Analysis of macro data:

There will be quite a lot of macro data again on Wednesday. We can't actually say that the previous day's data (which was also quite abundant) provoked strong movements for both pairs, but the market still processed it, and even quite logically at that, for the second straight day. Therefore, there are hopes that the market will trade more reasonably than in the last 2 months.

So, the first report on Wednesday is the eurozone's unemployment data. It is a relatively secondary report, the value of which is unlikely to change as a result of March. All other reports relate to the US and will be released in the second half of the day. First, we have the ADP report on the change in the number of employees in the private sector, which is an analogue of the NonFarm Payrolls report, but much less important. A little later, we have the ISM Business Activity Index in the services sector, which we consider the most important report of the day, but its actual value needs to significantly differ from the estimate, otherwise, we cannot count on a market reaction. In the evening, we have the results of the Federal Reserve meeting, but it is considered a fundamental event and will be discussed below. In general, we should expect strong movements in the second half of the day, and weak ones in the first.

Fundamental events:

There will be only one fundamental event on Wednesday, but what an event! First, the Fed will announce the results of its meeting, at which the key rate will most likely increase by another 0.25% and most likely a pause will be taken after that. Then a press conference with Fed Chairman Jerome Powell. He might speak on the US central bank's further actions but then again, it is impossible to predict what Powell will say, but surely a sharp surge of emotions awaits us in the evening, and both pairs may "fly off" alternately in both directions.

General conclusions:

On Wednesday, there will be enough macro data and a fundamental event as well. We are in for a rather exciting day, but, of course, stronger movements should be expected closer to the evening than in the first half of the day. Beginners should leave the market before the announcement of the results of the Fed meeting. Staying in it will only be possible with a Stop Loss set for open trades, preferably at breakeven, as movements can be very strong and unexpected. As for the first half of the day, we might witness a firm flat.

Basic rules of the trading system:

