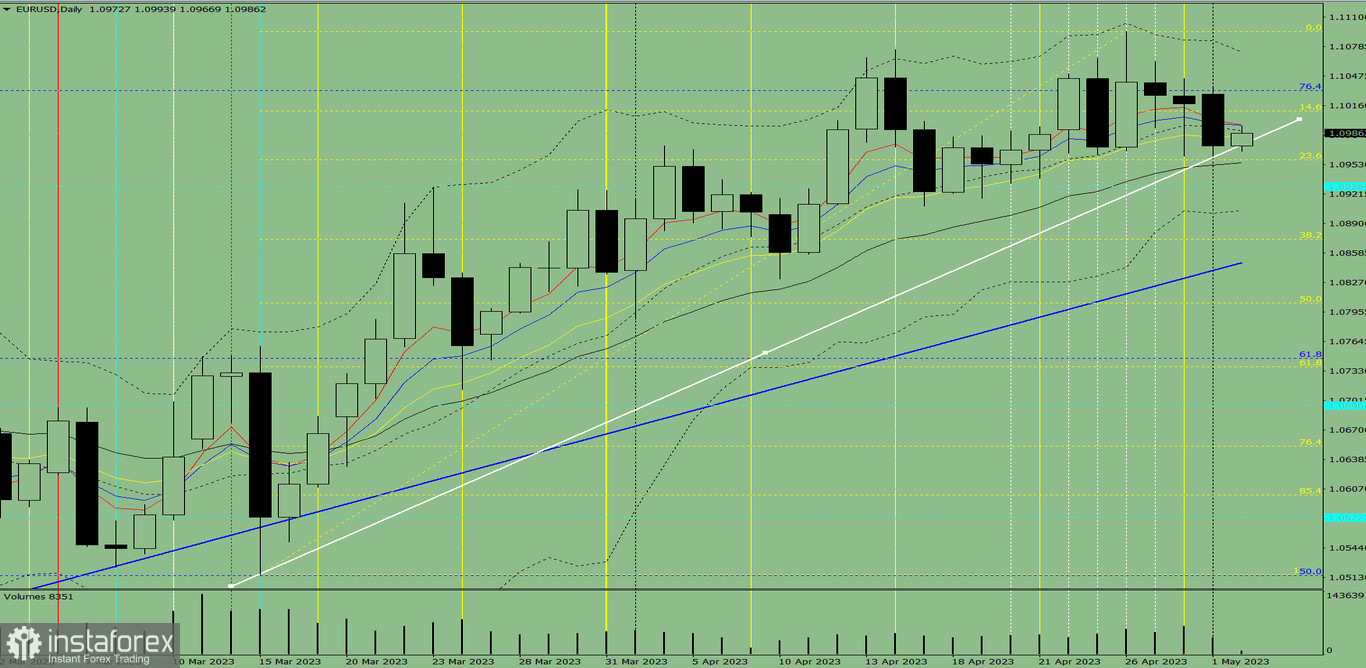

Trend analysis (Fig. 1).

The market may move upward from the level of 1.0971 (closing of yesterday's daily candle) to test 1.0995, the 8-period EMA (thin blue line), and then move downward with the target of 1.0930, the historical support level (blue dotted line). Upon testing this level, an upward movement is possible with the target of 1.0958, the 23.6% pullback level (yellow dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis - down;

- Volumes - down;

- Candlestick analysis - down;

- Trend analysis - down;

- Bollinger bands - up;

- Weekly chart - down.

General conclusion:

Today, the price may move upward from the level of 1.0971 (closing of yesterday's daily candle) to test 1.0995, the 8-period EMA (thin blue line), and then move downward with the target of 1.0930, the historical support level (blue dotted line). Upon testing this level, an upward movement is possible with the target of 1.0958, the 23.6% pullback level (yellow dotted line).

Alternatively, the price may move downward from the level of 1.0971 (closing of yesterday's daily candle) with the target of 1.0904, the lower limit of the Bollinger band indicator (black dotted line). When testing this level, an upward movement is possible with the target of 1.0958, the 23.6% pullback level (yellow dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română