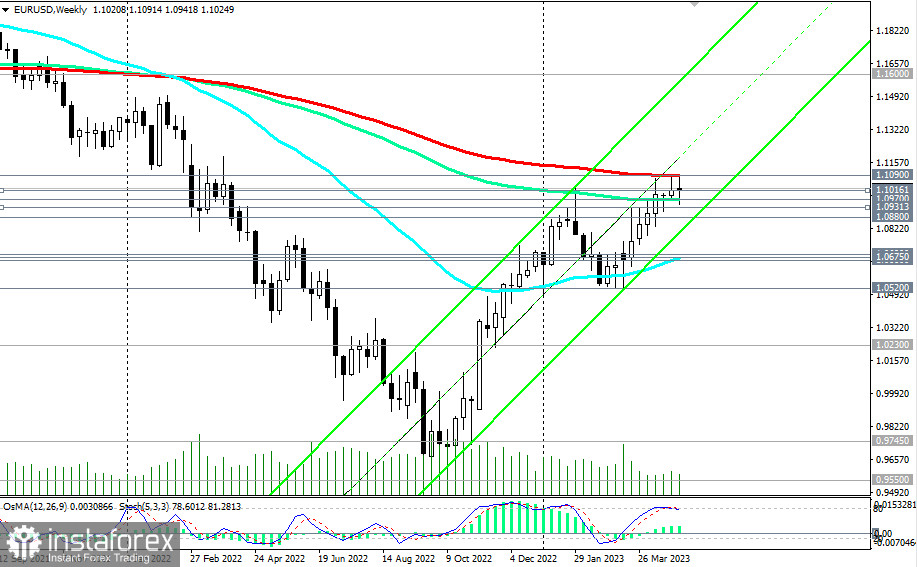

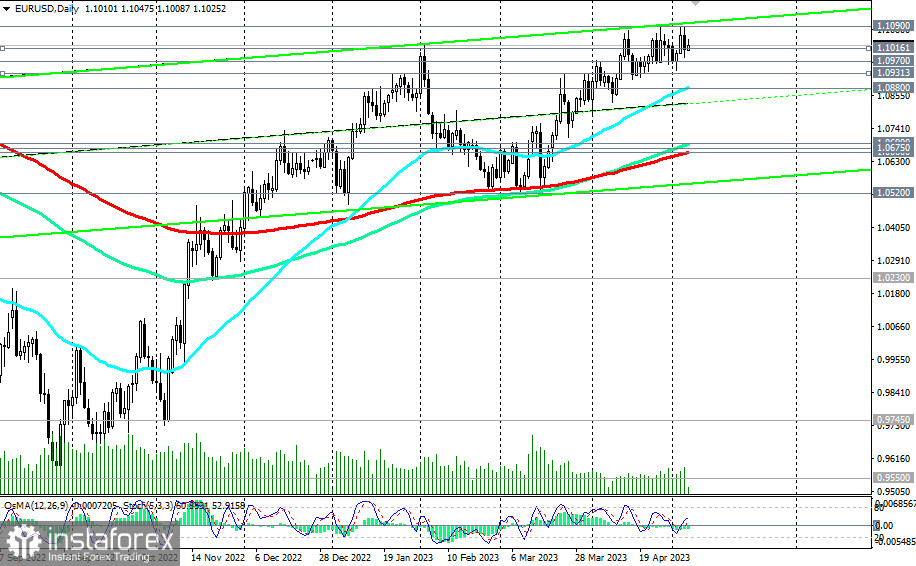

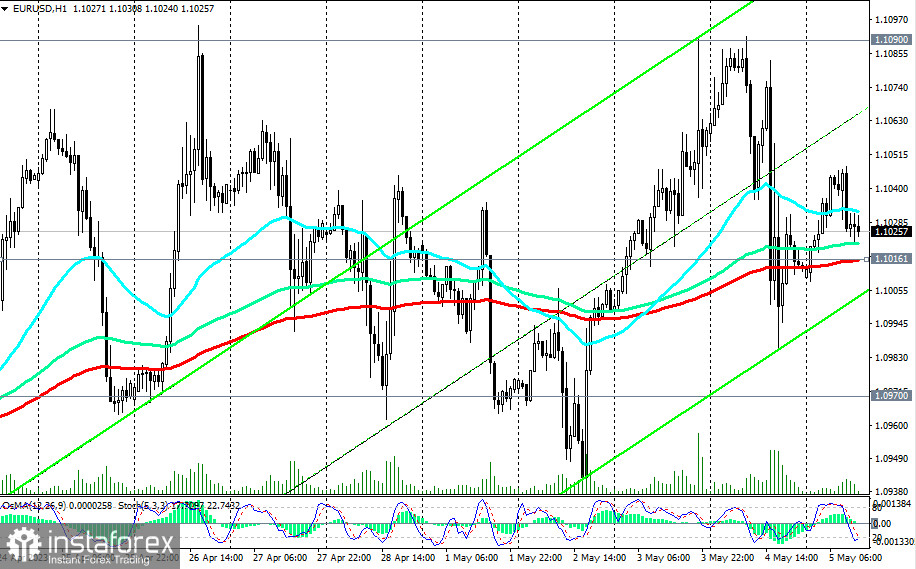

As of writing, EUR/USD was trading near the 1.1025 mark, 12 points higher than the closing price of yesterday's trading day. The pair remains in a range, limited by the key support level 1.0970 (144 EMA on the weekly chart) and 1.1090 resistance level (200 EMA on the weekly chart), maintaining a positive momentum. However, for a definitive breakthrough into the long-term bullish market zone, the pair needs a confirmed break of the 1.1090 mark.

In case of consolidation in this zone, the growth target for the pair will be the 1.1600 resistance level (the upper border of the upward channel on the weekly chart and 200 EMA, 144 EMA on the monthly chart), separating the global bullish trend from the bearish one.

In an alternative scenario, the corrective decline target could be the 1.0931 support level (200 EMA on the 4-hour chart). A breakdown of the 1.0880 support level (50 EMA on the daily chart) will increase the risk of breaking the medium-term trend, directing the pair to the key support levels 1.0690 (144 EMA on the daily chart), 1.0675 (50 EMA on the weekly chart), and 1.0660 (200 EMA on the daily chart).

The first signal for the implementation of this scenario could be the breakdown of the important short-term support level 1.1016 (200 EMA on the 1-hour chart).

Support levels: 1.1016, 1.1000, 1.0970, 1.0931, 1.0900, 1.0880, 1.0800, 1.0690, 1.0675, 1.0660, 1.0600, 1.0520

Resistance levels: 1.1090, 1.1125, 1.1200, 1.1300, 1.1400, 1.1500, 1.1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română