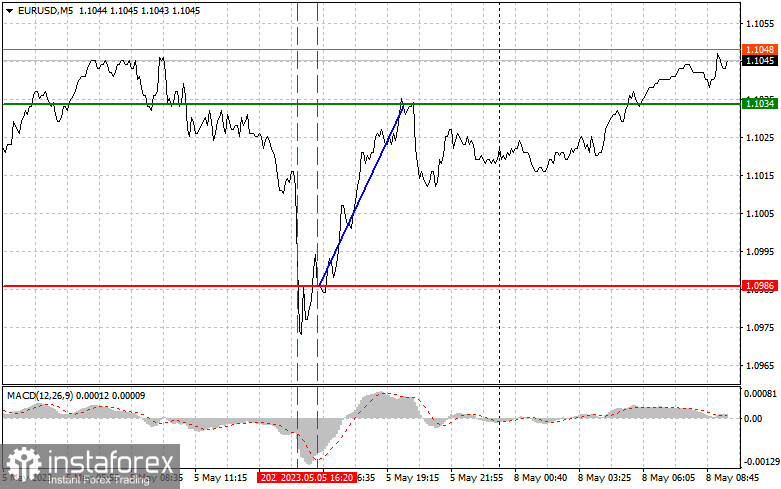

In the first half of the day, the price tested 1.1025 when the MACD indicator was well below the zero level. That is why traders had to wait for a retest, expecting scenario №2. After the release of the eurozone statistical data, I saw another update of 1.1025, which led to a signal to buy the euro. However, the currency failed to show a considerable rise. After the publication of the US labor market reports and a decline in the euro, traders followed scenario №2 to buy the asset. However, this happened only at 1.0986. This time the pair rose by more than 40 pips, allowing traders to recoup morning losses and make some profit.

A jump in the number of employed in the US non-farm sector in April led to a decline in the euro, but it did not last long. Buyers managed to keep their positions at the end of the week, which allowed the pair to continue growing. Today, traders are likely to pay attention to the Sentix investor confidence index for the eurozone, as well as the speech of ECB official Philip Lane. Since it is already clear what course the European Central Bank takes, there should not be any significant market changes today. I advise traders to focus on scenario №2.

In the second part of the day, countries will issue only insignificant reports, including wholesale trade sales, wholesale inventories, and employment trends index in the US. The data will not be of great interest to traders. Thus, buyers of risk assets, including the euro, may continue opening long positions.

Signals to buy EUR/USD:

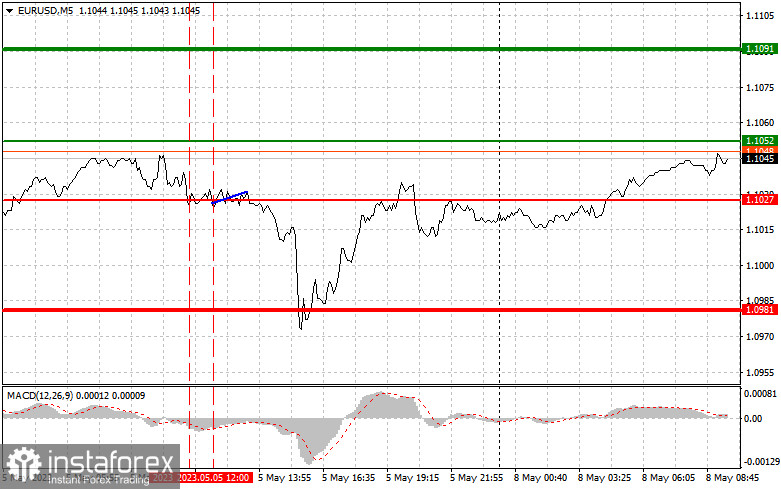

Scenario №1: Today, you can buy the euro when the price reaches 1.1052 (green line on the chart) with a target of 1.1091. At the point of 1.1091, I recommend exiting the market and selling the euro, expecting a movement of 30-35 pips from the entry point. You can expect the pair to rise today after data on the eurozone. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting its growth from it.

Scenario №2: Today, you can also buy the euro in case of two consecutive tests of 1.1027 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to an upward market reversal. You can expect growth to the levels of 1.1052 and 1.1091.

Signals to sell EUR/USD:

Scenario №1: You can sell the euro after reaching the level of 1.1027 (red line on the chart). The target will be at 1.0981, where I recommend exiting the market and immediately buying the euro, expecting a movement of 20-25 pips in the opposite direction. Pressure on the pair will return in case of weak bullish activity at daily highs. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting its decline from it.

Scenario №2: You can also sell the euro today in case of two consecutive tests of 1.1052 at the moment when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a downward market reversal. You can expect a decrease to the levels of 1.1027 and 1.0981.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română