The Federal Reserve is expected to raise interest rates by 25 basis points today, and then signal a pause in its aggressive rate hike campaign amid ongoing turmoil in the financial market. However, it should not be a surprise if the bank announces that its fight against inflation is not over, and that markets will see at least one more rate hike of 0.25%. After all, recent economic data releases are pointing to such a development.

Quite few economists expect the Fed to carry out a final interest rate hike today, especially amid tighter credit conditions and signs of an economic slowdown. But if that happens, interest rates will peak at 5.25%, which is the highest level since 2007.

Meanwhile, some believe that the Fed will announce a pause as stocks in regional bank stocks declined, following the collapse of the First Republic Bank. This is despite the fact that the central bank has so far tried to separate interest rate policy and provide support to the banking sector in any way possible.

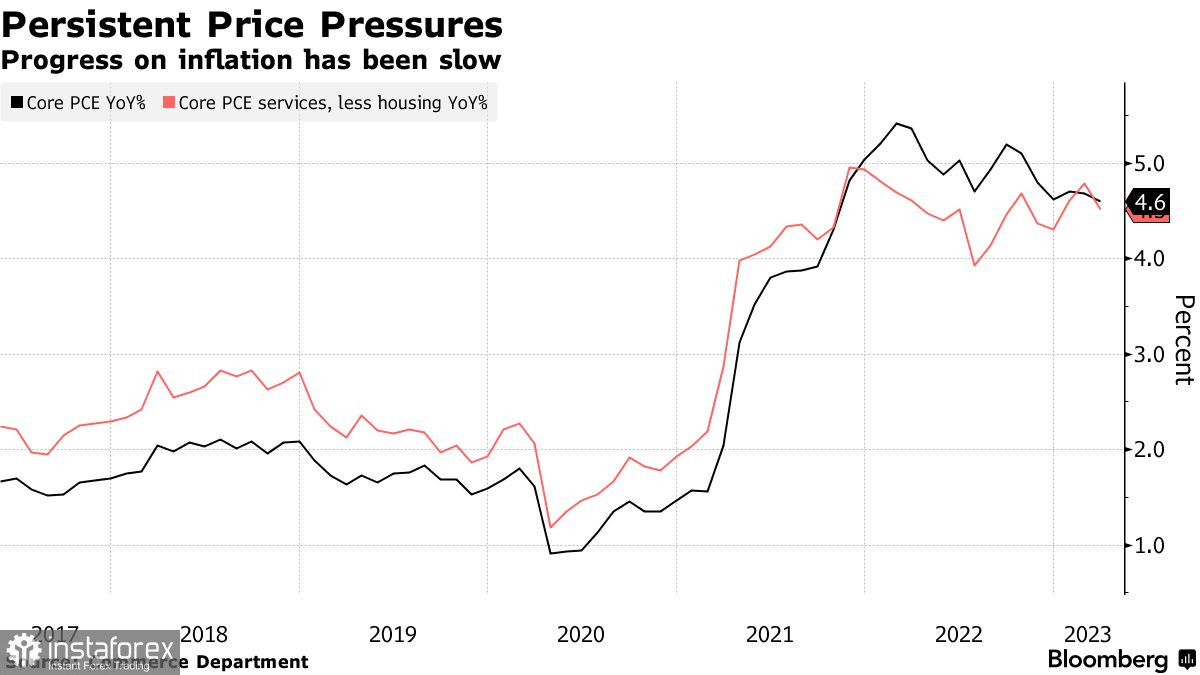

There is also some political pressure as several progressive lawmakers called on Powell to stop raising rates and warned that banking turmoil and cumulative rate hikes make the economy even more vulnerable to an excessive Fed reaction. Currently, the inflation rate remains well above the Fed's target of 2%, but progress in reducing prices is evident. Many experts expect consumer spending and service prices to continue to decline in the second half of the year, which will have a positive impact on inflation. A problematic issue remains the reduction of lending volumes, caused by the recent bankruptcy of banks.

In any case, any signal that the Fed may pause will lead to a sharp rise in risk appetite, which will have a positive impact on euro and pound in the short term.

In terms of the forex market, euro bulls have a chance to continue a rally, but in order to do so, the quote has to stay above 1.1000 and take control of 1.1030. This will allow a rise beyond 1.1060 and towards 1.1100. In case of a decline around 1.1000, the pair will fall further to 1.0960 and 1.0940.

In GBP/USD, both bulls and bears are trying to control the market. To see growth, the quote has to consolidate above 1.2500 as only that will trigger a much larger rise to 1.2540 and 1.2580. In case there is a decline, bears will attempt to take 1.2470, which could lead to a fall to 1.2430 and 1.2380.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română