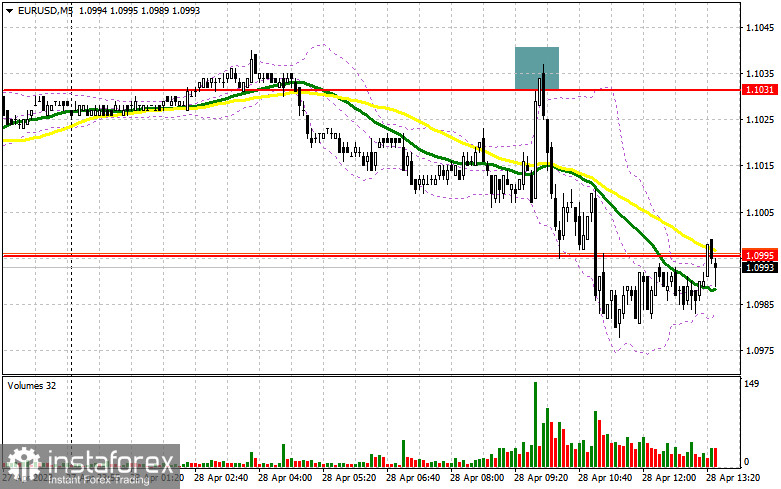

In my morning article, I turned your attention to 1.1031 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A rise and a false breakout created an excellent entry point into short positions. The pair dropped by more than 30 pips. For the afternoon, the technical outlook has changed slightly.

When to open long positions on EUR/USD:

This morning, I said that I no longer believe in a further upward movement of the euro. I thought that its trajectory would hardly change no matter whether GDP figures for the eurozone were upbeat or not. Given that the data disappointed traders, missing the forecasts, the pressure on the pair returned very quickly. In the afternoon, the US will unveil the PCE price index. If the indicator remains at a high level, the euro could fall to weekly lows. If the index declines markedly, the bulls will have a chance to defend the support level of 1.0979.

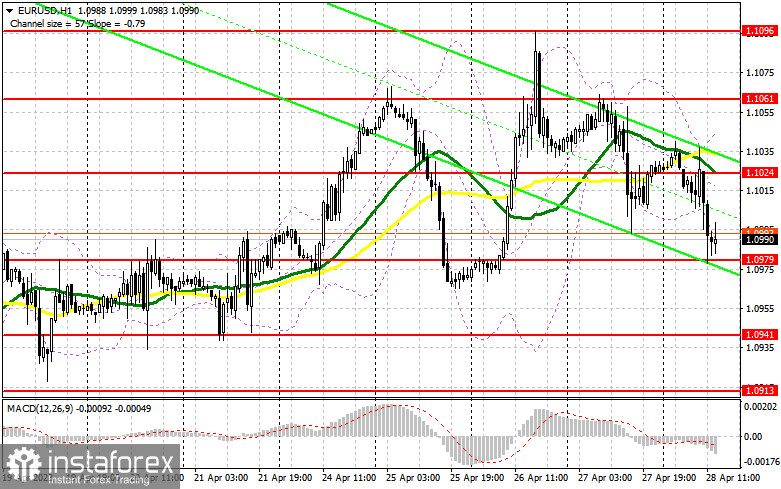

It would be extremely profitable to buy the euro on a decline from 1.0979. A false breakout of this level could give a buy signal. The pair may climb to the resistance level of 1.1024, where the moving averages are benefiting the bears. A breakout and a downward retest of this level will boost bullish bias, providing an additional entry point into long positions. It may help the pair hit a high of 1.1061. A more distant target will be the 1.1096 level where I recommend locking in profits.

If EUR/USD declines and bulls show no activity at 1.0979 in the afternoon, the pressure on the pair will only increase at the end of the week and month. Only a false breakout of the support level of 1.0941 will give a buy signal. You could buy EUR/USD at a bounce from the low of 1.0913, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers bolstered the downward correction. They need to protect the resistance level of 1.1024, formed in the morning. Market reaction to US data as well as a false breakout of this level will generate a sell signal. The pair may decrease to 1.0979. A drop below this level and an upward retest could trigger a downward movement to 1.0941. A more distant target will be the 1.0913 level, which is the last week's low. At this level, I recommend locking in profits.

If EUR/USD rises during the US session and bears show no energy at 1.1024, which is also likely, as inflation in the US remains high, I would advise you to postpone short positions until a false breakout of 1.1061. You could sell EUR/USD at a bounce from 1.096, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

The COT report (Commitment of Traders) for April 11 logged a rise in long positions and a drop in short ones. The latest US economic reports signaled a gradual overheating of the labor market as well as a decline in retail sales. It is likely to ease inflationary pressure in the United States, allowing the Fed to end the tightening cycle. However, according to the meeting minutes for March, Fed policymakers are not planning to abandon aggressive tightening. At the May meeting, the regulator could raise the key rate by 0.25%. It will help the US dollar maintain its lead against the euro, trading below 1.1000. This week, there will be no crucial economic reports, excluding PMI data. So, the bears could facilitate the downward correction. The COT report showed that long non-commercial positions increased by 18,764 to 244,180, while short non-commercial positions declined by 1,181 to 80,842. At the end of the week, the total non-commercial net position amounted to 162,496 against 143,393. The weekly closing price fell to 1.0950 against 1.1.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates bears' attempts to dominate the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.1045 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română