EUR/USD

Larger timeframe

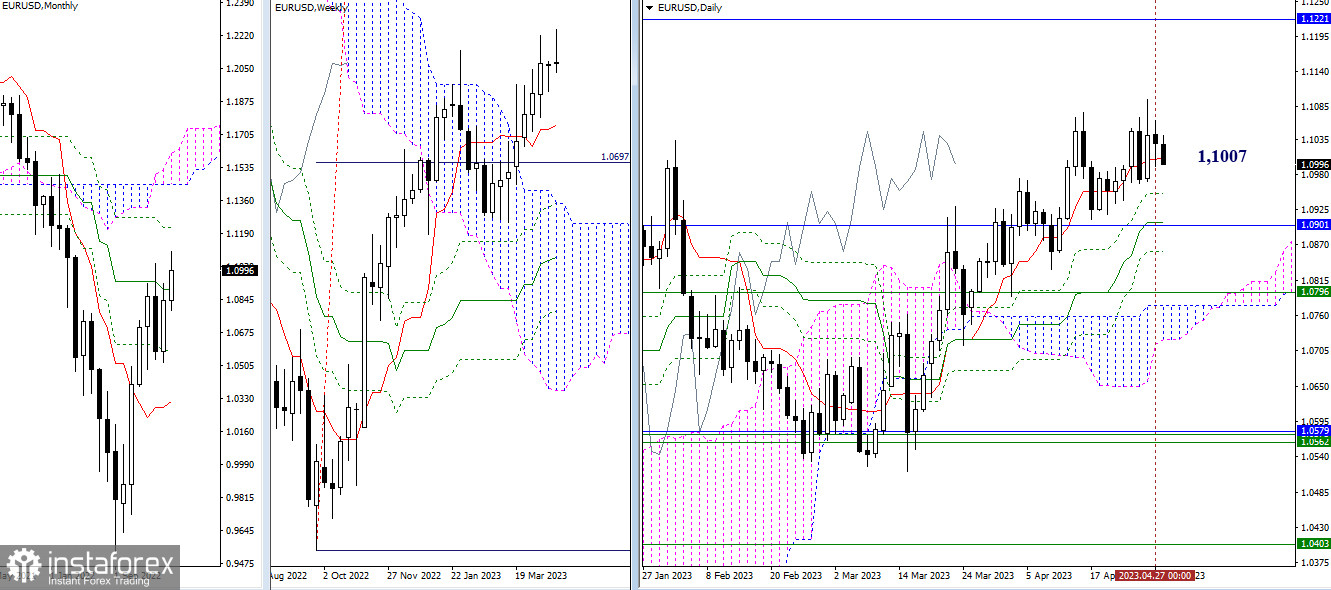

Despite the fact that EUR/USD has printed a higher high, the bulls did not gain a confident dominance. Once again, uncertainty is still ruling the market. Besides, traders display a sharp shift in market sentiment. The center of gravity and support under such conditions remains the intraday short-term trend at 1.1007. The next upward target is still seen at 1.1221 (monthly Fib Kijun). The inability of the bulls to ensure a steady upward movement may benefit their opponents. At the same time, the most significant bearish support level at this stage can now be spotted at the intersection of the daily (1.0905) and monthly (1.0901) mid-term trends.

