There is no point in even dwelling on the fact that the Federal Reserve's refinancing rate was raised by twenty-five basis points, since we already expected this decision. Much more important is what Fed Chairman Jerome Powell said afterward. Although he did not answer the question about further interest rate hikes, and even hinted that it is not yet advisable to consider easing monetary policy, the market reaction is quite unambiguous. The rhetoric of the Fed head was more moderate and calm, without any hints of further tightening of monetary policy. This was enough for the euro to rise further.

Now the ball is in the European Central Bank's court, and its actions will determine the further development of events. If the ECB raises the refinancing rate by twenty-five basis points today, nothing extraordinary will happen. Of course, the single currency will grow a bit more, but no more than that. However, just last week, two key representatives of the ECB clearly hinted at the possibility of a more significant rate hike. By fifty basis points. And if everything happens as such, then, in this case, the euro will, of course, continue to grow actively.

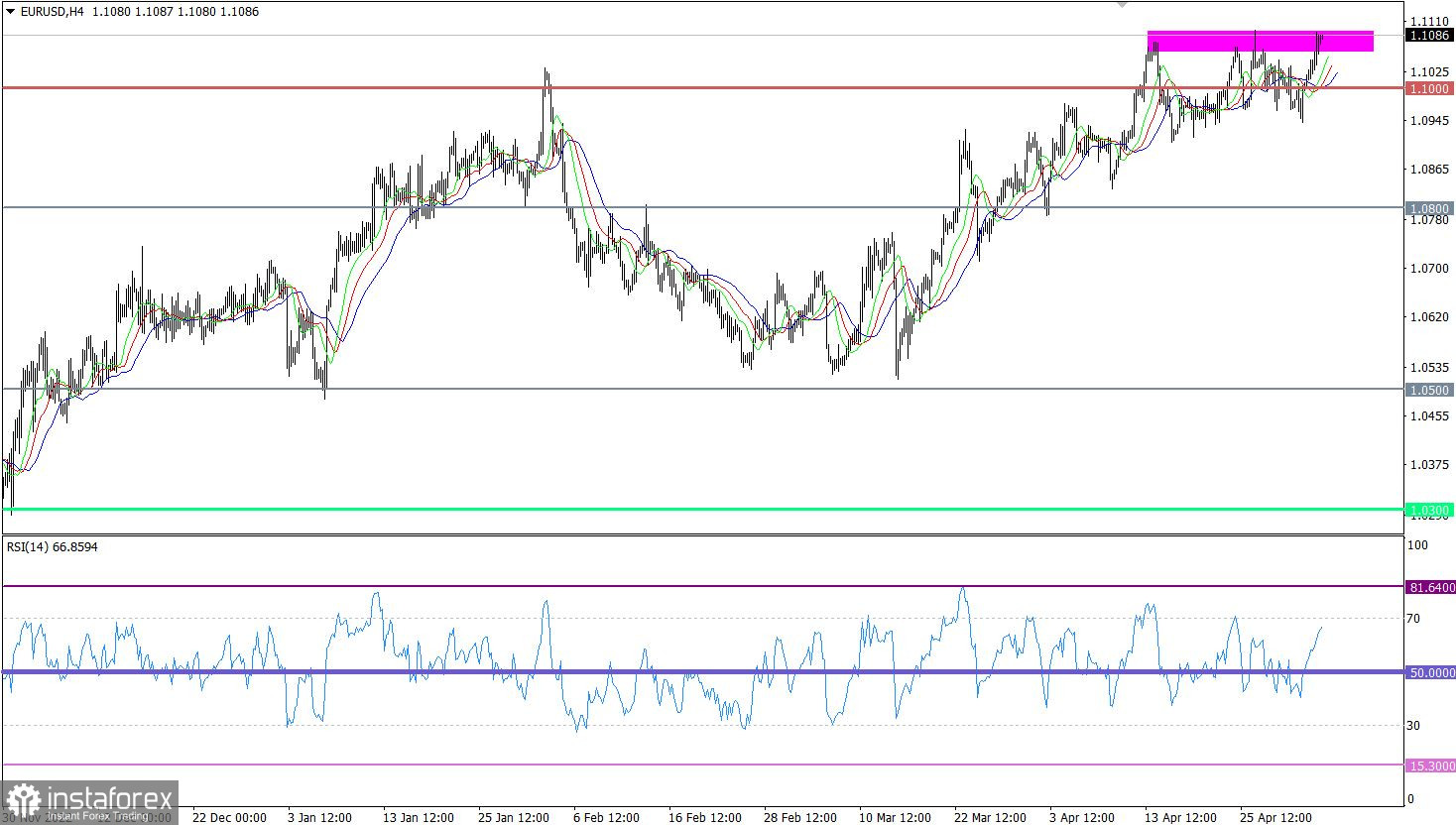

The euro has strengthened against the US dollar due to a strong flow of information and news, during which speculative activity was observed in the market. As a result, a technical signal emerged for prolonging the medium-term uptrend.

During the sharp price change, on the four-hour chart, the RSI technical indicator crossed the middle line 50 upwards. This signal indicates an increase in the volume of long positions on the euro.

On the same time frame, the Alligator's MAs have numerous intersections, which corresponds to the current stagnation.

Outlook

We can assume that keeping the price above the 1.1100 mark will indicate a subsequent increase in the volume of longs on the euro. This, in turn, may strengthen the uptrend. Failure to keep the price above the benchmark value paves the way for fluctuations, with a reversal to the level of 1.1000.

The complex indicator analysis points to an upward cycle in the short-term, medium-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română