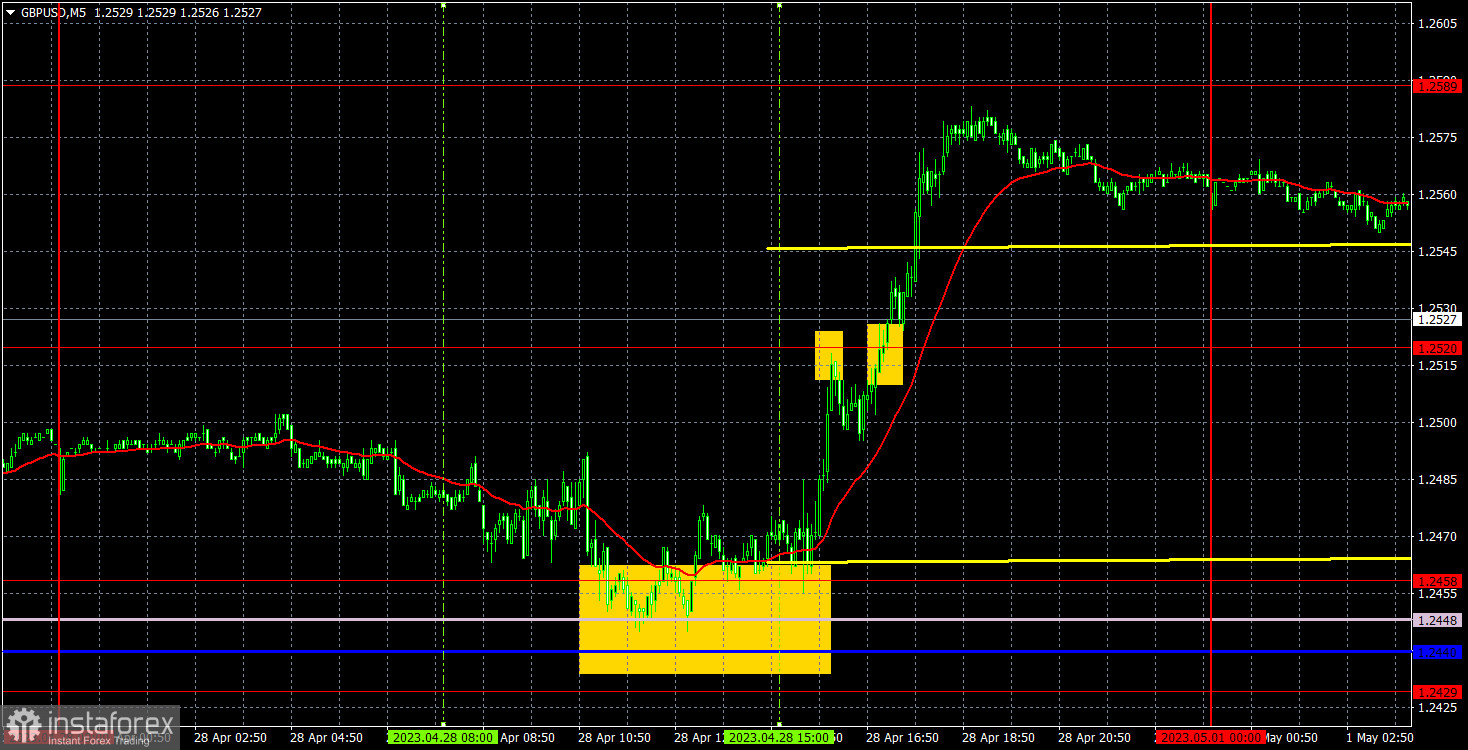

GBP/USD on M5

On Friday, GBP/USD showed a completely different movement during the day compared to the EUR/USD pair. While both pairs were steadily declining during the European trading session, in the second half of the day, the British pound suddenly surged and managed to appreciate by more than 100 pips. It is hard to name the reasons behind such strong growth of the pair, which is already trading at its peak levels. There were no reports in the UK on Friday, and all reports in the US were of minor importance. If traders had any essential information, the EUR/USD should have shown the same dynamics. In any case, there were no reasons for the British pound to show such a strong movement. However, the market has long been accustomed to such behavior of the pair. The British pound has been growing against all odds and common sense for a long time.

Thanks to the good trend movement during the day, good trading signals were formed. However, the first one appeared only at the beginning of the North American session. The pair rebounded from the area of 1.2440-1.2458, so it was necessary to open long positions. Unfortunately, around the level of 1.2520, there was a small pause and a sell signal was formed, which spoiled the whole picture. Long positions brought us a profit of about 30 pips, while short positions were closed with a loss of 30 pips. Nevertheless, traders did not leave the market without profit because another buy signal was formed around the level of 1.2520, which generated about 30-40 pips in profit. This deal should have been closed manually closer to the end of the day since the target level was not reached.

COT report

According to the latest COT report on the British pound, the non-commercial group of traders opened 5,600 BUY contracts and 1,000 SELL contracts. As a result, the net position of the non-commercial group traders has increased by 4,600 and continues to grow. The net position has been steadily rising for the past 8-9 months, but the sentiment of major market players remained bearish during this time. Now it can be called bullish to some extent. Although the British pound is strengthening against the US dollar in the medium term, it is hard to explain this behavior from the fundamental point of view. There is still the possibility of a sharp decline in the pound. Both major pairs are moving in a similar way now, but the net position of the euro is positive and even implies the imminent completion of the upward momentum, while for the pound, it still suggests further growth. The British currency has already risen by more than 2,100 points, which is a lot, and without a strong downward correction, the continuation of growth would be absolutely illogical. The non-commercial group of traders currently has a total of 53,500 sell contracts and 59,500 buy contracts. I remain skeptical about the long-term growth of the British currency and expect it to decline.

