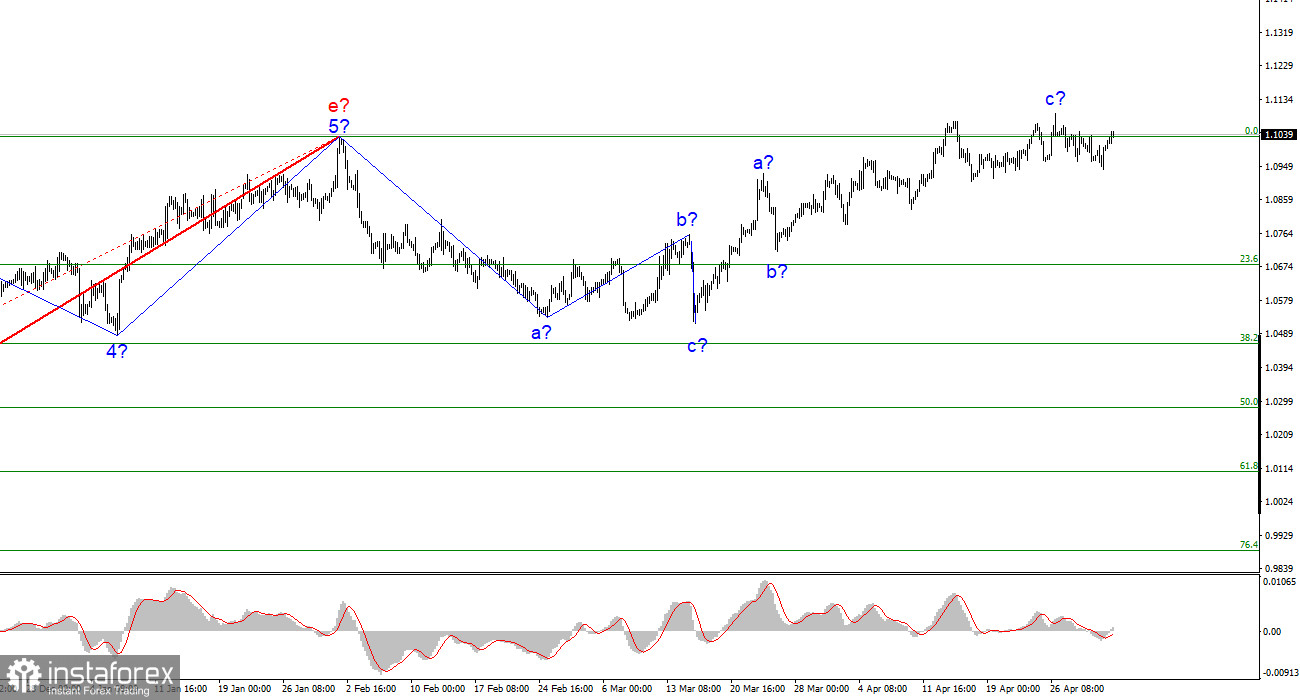

The wave markup of the 4-hour chart for the euro/dollar pair continues to get tangled due to the latest ascending waves, but it does not change in recent days and weeks. These waves could be an independent upward segment of the trend (since the last downward move can be considered a three-wave and completed), and they could also be nearing completion if it takes on a three-wave form. Thus, the wave pattern for the euro currency can be very complex, and it isn't easy to work with it now. At the current positions, the formation of an upward set of waves may end since the third wave's peak went beyond the first peak. The same thing we saw in the last downward formation (minimal update of the low and completion of the segment). At the same time, there are other options for wave markup. For example, a full-fledged five-wave (but also corrective) structure. Working off the scenario with a decrease in the pair is now advisable because the ascending three-wave looks complete and finished. Consequently, in the near future, the formation of a new downward three-wave may begin. However, a new successful attempt to break through the 1.1030 mark will indicate the market's readiness for new purchases.

The results of the Fed meeting are 90% predetermined.

The euro/dollar pair on Wednesday rose by 40 basis points. We have been observing horizontal movement for several weeks, so a price change of 40–50 points up or down does not affect the current wave markup. It simply delays the completion of wave c and the entire upward segment of the trend and postpones the formation of a new downward segment. Individual economic reports result in market reactions, but these reactions do not help the pair start the decline that the current wave markup anticipates. Thus, the wave pattern does not change, and tonight – the conclusion of the Fed meeting, which is always very interesting and important for the market, but perhaps not today.

