Following a dynamic trading session on Wednesday, Wall Street's major indexes showed growth. The main point of attention was the publication of the minutes from the Federal Reserve's meeting. They revealed a cautious view of policymakers, influencing investor rate expectations.

Uncertainty in the economy, oil prices, and financial markets was the primary reason for such caution by the Fed. This is confirmed by the minutes of the meeting held on September 19-20.

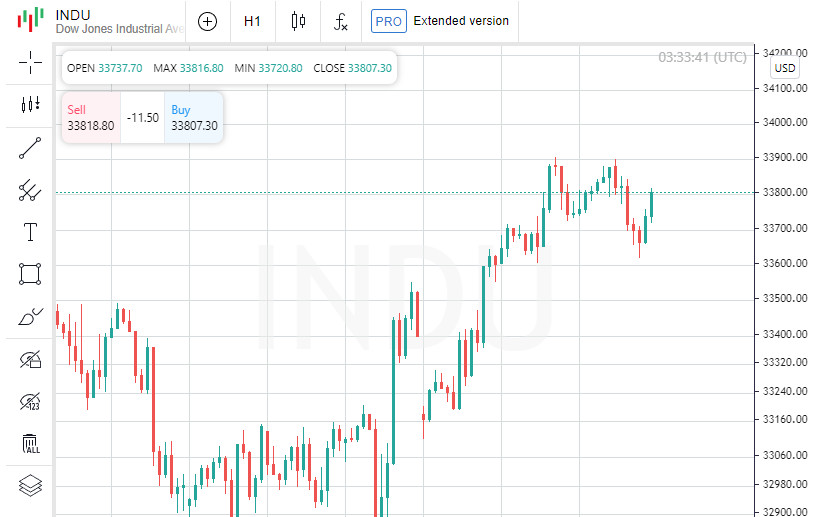

The trading session was quite volatile: indices started with growth, then dipped slightly, but by the end of the session, they regained and even added to their numbers.

Angelo Curkafas, Senior Investment Strategist at Edward Jones, emphasized the importance of the minutes for investors. He noted that the primary focus now is on a possible interest rate hike. However, he also mentioned the significance of upcoming consumer price index (CPI) data expected on Thursday.

Additionally, it was noted that producer prices in the US rose in September due to energy carrier prices, although the main inflationary pressure began to decrease.

By the end of the day: Dow Jones strengthened to 33,804.87 (+0.19%), S&P 500 reached 4,376.95 (+0.43%), and Nasdaq Composite closed at 13,659.68 (+0.71%).

The energy index experienced a 1.4% decline, becoming the most vulnerable among the 11 key industrial sectors of the S&P. This was influenced by a 3.6% drop in Exxon Mobil shares after announcing the acquisition of Pioneer Natural Resources for $59.5 billion. Meanwhile, Pioneer shares grew by 1.4%.

Sectors most responsive to interest rate changes showed the most growth: real estate strengthened by 2%, and utilities by 1.6%, thanks to a drop in treasury bond yields.

The yield on the 10-year US Treasury bonds reached a two-week low. Such dynamics are due to the increased interest in safe assets because of the ongoing conflict in the Middle East.

The public offering of Birkenstock Holding did not yield the expected results, with the company's shares dropping 12.6% to $40.20, not reaching the initial price of $46.

On the other hand, shares of Eli Lilly rose by 4.5% after positive research results from competitor Novo Nordisk on kidney deficiency treatment were revealed. However, shares of DaVita and Baxter International fell by 16.7% and 12.3% respectively.

On the New York Stock Exchange, rising stocks prevailed, while a downward trend was observed on Nasdaq.

The S&P 500 index recorded 12 new highs and 10 new lows. On Nasdaq, there were 44 new highs and 206 new lows.

The total trading volume on US exchanges amounted to 10 billion shares, approaching the average trading volume of 10.7 billion over the last 20 days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română