The EUR/USD currency pair continued to move calmly and with relatively low volatility upward on Wednesday. The publication of the ISM or ADP index was scheduled for the evening of that day, which came out a little earlier the same day. Recall that traders ignored both of these reports, although they were supposed to trigger a rise in the dollar. The market's reaction to the Fed meeting was virtually absent in the evening. We will talk more about the meeting itself later, but now it is worth noting that the dollar should have risen almost in any case on Wednesday evening. Why? Let's figure it out.

First, the pair has been growing for two months already. This is quite enough to expect a correction after an important fundamental event. Second, the pair rose in anticipation of the Fed meeting, as if working out the future decision of the regulator. And the decision could only be one - an increase in the rate by another 0.25%, which we all eventually saw. This decision was not "dovish," so the dollar's fall before the meeting means either a complete disregard for the fundamental background by traders or their expectations of some other "dovish" news. But there was no "dovish news" in the end. Powell did not even clearly say that the rate would no longer rise. We saw another illogical upward movement of the pair and another illogical market reaction, and the technical picture did not change.

Traders continue to ignore the macroeconomic background, which favors the dollar. Any reason is used for new purchases of the European currency or the pound. Thus, even a small correction of the pair on Thursday does not allow any conclusions to be drawn. If the quotes consolidate below the moving average again, it will mean nothing, as we have seen many such consolidations over the past two months. It remains only to wait until the market gets tired of constantly buying the euro out of thin air.

Fresh results from the Fed meeting.

The market expectations for the Fed meeting were almost unambiguous. The rate hike probability by 0.25% was estimated at 90%. The likelihood of announcing the end of the monetary policy tightening cycle was nearly zero. The Federal Reserve could have ended the tightening on Wednesday evening, but this will now depend entirely on the incoming macroeconomic statistics. If inflation suddenly rises again, the Fed will go for additional tightening. Thus, from the beginning, the market had no right to expect statements from Powell: "Today, we are ending the key rate hike."

Powell, of course, did not say anything like that. He noted that "inflation is still too high, but is likely to continue to decline over time" since the effect of rate hikes can be observed for up to 18 months. The wording about the need for further monetary policy tightening was also removed, but this fact is not "dovish." It was obvious to everyone that even the Fed would not constantly raise rates. There is no need for this anymore since inflation is falling every month and has already reached 5%.

At the same time, the ECB raised the rate by 0.25%, implementing the most "dovish" scenario. The most important thing is that the ECB slowed the tightening pace to a minimum, so two more rate hikes with the same step and the cycle could also be completed in the European Union. And we consider this factor even more important, as the European currency loses the potential factor of its support. Earlier, the euro could enjoy demand because the ECB maintained the pace of rate growth at 0.5%. Now this is no longer the case. And considering the growth of the euro currency in recent months, the "divergence of rates" between the ECB and the Fed for 2023 should have already been worked out. No matter how you look at it, the European currency is overbought, unjustifiably high, and has no factors for further growth.

