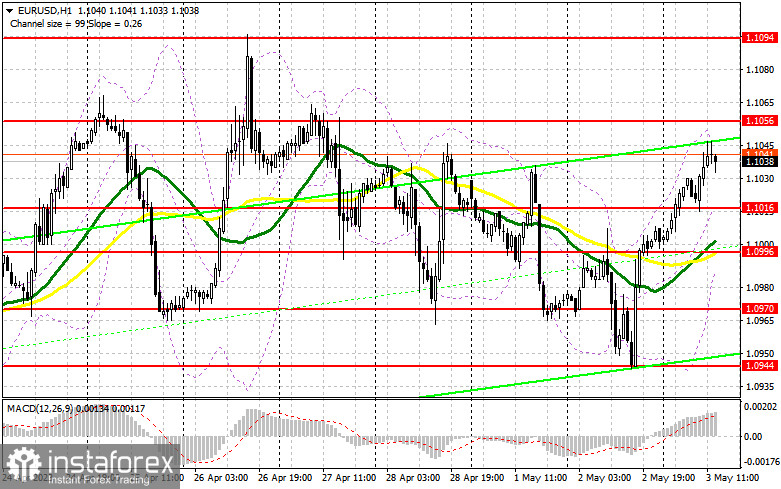

In my morning article, I turned your attention to 1.1034 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A rise and a false breakout of gave an entry point into short positions. However, a large downward movement did not take place. After some time, the bulls regained the upper hand, which led to a drop in Stop Loss orders. For the afternoon, the technical outlook has been partially revised.

When to open long positions on EUR/USD:

Many traders expect the Fed to undertake the last rate increase this year before taking a pause in the tightening cycle. If so, it will bolster the euro and may lead to a sharp upward movement of the pair after the meeting. If Jerome Powell does not hint at a policy reversal but, on the contrary, points to further rate hikes, the euro/dollar pair is sure to take a nosedive. EUR bulls may incur significant losses. Given that it is difficult to predict what to expect from the Fed, it is better not to open long positions. I would advise you to wait for a decline and a false breakout of 1.1016, the support level formed today. It will lead to a buy signal with an increase to a new resistance level of 1.1056. Apart from the Fed's rate decision, weak ADP and Services PMI Index data could trigger a surge in volatility. A breakout and a downward retest of 1.1056 will boost a bull market. It will give an additional entry point into long positions. The pair may advance to 1.1094. A more distant target will be 1.1129 where I recommend locking in profits.

If EUR/USD declines and bulls show no activity at 1.1016 in the afternoon, it will hardly affect the main trend. Yet, the pressure on the pair will increase. Only a false breakout of the support level of 1.0996 will provide a buy signal. You could buy EUR/USD at a bounce from 1.0970, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers tried to take control of the market but failed to start a significant downward movement. They could make another attempt amid strong US reports. In this case, they need to protect 1.1056. After that, there could be a false breakout of this level, which will a good entry point into short positions. The pair could drop to the support level of 1.1016. A decline below this level as well as an upward retest will cause a fall to 1.0996. A more distant target will be the 1.0970 level where I recommend locking in profits.

If EUR/USD rises during the US session and bears show no energy at 1.1056, which is also quite likely given that the Fed may actually announce the end of the tightening cycle, it is better to postpone short positions until a false breakout of 1.1094. You could sell EUR/USD at a bounce from a high of 1.1129, keeping in mind a downward intraday correction of 30-35 pips.

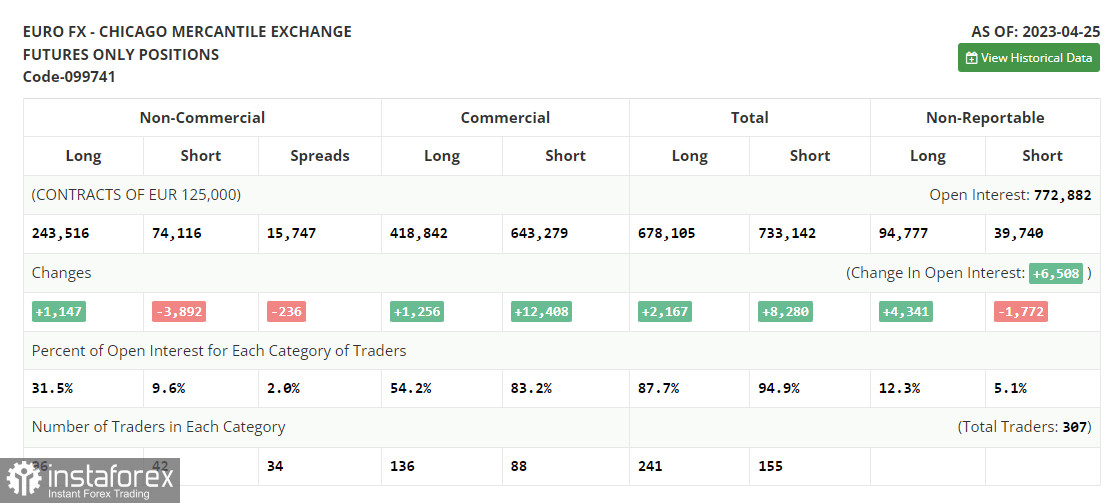

COT report

The COT report (Commitments of Traders) for April 25 logged an increase in long positions and a decrease in short positions. Despite some market moves ahead of the Federal Reserve meeting, where rates will definitely be raised by 0.25%, traders are not in a hurry to close long positions on EUR/USD as they expect more aggressive policy from the European Central Bank. The risk of a recession in the US and a rapid slowdown in the economy, along with problems in the banking sector, also allow traders to bet on growth in risky assets in the medium term, which is beneficial to EUR buyers. The COT report shows that non-commercial long positions rose by 1,147 to 243,516, while non-commercial short positions declined by 3,892 to 74,116. As a result, the total non-commercial net position went up last week to 144,892 against 139,956 a week earlier. EUR/USD closed last week lower at 1.1006 from the closing price of 1.1010 in the previous week.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.1050 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română