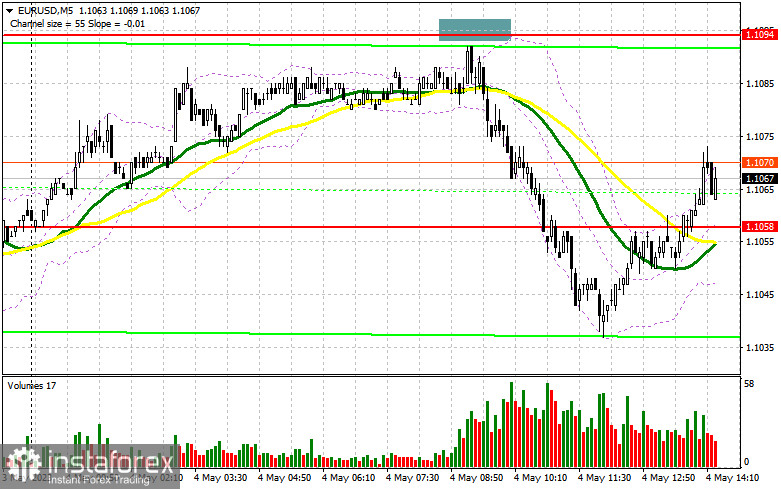

In my morning article, I turned your attention to 1.1094 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A rise in the euro occurred at the start of the European session. However, the pair lacked only a few points for a false breakout of 1.1094. I did not open any positions around 1.1058 as the fall in the euro amid upbeat PMI data in the Eurozone looked extremely strange.

When to open long positions on EUR/USD:

In the afternoon, the ECB will announce the rate decision. If the regulator hikes the key rate by 50 basis points, the pressure on the pair may return. However, the overall outlook remains bullish. Speculators should pay attention to the speech of ECB President Christine Lagarde as well as US initial jobless claims and trade balance data.

Given that the volatility is likely to be high, the technical outlook for the afternoon was revised. I would advise you to open long positions only after a decline and a false breakout of 1.1039, a new support level formed today. It could lead to a buy signal. As a result, the pair may climb to a new resistance level of 1.1090. A breakout and a downward retest of this level will facilitate bullish sentiment, creating additional entry points into long positions. The euro is likely to reach 1.1129. A more distant target will be the 1.1174 level where I recommend locking in profits.

If EUR/USD declines and bulls show no activity at 1.1039 in the afternoon, bears may start a more significant downward correction. If so, only a false breakout of the support level of 1.0996 will give new entry points into long positions. You could buy EUR/USD at a bounce from 1.0970, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers are not ready to give up. If the euro fails to rise above 1.1090 after Christine Lagarde's speech, it is likely to tumble lower. Bears get an excellent chance to defend 1.1090, providing a good entry point into short positions with the prospect of a drop to the support level of 1.1039. The moving averages are likely to move to this level as well. A fall below this level as well as an upward retest could trigger a downward movement to 1.0996. I recommend locking in profits at this level.

If EUR/USD rises during the US session and bears show no energy at 1.1090, which is likely as the ECB may raise rates by 50 basis points. It is better to postpone short positions until a false breakout of 1.1129. You could sell EUR/USD at a bounce from 1.1174, keeping in mind a downward intraday correction of 30-35 pips.

COT report

The COT report (Commitments of Traders) for April 25 logged an increase in long positions and a decrease in short positions. Despite some market moves ahead of the Federal Reserve meeting, where rates will definitely be raised by 0.25%, traders are not in a hurry to close long positions on EUR/USD as they expect more aggressive policy from the European Central Bank. The risk of a recession in the US and a rapid slowdown in the economy, along with problems in the banking sector, also allow traders to bet on growth in risky assets in the medium term, which is beneficial to EUR buyers. The COT report shows that non-commercial long positions rose by 1,147 to 243,516, while non-commercial short positions declined by 3,892 to 74,116. As a result, the total non-commercial net position went up last week to 144,892 against 139,956 a week earlier. EUR/USD closed last week lower at 1.1006 from the closing price of 1.1010 in the previous week.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates bulls' attempt to regain the upper hand.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.1090 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română