The market is 90% sure that tonight the FOMC will announce a new increase in the interest rate by 25 basis points. This decision is already factored into current prices, and no other scenarios exist. Virtually no one expects the Fed to pause in May, and no one expects a rate hike of 50 points. Based on this, what Jerome Powell says at the press conference will be very important. Analysts are divided on this issue. Some believe Powell will retain space for one or two more increases if necessary. In contrast, others believe that Powell will openly declare a pause in tightening monetary policy. I believe that guessing what Powell will say tonight makes no sense. You must wait for his speech and act according to the news background. Undoubtedly, if Powell hints at possible additional one or two rate hikes, demand for the US currency will grow. And this would greatly help form a new downward set of waves.

General conclusions.

Based on the analysis conducted, the formation of the upward segment of the trend is nearing completion. Therefore, sales can now be recommended, and the pair has quite a large space for a decline. The targets in the 1.0500–1.0600 can be considered quite realistic. With these targets, I advise selling the pair on the reversals of the MACD indicator "down" until the pair is below the 1.1030 mark, corresponding to 0.0% Fibonacci.

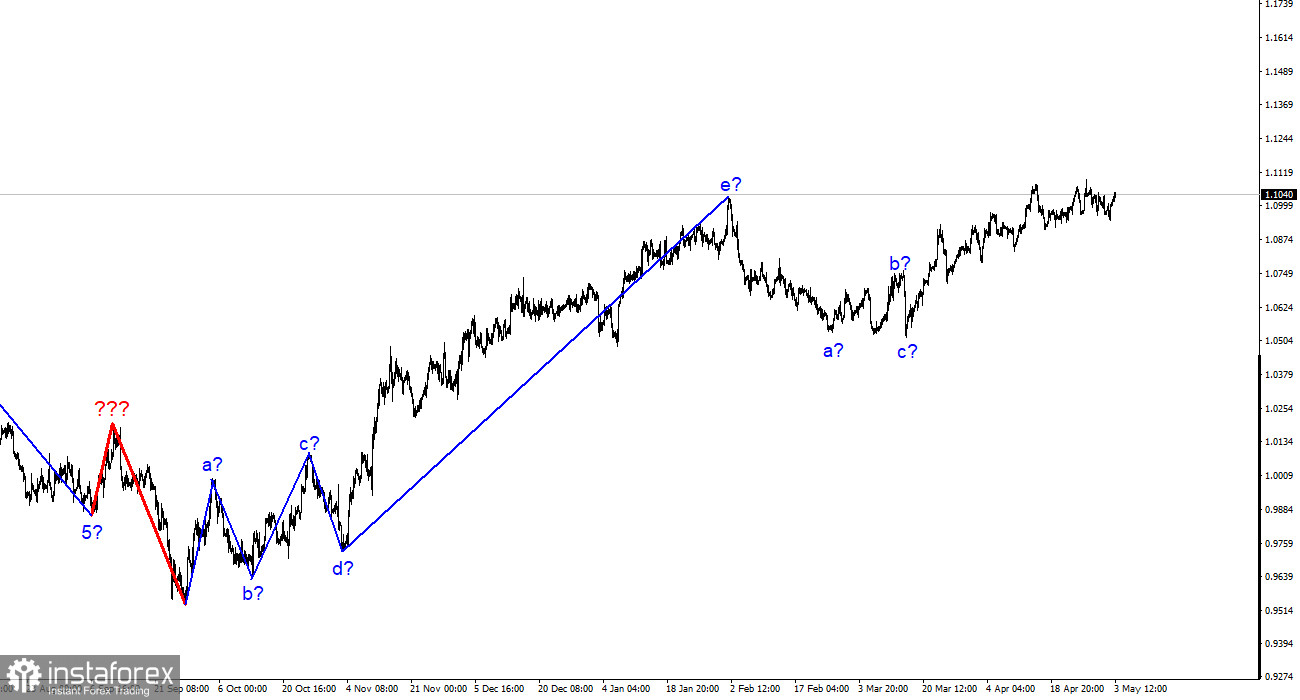

On the older wave scale, the wave markup of the ascending segment of the trend has taken on an extended form but is likely completed. We have seen five waves, which most likely form an a-b-c-d-e structure. The formation of the downward segment of the trend may still need to be completed, and it can take any form in terms of structure and length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română