As expected, the Federal Reserve announced another 25-basis-point increase in interest rates.

However, dollar declined because the rhetoric of the Fed was more moderate and calm than before, even though Chairman Jerome Powell did not answer the question about further interest rate hikes and even hinted that it is not advisable to consider easing monetary policy for now.

Today, the European Central Bank is scheduled to announce its decision on interest rates which, if similar to that of the Fed, will not cause a significant effect in markets except, perhaps, for a slight dip in dollar. However, last week, two ECB representatives hinted at the possibility of a more significant rate hike, that is, by 50 basis points. If this happens, dollar will show a more rapid decline.

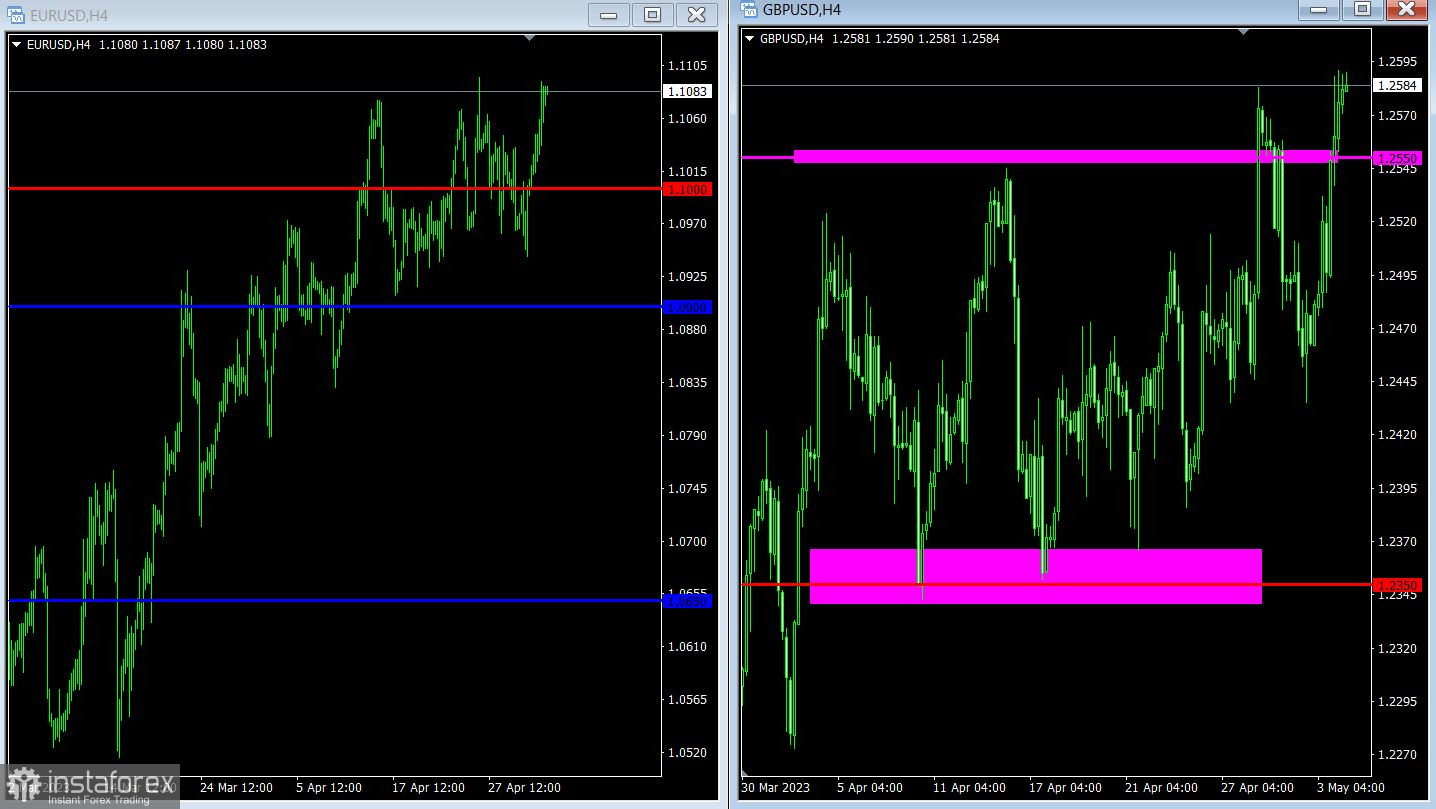

EUR/USD rose by over 100 pips, prolonging the medium-term upward trend. If it continues to stay above 1.1100, market players will see further growth in euro.

The medium-term upward trend is also continuing in GBP/USD. If the quote stays above 1.2550, then market players will also see further growth in pound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română