EUR/USD

On Tuesday, the euro rose by 28 points, as the volume of industrial orders in the US increased by 0.9% in March, against an expected 1.1%, and the labor market's assessment of open vacancies for March shrank to 9.59 million from the previous 9.97 million. In my opinion, investors did not take one thing into consideration - yesterday, the Reserve Bank of Australia raised the rate from 3.60% to 3.85% amid overall market confidence in maintaining the rate at the previous level. Such a decision indirectly indicates a likely tough stance in today's Fed meeting. That is, when raising the rate by the expected 0.25%, the Committee may not announce the anticipated pause in the rate hike cycle. Investors also hardly reacted yesterday to the decline in core inflation (CPI) in the euro area itself from 5.7% YoY to 5.6% YoY, which may soften the European Central Bank's stance.

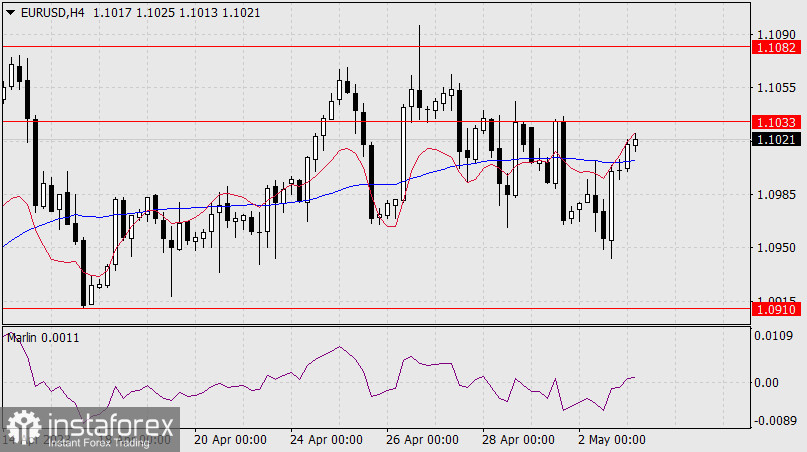

For now, the euro is approaching the target level of 1.1033. Crossing the resistance level may extend growth to the upper limit of the price channel at 1.1082. Breaking through the channel will open the target at 1.1185.

According to the main scenario, I expect the price to fall to the MACD line on the daily chart at 1.0910 (April 17th low), and then to the support level at 1.0804 (February 14th high).

On the four-hour chart, the price managed to rise above the MACD indicator line, and the Marlin oscillator moved into the growth zone. The local growth may turn out to be false, as well as the decline preceding it. We are waiting for the Fed's decision on monetary policy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română