The euro and the pound have returned to their monthly highs after the US Federal Reserve raised interest rates yesterday, stating that it expects a recession to occur alongside moderate economic growth.

In the accompanying statement from the Federal Open Market Committee (FOMC), it was mentioned that the US economic activity grew at a moderate pace in the first quarter of this year thanks to a steady increase in employment in recent months. Considering that the unemployment rate remains extremely low, inflation is likely to continue at an elevated level.

As for the US banking system, it is considered to be reliable and stable. Stricter lending conditions for households and businesses will undoubtedly put pressure on economic activity, employment, and most importantly – inflation. However, the Fed believes the extent of these effects remains uncertain, so the committee must continue to pay close attention to inflationary risks.

Regarding the banking system, the Fed might have overlooked the bankruptcy of two regional banks in March of this year and another one this past Monday. PacWest Bancorp is next in line, with its shares plummeting 54% this week after news that the bank is exploring strategic options to exit the crisis, including a sale or raising capital from investors. The rhetorical question is whether the Fed will have to lose four major banks to finally stop raising interest rates.

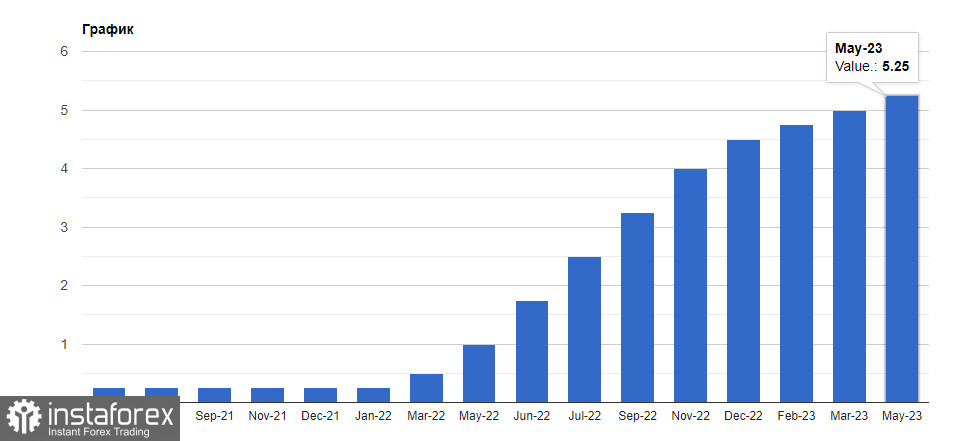

The statement also said that the committee aims to achieve maximum employment and 2 percent inflation in the long term. To support these goals, it was decided to raise the target range for the federal funds rate to 5%-5.25%, while carefully monitoring incoming information and assessing the implications for monetary policy. If necessary, the central bank will take additional tightening measures to achieve the target inflation rate of 2 percent.

Regarding the Fed's balance sheet, the committee will continue to reduce it, as was previously announced in its plans.

As for future decisions, they should consider a wide range of information, including data on the state of the labor market, inflationary pressures, inflation expectations, as well as financial and political events.

The outcome of yesterday's meeting is a cautious stance by the Federal Reserve, without further tightening unless necessary. While this may not be a "green light" for buyers of risk assets, especially the euro and the British pound, it is still a positive development, as the regulator will eventually be forced to ease its policy.

As for the technical outlook for EURUSD, bulls have a good chance to continue growth. For this, they need to hold above the area of 1.1055 and gain control of 1.1095. This will allow the bulls to overcome the level of 1.1130 and then head for an upward target at 1.1170. If the instrument declines, I expect larger market players to step in only at the level of 1.1055. If nothing happens there as well, it is worth waiting for the price to test the low of 1.1025. Otherwise, it is advised to open long positions from 1.0990.

On the GBPUSD chart, bulls remain in control of the market. To extend growth, buyers need to reach 1.2600. A breakout of this level will make it possible for the price to return to 1.2630. Then the pound may rush to the upside toward the 1.2665 area. In case of a decline, bears will try to seize control of the 1.2560 level. If they succeed and break below this level, bullish stop-loss orders will be triggered and the GBPUSD pair will drop to the low of 1.2530 and later to 1.2490.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română