European inflation for April jumped to 7% year-on-year. The acceleration of the consumer price index turned out to be minimal, at only 0.1%. A month earlier, inflation lost 1.6% at once. Thus, overall, inflation continues to decline, which cannot but please the ECB. If we consider the general dynamics of the indicator, there is no reason to panic about the rise in inflation in April. Commerzbank analysts believe that inflation will continue to decline in the coming months. ECB and Fed representatives have repeatedly stated that raising interest rates can affect the economy (and inflation) for up to 18 months. After the ECB stops raising rates, inflation may decline for up to 18 months. Of course, it will do so slowly, but all other things being equal, there should be no new acceleration.

Commerzbank analysts also noted that the inflationary impulse on food products is weakening, and core inflation did not grow in April. They point out that pressure on the ECB to tighten monetary policy remains high but did not share their forecast for this Thursday. The consensus forecast assumes a rate increase of another 25 basis points, which I agree with. The ECB does not have the capabilities of the Fed, so the rate is more likely to grow weaker in total than in the United States. Analysts believe the rate will rise thrice by 25 basis points and reach 4.25%. Everything will depend on inflation dynamics, which external factors, such as rising energy prices, can influence. If inflation starts to accelerate again, the regulator may decide to raise the rate one or two more times by the end of the year, but this Thursday, it will raise it by 25 basis points. The market will perceive any other ECB decision as a "surprise."

Based on the above, a further decline in the euro and pound demand will be justified. The Bank of England will also raise the rate by a maximum of 25 basis points next week, which the market could have already considered. And it could have been taken into account because the central banks' decisions have been known for several weeks. These rate hikes are not already considered; therefore, both pairs can start building downward waves, which the current wave analysis assumes. Weak reporting from the United States on Friday could spoil the whole picture. The decline in the labor market will not strongly impact the Fed rate, as it may peak on Wednesday. However, demand for the US currency may decrease at the end of the week.

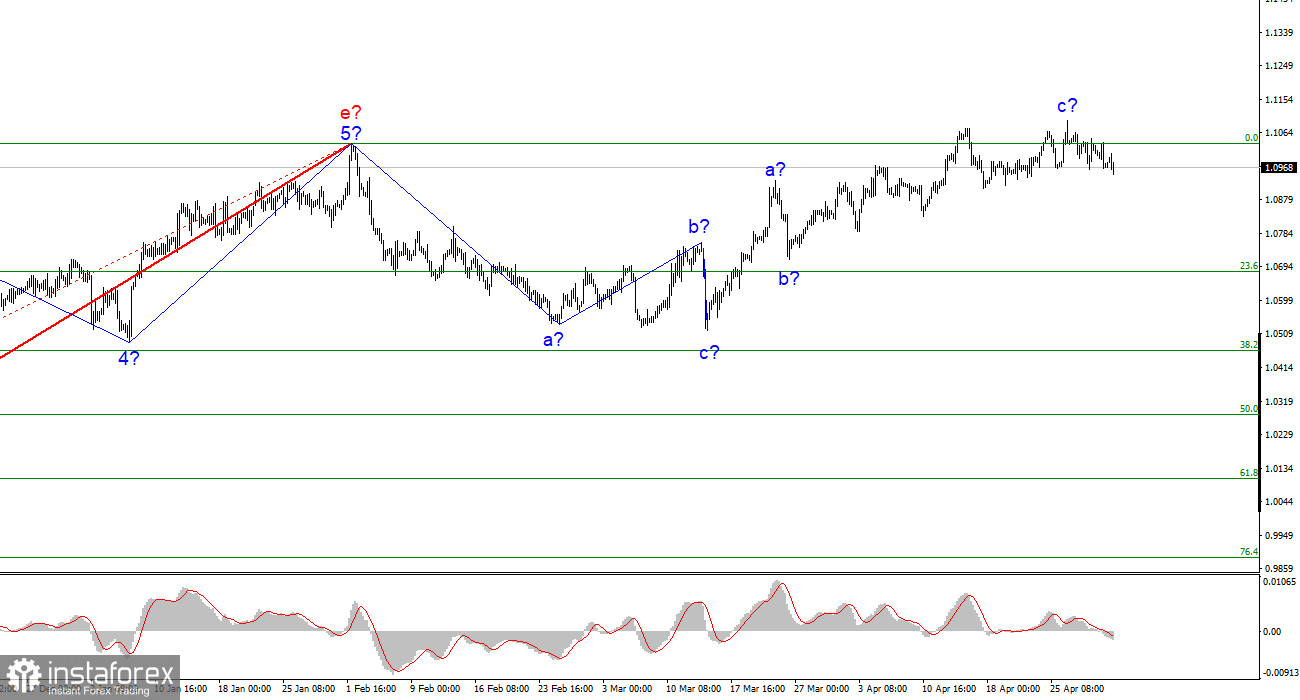

Based on the analysis, the formation of the upward trend section is nearing completion. Therefore, selling is advisable, as the pair has much room for decline. The targets in the 1.0500–1.0600 can be considered quite realistic. With these targets, I recommend selling the pair on the MACD indicator's reversal "down" as long as the pair is below the 1.1030 mark, corresponding to 0.0% on the Fibonacci scale.

The wave pattern of the pound/dollar pair has long suggested the formation of a new downward wave. The wave markup, as is the news background, is somewhat unambiguous. I do not see factors that support the pound in the long term, and wave b can turn out to be very deep, but it has not even started yet. A decline in the pair is more likely now, but the first wave of the ascending section continues to become more complicated, and the quotes have moved away from the 0.0% Fibonacci mark. Now, determining the beginning of the formation of wave b will be more difficult.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română