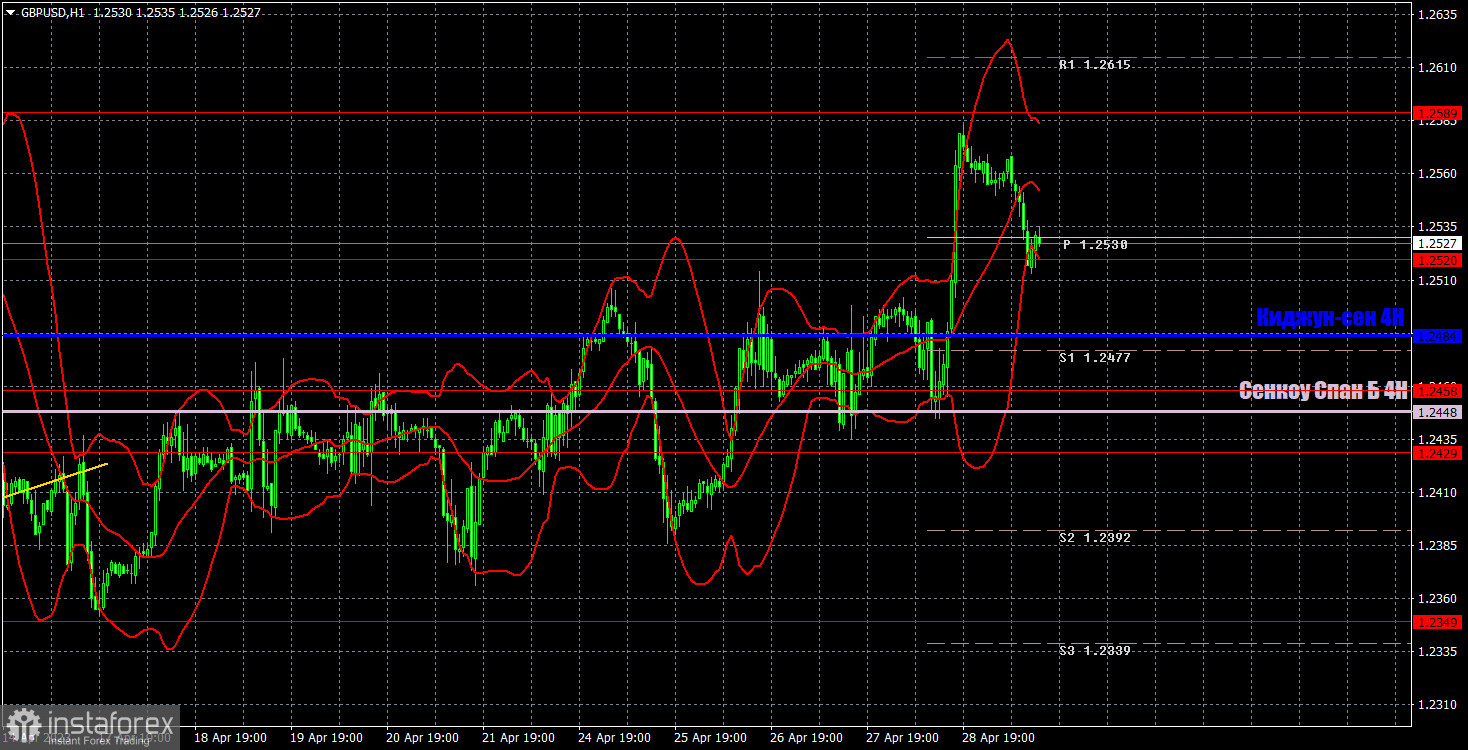

GBP/USD on H1

On the 1-hour time frame, the GBP/USD pair resumed its groundless upward movement but still continued to swing back and forth. The pound has not managed to show a significant decline after overcoming another ascending trendline. Currently, a fourth ascending trendline can be formed but its breakout will not lead to a decline. In the short term, the pair is likely to go up and down, ignoring all incoming data. For May 1, I would like to highlight the following important levels: 1.2185, 1.2269, 1.2349, 1.2429-1.2458, 1.2520, 1.2589, 1.2659, and 1.2762. The Senkou Span B (1.2448) and Kijun-sen (1.2484) lines may also generate signals. Bounces and breakouts of these levels and lines will also serve as signals. The Stop Loss level should be set at breakeven when the price moves in the right direction by 20 pips. The Ichimoku indicator lines may move during the day, which should be taken into account when determining trading signals. The illustration also shows support and resistance levels that can be used to take profit. On Monday, no important events are scheduled in the UK. In the US, the ISM Manufacturing PMI will be published. It can provoke a market reaction, but the overall unfavorable nature of the movement is likely to persist.

On the chart:

Support and resistance levels are bold red lines at which the price movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the Ichimoku indicator lines plotted on the 1-hour time frame from the 4-hour chart. They are considered strong levels.

Extremum levels are thin red lines from which the price has previously rebounded. They provide trading signals.

Yellow lines are trendlines, trend channels, or other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each category of traders.

Indicator 2 on the COT chart is the size of the net position for the non-commercial group of traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română