The GBP/USD currency pair grew on Wednesday until the announcement of the Fed meeting results. And on Thursday, it showed a minuscule correction. We assumed that the ECB meeting results would be "dovish" (meaning a slowdown in the pace of monetary policy tightening to a minimum) and that the euro currency might begin to fall. The pound sterling may follow suit, as European currencies often trade similarly. However, the pound spent most of the day near its local highs and showed no desire to move southward.

Recall that on Wednesday, two important reports were published in the United States, which turned out to be stronger than forecasts. However, the market again ignored the factor supporting the US currency. Thus, the overall situation has not changed after the most important event – the Fed meeting. It is worth noting that the results were quite predictable, and Jerome Powell did not say anything shocking or unexpected at the press conference. Therefore, the more restrained market reaction was quite logical. The only illogical thing was the direction of movement.

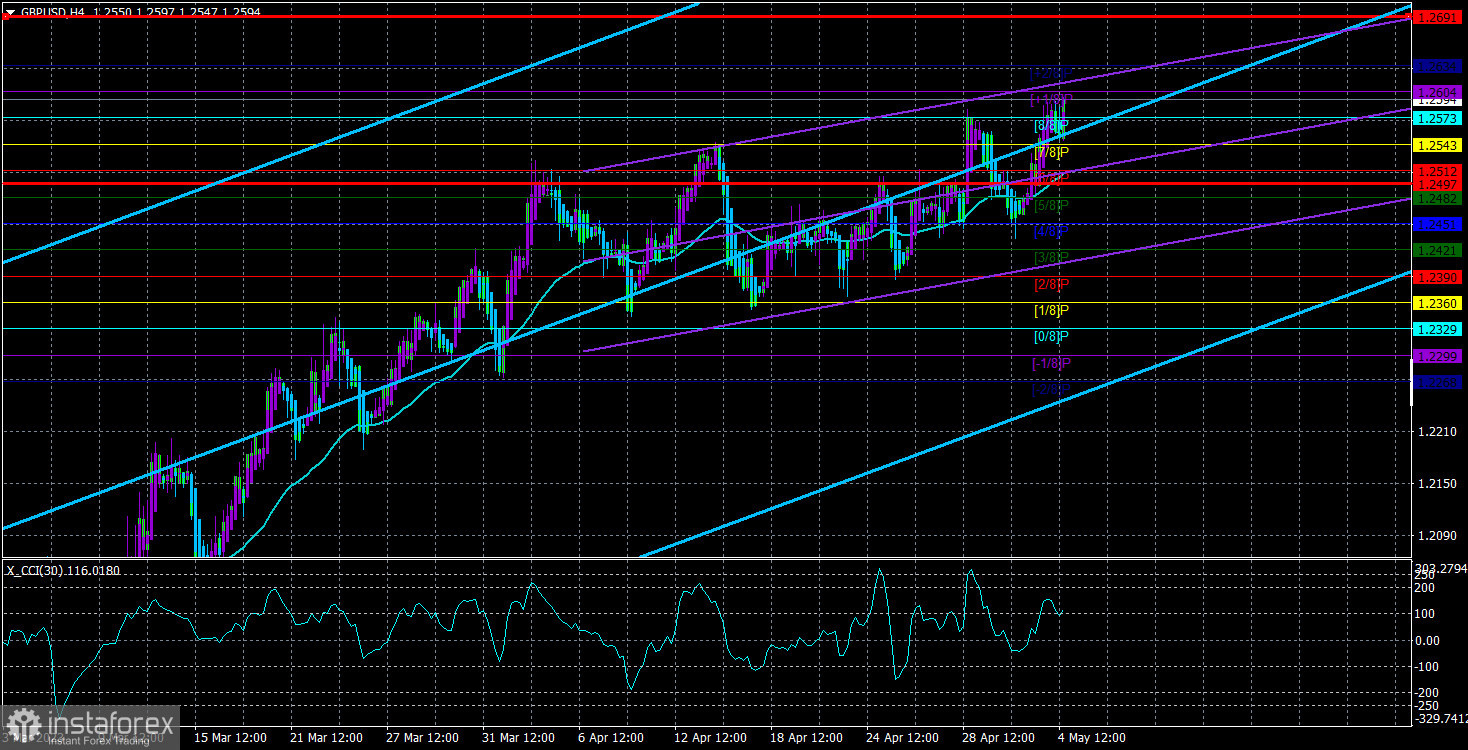

As a result, the pound sterling maintains a "bullish" mood, although there is no basis for this. The inertial upward movement continues, although it is visible that the pair is crawling up with the last of its strength. The CCI indicator indicates a strong overbought condition. The price has yet to be able to correct for two months already. The upward movement is slowing down. The Bank of England has already slowed the pace of its rate hikes to a minimum. What else does the pound need to start falling?

However, as we have already said, a decline will only happen once the market starts to fix profits on longs and open shorts. Therefore, we still advise you to be cautious about all sell signals and, simultaneously, be ready for a sharp drop in the pair at any moment. Despite the strong upward trend on the 4-hour timeframe, it is better to trade now on the youngest timeframes.

