The euro has an excellent chance to continue its growth today, provided that the European Central Bank refrains from slowing down the pace of the key rate hike even amid the core inflation data. The fact is that the indicator declined for the first time in 10 months. It decreased very slightly, only by 0.1%, while the overall CPI index resumed growing and returned to the level of 7.0%. Thus, the ECB may face quite a dilemma.

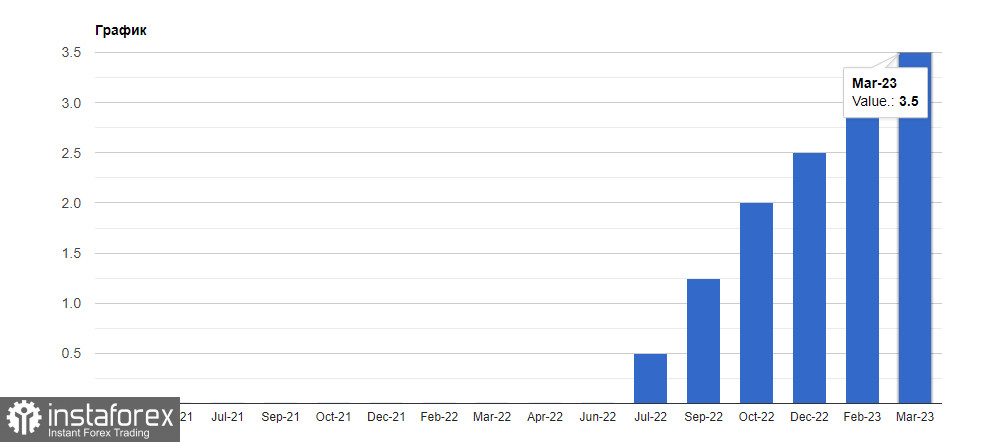

Economists suppose that tighter conditions of the loan are already affecting the economy. It is expected that officials will raise the interest rate by just a quarter point today to 3.25%. However, the key interest rate could also jump to 3.75% from 3.5%.

Nevertheless, a more considerable change cannot be ruled out. There are analysts who believe that officials will choose a 50-basis-point rise as the core price growth is still significantly above the target level of 2%, while the wage growth is gaining momentum. If this happens, the European currency will surely gain in value, especially after the Federal Reserve hinted at a pause in the rate hike cycle.

Regardless of today's outcome, ECB officials emphasize that the most aggressive monetary policy tightening in the ECB's history is nearing its end. Markets are anticipating two more hikes before benchmark rates stabilize at 3.75%.

Recent comments from European politicians indicate that the stabilization of core inflation and signs of tighter conditions of the loan convinced them that it is time to abandon a 50-basis-point increase. The ECB will make its statement at 14:15 in Frankfurt, and President Christine Lagarde will meet with the press half an hour later.

A compromise on a smaller rate hike may include a signal that borrowing costs should still rise. However, many economists expect any forecasts to be vague due to the ECB's commitment to incoming data. This will limit the upward potential of the currency pair, as neither the Fed nor the European regulator gives clear signals about the moment they will completely abandon the tight policy.

Notably, yesterday, the FOMC decided to raise the target range for the key rate to 5%-5.25%. At the same time, the committee stated that it would continue to closely monitor incoming information and assess consequences for monetary policy. If necessary, the Fed will take additional tightening measures to achieve the target inflation rate of 2%.

As for the technical picture of EUR/USD, bulls still have every chance to continue growing. To do this, they need to stay above 1.1055 and take control of 1.1095. This will allow them to break the 1.1130 level. From that level, they could climb to 1.1170. In case of a decline, I expect any actions from major buyers only around 1.1055. Otherwise, it would be good to wait until the price updates the low of 1.1025 or open long positions from 1.0990.

As for the technical picture of GBP/USD, bulls continue to control the market. To push the price higher, bulls should take control of 1.2600. Only a breakout of this level may allow the pair to recover to 1.2630. In this case, the price may climb to 1.2665. If the pair falls, bears will try to take control of 1.2560. If they succeed, a breakout of this range may push GBP/USD to the low of 1.2530 with the prospect of reaching 1.2490.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română