The euro and the pound fell after hearing the news that two key inflation indicators pointed to sustained pressure in the US in recent months, supporting the case for a new interest rate hike by the Federal Reserve.

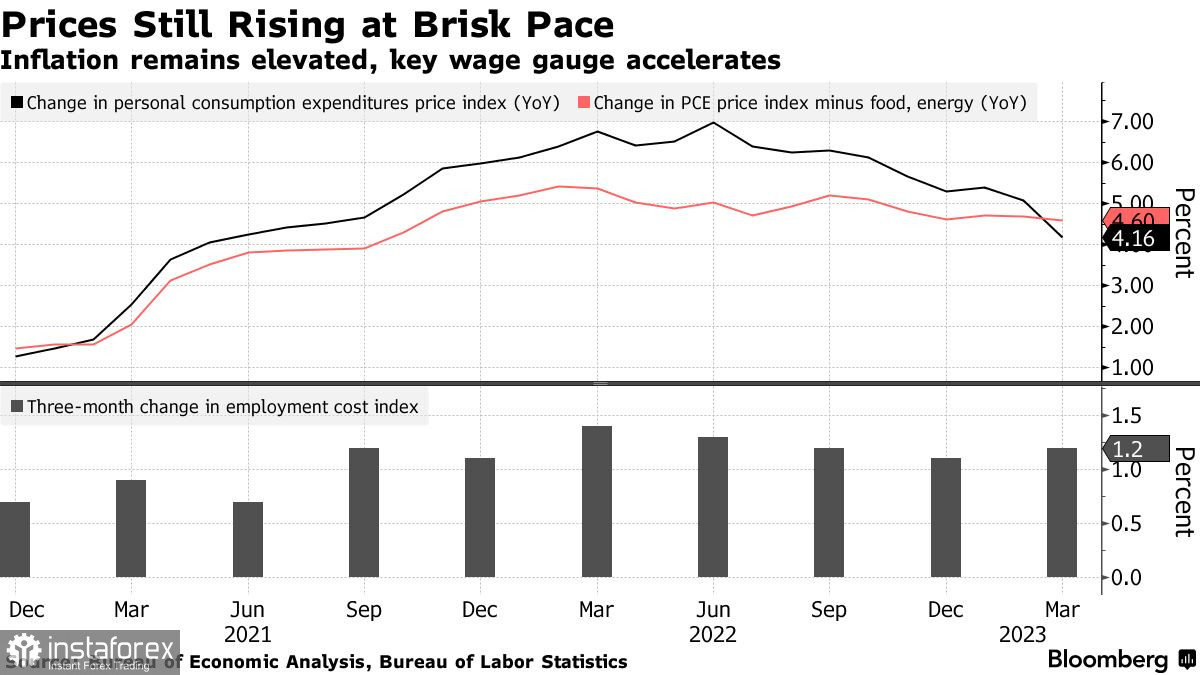

The Personal Consumption Expenditures (PCE) price index, excluding food and energy, the Fed's preferred core inflation measure, rose 0.3% in March compared to the previous month and 4.6% compared to a year earlier. The Commerce Department report also said that the employment cost index, which the Fed also closely monitors, rose 1.2% in the first quarter compared to the previous period, exceeding economists' forecasts.

I would like to remind you that the main goal of the Fed is a 2% level, which is measured by a broader indicator, but the central bank considers the core indicator as a better indicator of the trend.

Price data, especially in combination with rising labor costs, confirm expectations that Fed policymakers will continue to raise interest rates, raising them by another quarter of a percentage point at this week's meeting.

A positive aspect in the PCE report was the slowdown in the growth of service costs. Thus, service prices, excluding housing, rose only 0.2% in March. However, in annual terms, the indicator remains elevated at 4.5%.

Despite this, there are concerns that persistent inflation in the service sector, partly driven by strong wage growth in these industries, risks keeping price growth above the Fed's target indicator in the foreseeable future.

As for further benchmarks, since it is obvious that the Fed will raise rates at the May 2-3 meeting, many expect the central bank to then take a long pause, but the latest data allow for a more aggressive approach that the committee could use as early as next week.

Personal consumption expenditures, adjusted for prices, remained unchanged last month, reflecting reduced spending on goods and moderate spending on services after a revised 0.2% decrease in February. The decline in consumer spending indicates that households are becoming more cautious and cutting purchases.

As for income, it grew by 0.3%. Real wages also grew by 0.3% for the month. The saving rate jumped to 5.1% - the highest level since the end of 2021.

Regarding the technical picture of EURUSD, the bulls still have a chance to continue the growth. To do this, they need to stay above 1.1000 and take control of 1.1030. This will allow them to move beyond 1.1060. From this level, it is possible to climb to 1.1100. In case the trading instrument falls, I expect major buyers to only take action around 1.1000. If there is no one there, it would be good to wait for the 1.0960 low to be updated, or to open long positions from 1.0940.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română