The euro traded significantly lower after the European Central Bank announced its decision to raise the base interest rate by only 25 basis points. Although the rates are now at a level unseen since November 2008, the ECB continues to fight rising consumer prices.

The decision coincided with economists' forecasts and previous statements by ECB representatives that now is not the best time to keep policy as tight as possible. The latest credit data was a key factor in policy makers' decision, as a sharp slowdown in lending, on which all of Europe is "sitting," could cause far more problems than high core inflation. A recent ECB survey showed that banks have already significantly restricted access to loans, which indicates that high interest rates have already begun to affect the real economy.

The decision was also made after inflation data published earlier this week showed an increase in the core indicator to 7% annually in April. At the same time, as I mentioned earlier, core inflation, excluding food and energy prices, fell only to 5.6% from 5.7%.

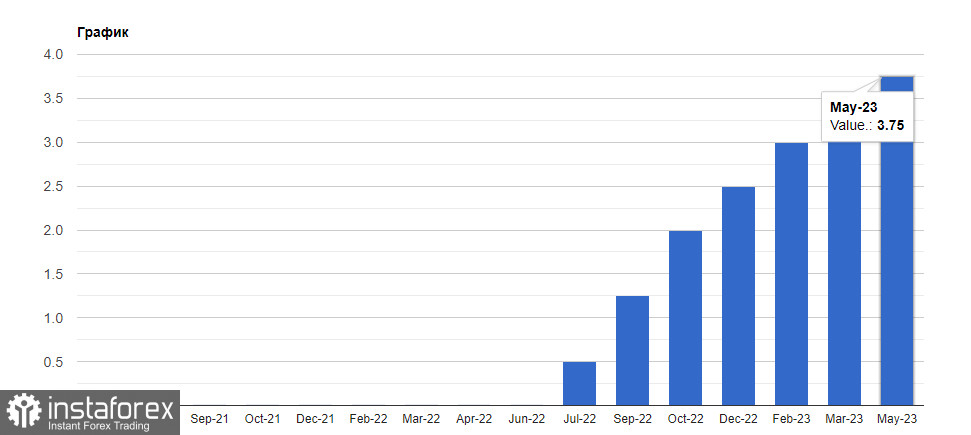

Recall that the ECB started to actively combat price pressures back in July 2022, when it raised its key rate from -0.5% to zero.

However, despite the consistent rate hikes since then, inflation remains significantly above the ECB's 2% target. According to forecasts published last week by the International Monetary Fund, inflation in the eurozone will not reach the ECB's target until 2025.

The latest data has already shown that the eurozone economy grew less than expected in the first quarter of the year, recording sluggish GDP growth at 0.1%. But even this avoided a recessionary scenario. Nevertheless, unemployment figures remain at a reasonably good level. The latest data for March showed a drop in the unemployment rate to 6.5%.

On Wednesday, the Federal Reserve also announced that it is raising rates by 25 basis points, bringing the target range to 5-5.25% – the highest level since August 2007. The US central bank also suggested that it may be close to pausing rate hikes, but there were no specific hints on when that would be done.

And while stress in the European banking sector is still a rather remote scenario, even some probability of it can become additional ammunition for dovish decisions by the ECB in the near future.

As for the technical picture of EURUSD, the bulls now have fewer chances to continue rising. To do this, they need to stay above 1.1040 and take control of 1.1095. This will allow them to break through the 1.1130 barrier. From this level, they can climb to 1.1170. In case the pair falls, I expect large buyers to become active only around 1.1040. If traders aren't active there, it would be good to wait for the update of the 1.1025 low or open long positions from 1.0990.

As for the technical picture of GBPUSD, the bulls continue to control the market. In order for the pair to rise further, it is necessary to take control of 1.2600. Breaking through this level will strengthen the hope for further recovery to the 1.2630 area, after which we can talk about a sharper surge around 1.2665. In case the pair falls, bears will try to take control of 1.2560. If they manage to do so, breaking through this range will hit the bulls' positions and push GBPUSD to a low of 1.2530 with the prospect of reaching 1.2490.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română