The macroeconomic background was weak for the pound.

We also expected the market to continue working out the Fed meeting results on Thursday. However, no resonant decisions were made and announced, so there was nothing to react to. In the morning in the UK, a report on business activity in the services sector was released, which rose to 55.9, exceeding all forecasts. Naturally, the market took the opportunity to open long positions again. Only a report on jobless claims was published in the United States, which fully coincided with the forecasts.

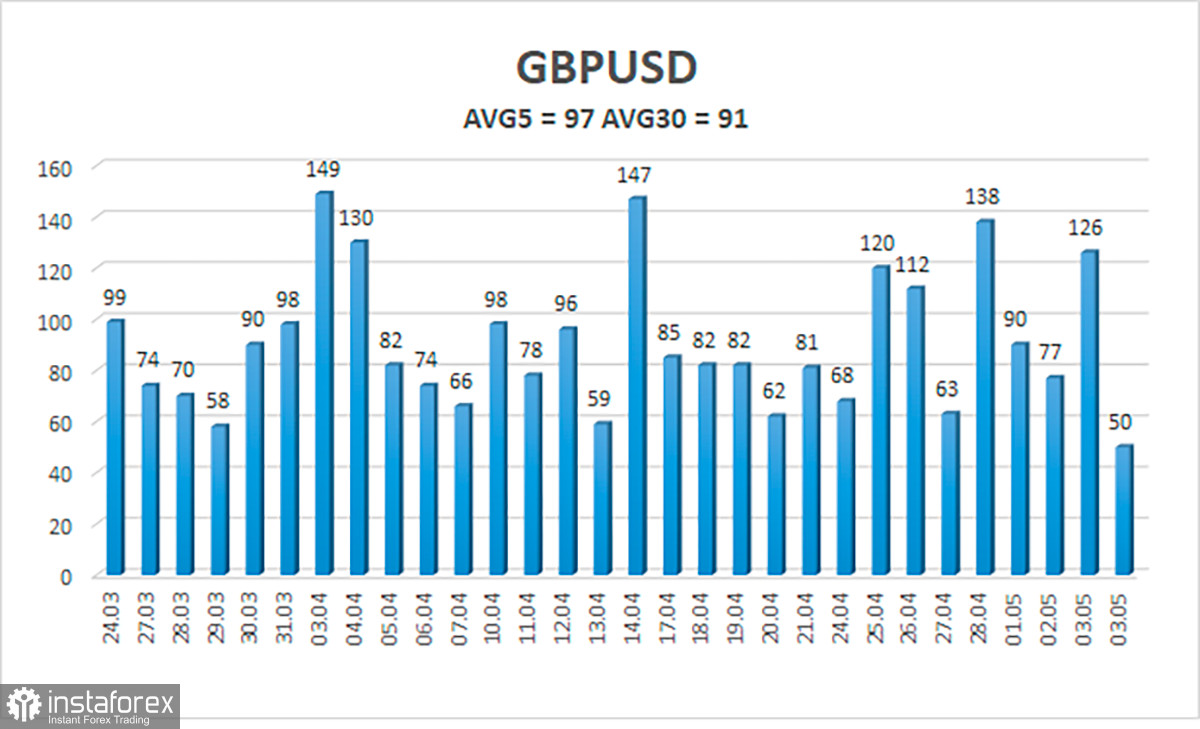

And as a result, the pound sterling spent most of the day treading water in a range not exceeding 45–50 points. And this is after the Fed meeting, after the rate hike, and after hints of a possible end to the tightening cycle. It is important to note that market volatility has significantly decreased recently, as shown in the example below. The average 30-day volatility of the pound is only 91 points, an average value. In the global scheme of things, the market is calming down after a two-year downtrend and a nine-month upward correction.

This week, the market has only ignored the nonfarm payroll and unemployment reports. If they turn out to be weak, there is no doubt that the dollar will fall again. Suppose the dollar manages to show growth on weak data from overseas. In that case, it will again be possible to conclude the illogical movement of the pair and the market's reaction to the macroeconomic background. If the statistics turn out to be strong, it is far from certain that the dollar will grow. It may show "formal" growth of 50 points and return to its original position by the end of the day. In general, movements remain illogical and chaotic no matter what the "fundamental" or macroeconomic factors are. Volatility is falling, and sometimes it isn't easy to trade even on the youngest timeframes. Plus, it should be understood that low volatility means the pair is treading water all day long. Consequently, it generates many false signals at the same level.

The average volatility of the GBP/USD pair over the last five trading days is 97 points. For the pound/dollar pair, this value is "average." Therefore, on May 5, we anticipate movement within channels 1.2497 and 1.2691. A reversal of the Heiken Ashi indicator back down will signal a new wave of downward movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2543

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2604

R2 – 1.2634

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe is trying to resume its upward movement. Sideways movement can resume anytime, as we have seen more consolidation than a trend in the last few weeks. Trading can only be done again based on Heiken Ashi indicator reversals or younger timeframes.

Illustration explanations:

Linear regression channels - help determine the current trend. If both point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should now be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română