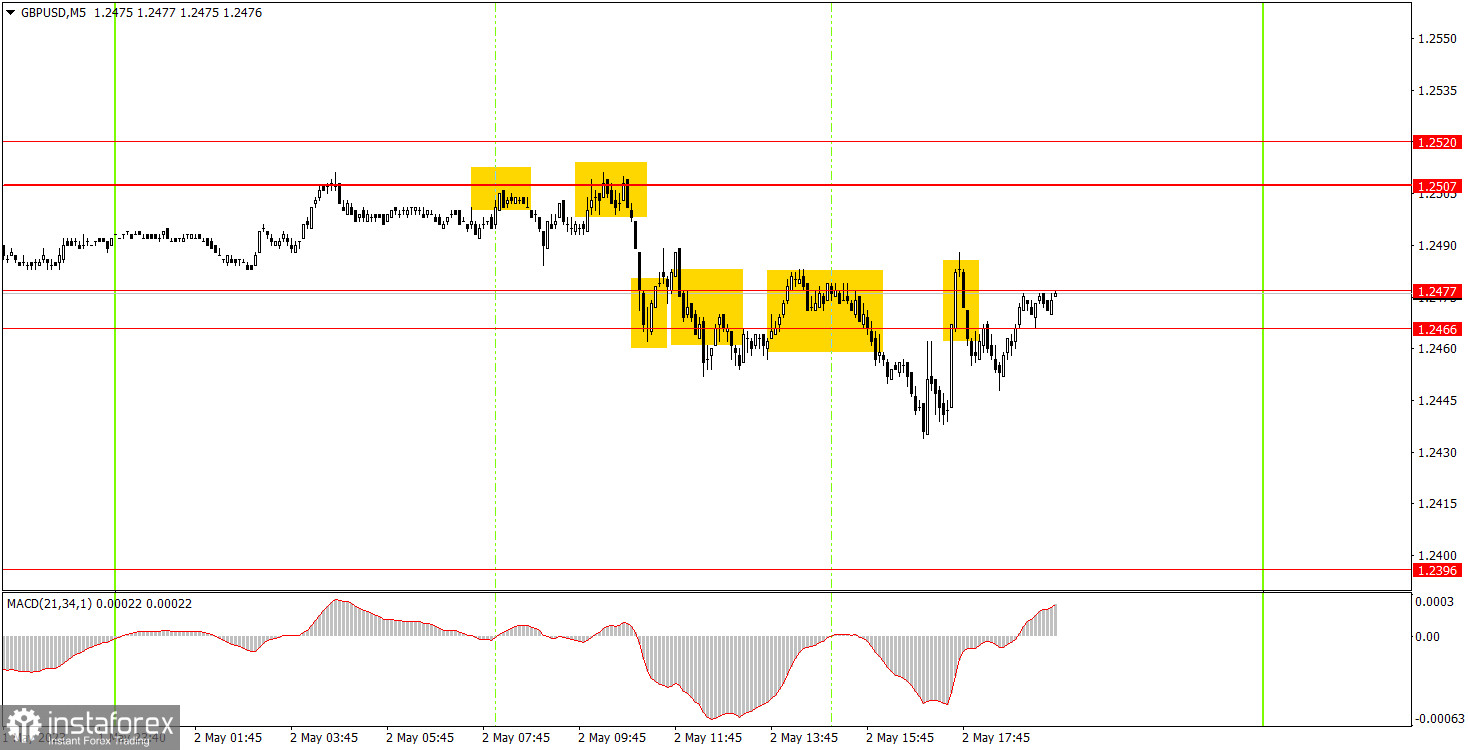

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

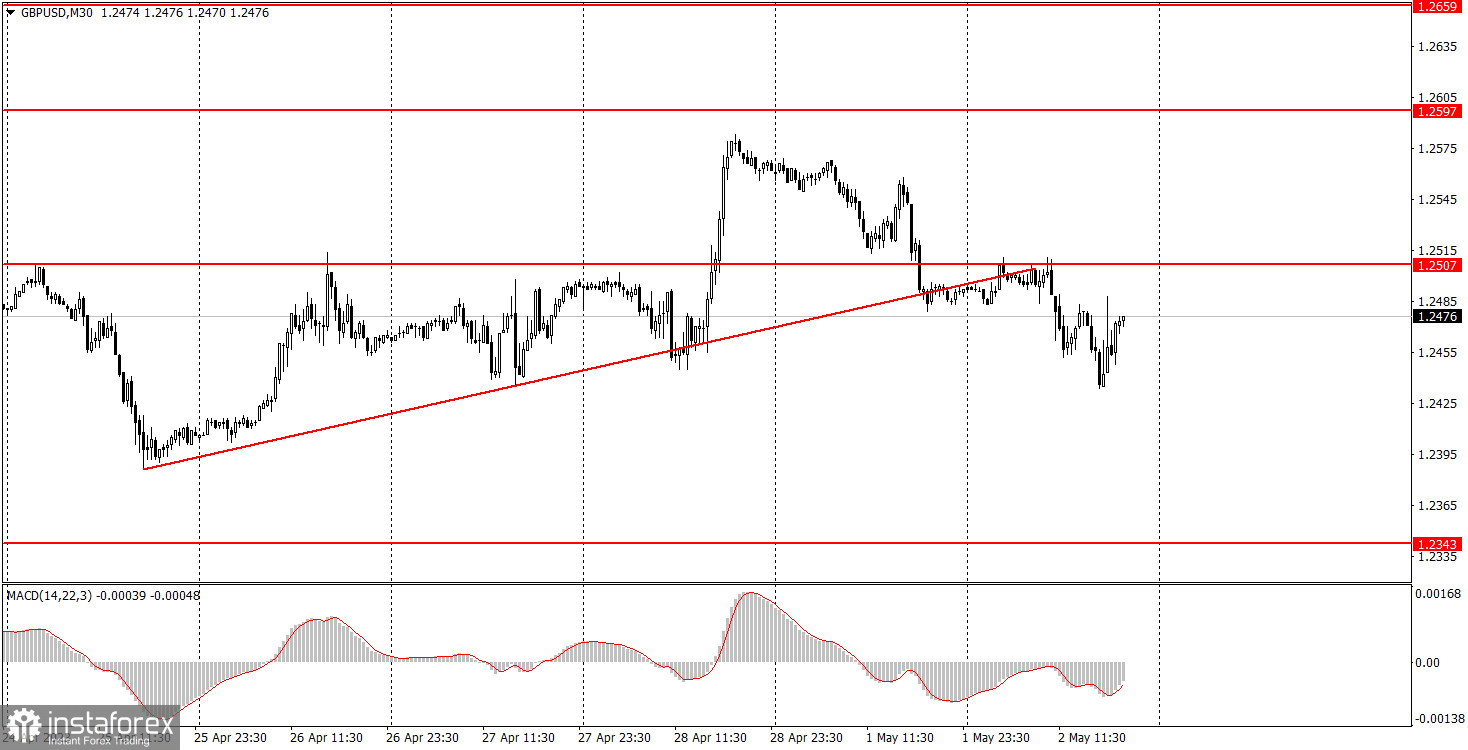

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart:

Support and Resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română