H4 – H1

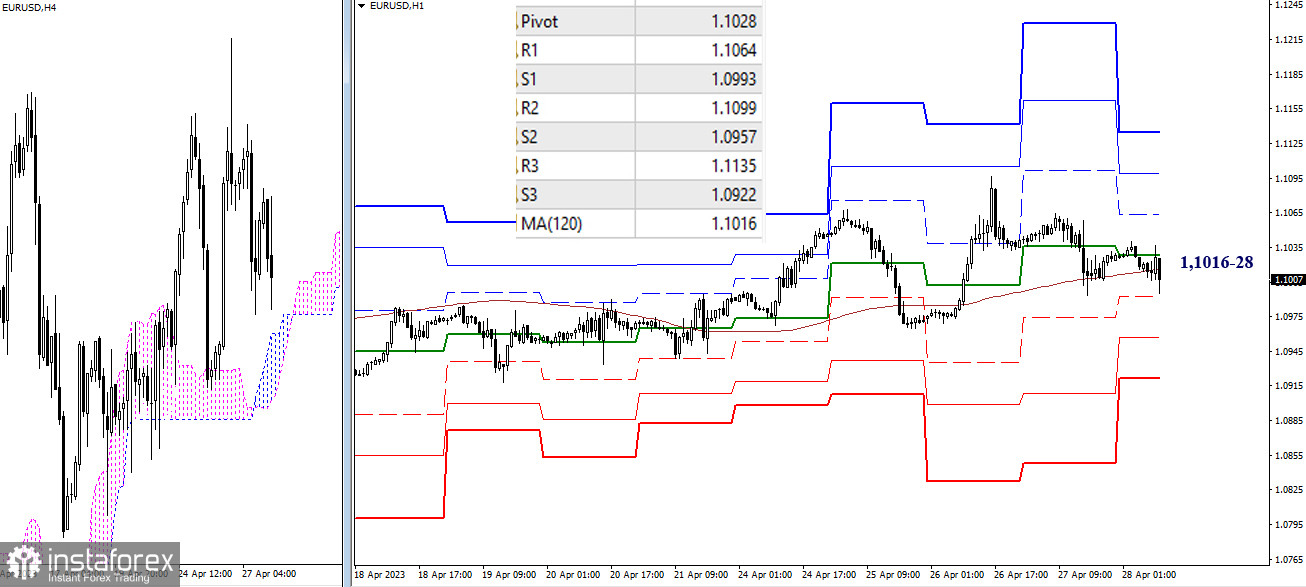

On smaller timeframes, there is a struggle for key levels. Today trading interests are clustered in the range of 1.1016-28 (central pivot level + weekly long-term trend). In case the bears manage to develop a descending intraday movement, they will need to overcome classic pivot levels (1.0993-1.0957-1.0922). On the other hand, the bulls will pursue the task of pushing the price up through the resistances of classic pivot levels (1.1064-1.1099-1.1135).