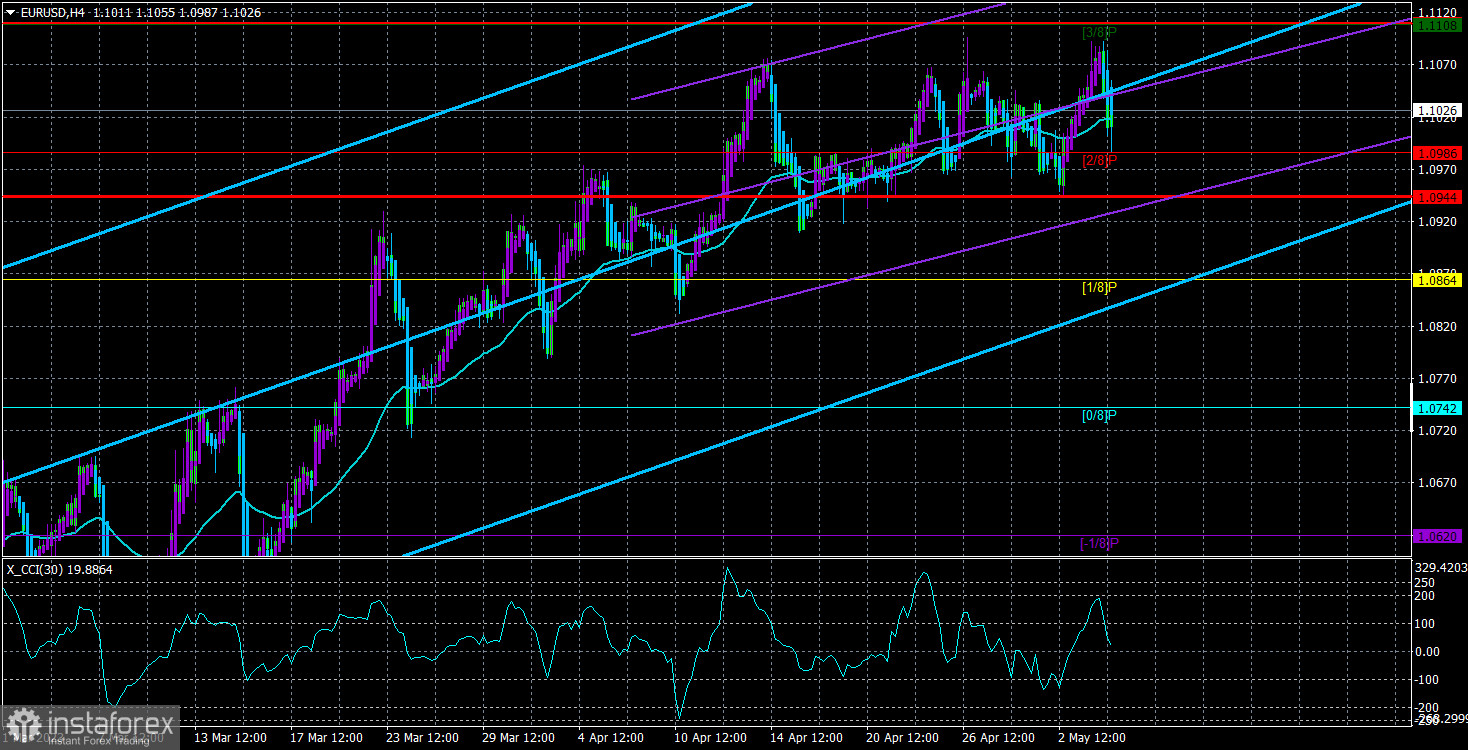

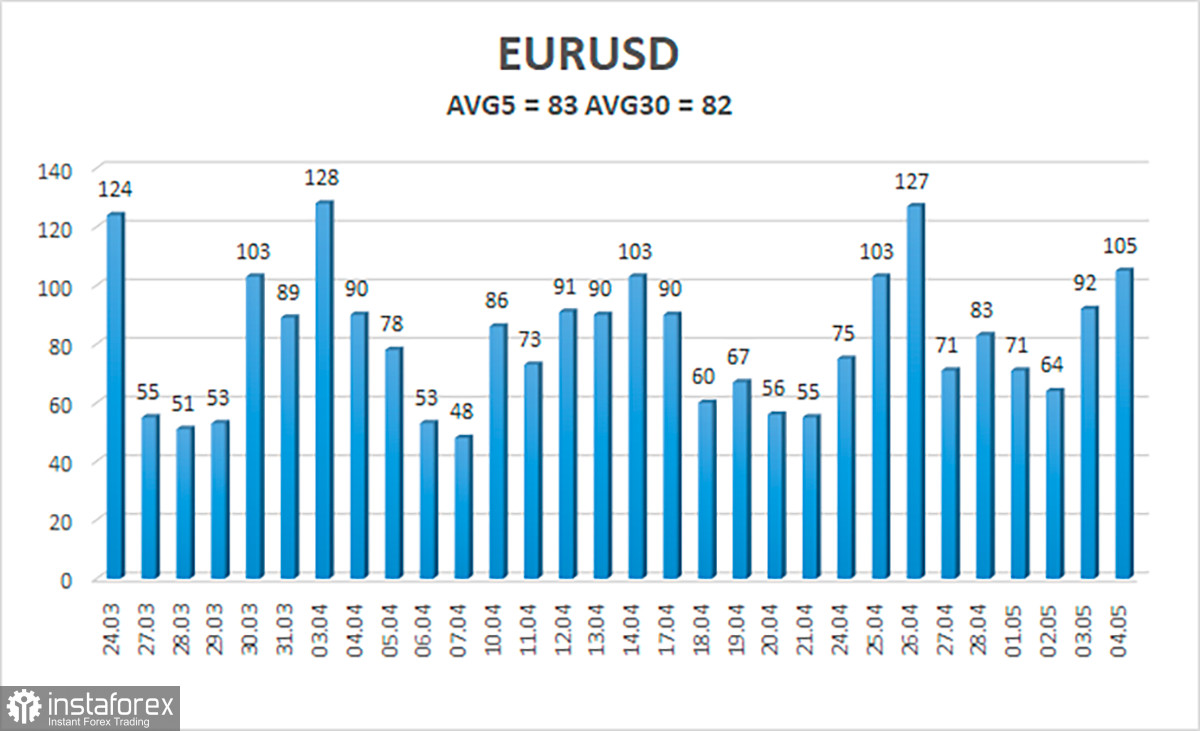

The average volatility of the euro/dollar currency pair for the last five trading days as of May 5 is 83 points and is characterized as "medium." Thus, we expect the pair to move between levels 1.0944 and 1.1110 on Friday. The reversal of the Heiken Ashi indicator back up will indicate a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is again trying to resume its upward movement. At this time, the movement is more horizontal, so trading can only be done on reversals of the Heiken Ashi indicator. Or on the youngest timeframes, where at least intraday trends can be caught.

Explanation of illustrations:

Linear regression channels - help to determine the current trend. If both are directed in one direction, the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on the current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română