***

GBP/USD

Larger timeframe

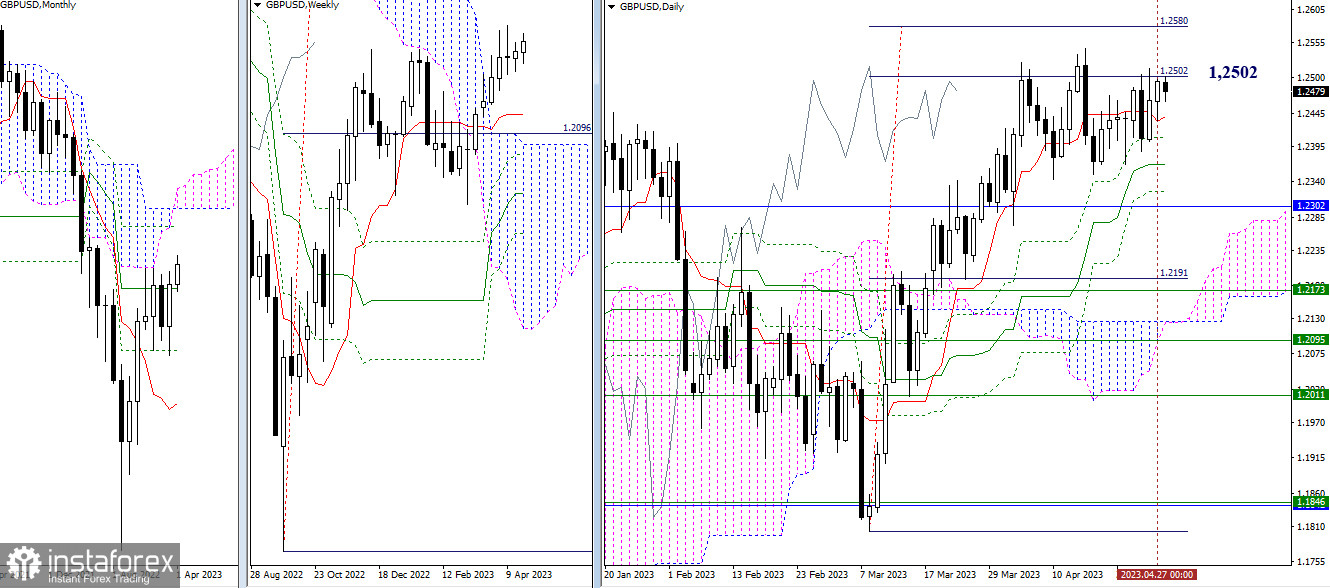

Earlier, the bulls were able to consolidate GBP/USD above the daily short-term trend (1.2440), but for several days they have not been able to overcome the resistance of the first intraday target aimed for a break of the cloud (1.2502). The main task for the bulls remains the 100% achievement of the intraday target (1.2580). For the bears, it is still important at this stage to overcome the support of the daily golden cross of Ichimoku (1.2440-1.2409-1.2367-1.2325). Then, they will have to break the final level of the designated support zone, which coincides with the monthly mid-term trend (1.2302).

H4 – H1

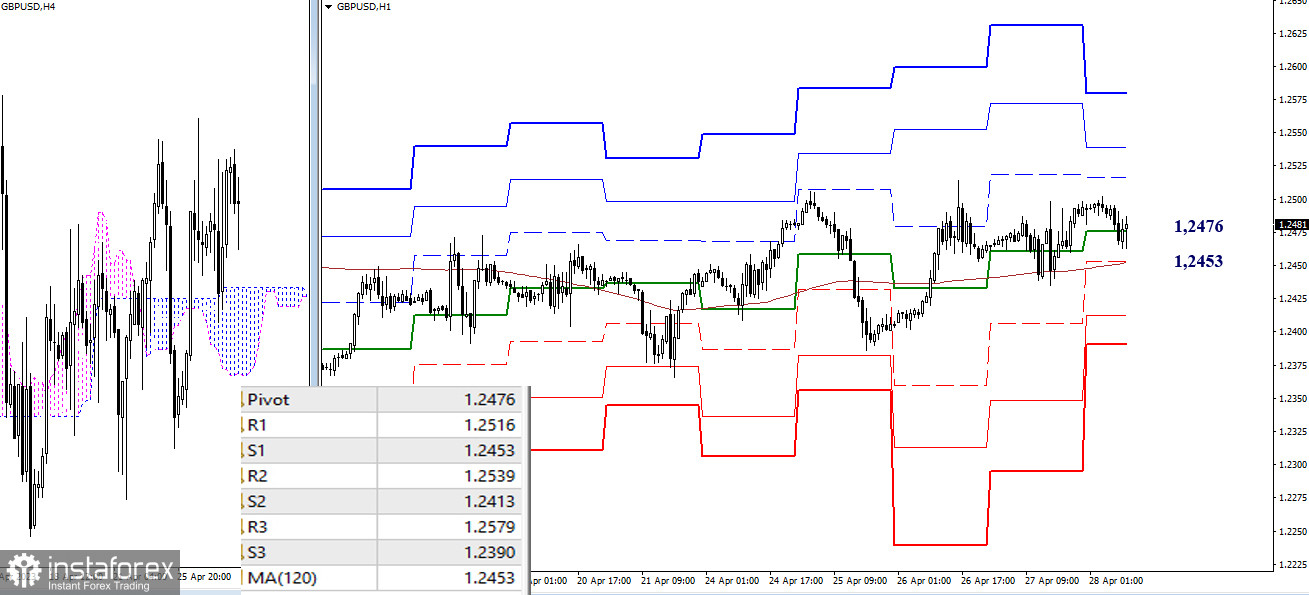

On smaller timeframes, the pound sterling maintains an advantage and GBP/USD is trading above the weekly long-term trend (1.2453). Bullish sentiments may reinforce within the day if the resistance of classic pivot levels (1.2516-1.2539-1.2579) is surpassed. The targets for the bears today, in case of consolidation below the weekly long-term trend (1.2453), will be 1.2413 and 1.2390 (support of classic pivot levels).

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Smaller timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trend line)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română